As an experienced Forex trader, I’ve witnessed firsthand the exhilarating possibilities of intraday trading. It’s a fast-paced realm where traders harness short-term market movements to potentially reap quick profits. For newcomers, grasping the intricacies of intraday trading in Forex is paramount to navigating this lucrative yet demanding market.

Image: profitmust.com

Intraday Trading: What it Entails

Understanding the Basics

Intraday trading, unlike traditional buy-and-hold strategies, involves executing trades within a single trading day. Traders analyze real-time market data to identify potential opportunities, aiming to profit from short-term price fluctuations. It demands vigilance and a keen understanding of market dynamics.

Historical Roots and Importance

Evolution of Intraday Trading

The origins of intraday trading can be traced back to the early days of financial markets. The advent of electronic trading platforms in the 1980s revolutionized the landscape, enabling traders to execute trades swiftly and efficiently. Today, intraday trading has become a popular option for traders seeking to tap into the dynamic nature of the Forex market.

Mechanism of Intraday Trading

Navigating Market Fluctuations

Intraday traders rely on technical analysis to pinpoint potential trading opportunities. By studying historical price data, traders identify patterns and trends that may indicate future price movements. Understanding market psychology, such as support and resistance levels, and incorporating risk management strategies are also crucial.

Cutting-Edge Trends and Innovations

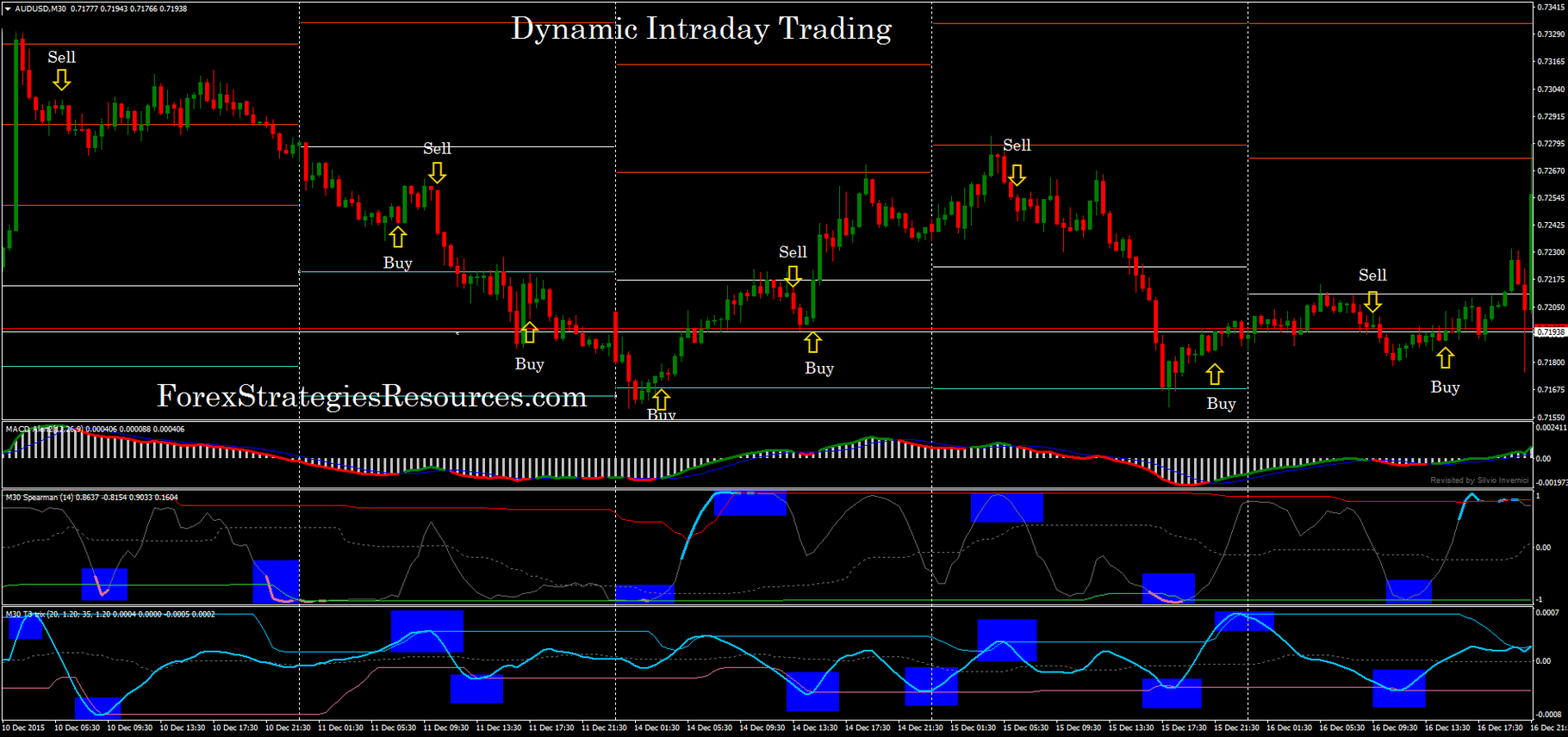

Image: www.forexstrategiesresources.com

Evolving Technologies and Strategies

The Forex market is constantly evolving, driven by advancements in technology and trading strategies. High-frequency trading algorithms, which execute trades in milliseconds, have gained prominence in recent years. Additionally, the integration of machine learning and artificial intelligence in trading platforms is enhancing the efficiency and accuracy of trade execution.

Essential Tips for Success

Expert Insights and Proven Strategies

Embarking on an intraday trading journey requires a combination of knowledge, experience, and prudent risk management. Here are few invaluable tips:

- Define a trading plan: Establish clear objectives, risk tolerance, and trading strategies before executing any trades.

- Manage risk effectively: Utilize stop-loss orders and position sizing strategies to mitigate potential losses.

Frequently Asked Questions

What Is Intraday Trading In Forex

Clarifying Common Queries

- Q: What is the difference between intraday trading and swing trading?

A: Intraday trading involves closing trades within the same day, while swing trading holds positions for several days or weeks, capitalizing on longer-term market trends. - Q: Is intraday trading suitable for beginners?

A: Intraday trading requires quick decision-making and a high level of market understanding. Beginners are advised to gain experience in traditional trading before venturing into intraday trading.

Are you eager to delve deeper into the dynamic world of intraday trading in Forex? If so, explore the wealth of resources available to enhance your knowledge and skills. Engage with trading forums, attend webinars, and keep abreast of the latest market trends. With determination and a commitment to continuous learning, you can unlock the potential of this fast-paced and rewarding trading avenue.