Introduction

The foreign exchange market, commonly known as Forex or FX, is the global marketplace where currencies are traded. With a daily trading volume that exceeds $6 trillion, Forex is the most liquid market in the world, offering traders unparalleled opportunities for profit.

Image: kinesis.money

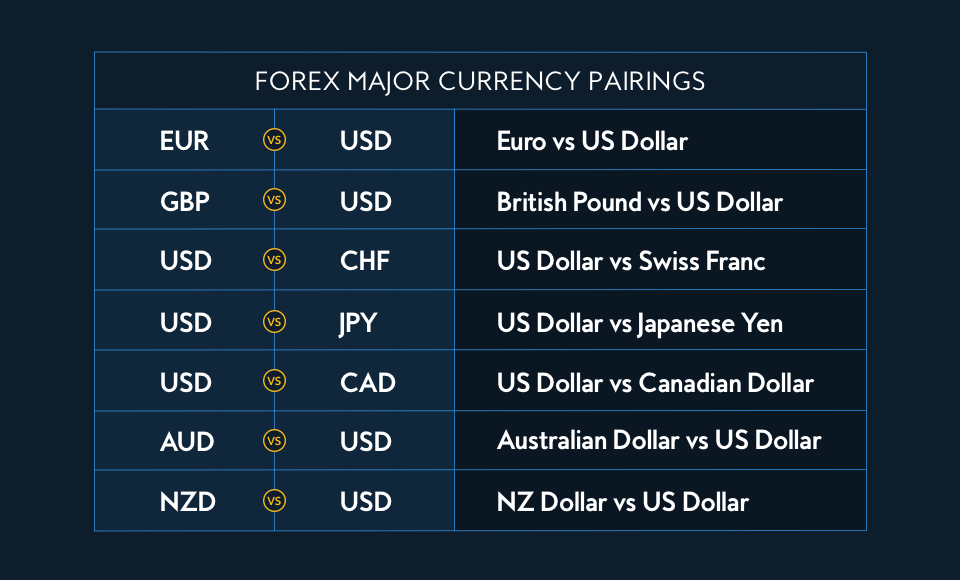

For Forex traders, selecting the right currency pairs to trade is crucial to success. Each currency pair has its unique characteristics and trading dynamics, and understanding these differences is essential for maximizing returns and minimizing risk. This article will explore the top five Forex currency pairs, providing an in-depth analysis of their historical performance, market dynamics, and trading strategies.

1. EUR/USD: The Euro against the US Dollar

The EUR/USD currency pair, also known as the “Euro,” is the most traded currency pair in the world. It represents the value of the Euro against the US Dollar and is heavily influenced by the economic and political factors of the eurozone and the United States.

The EUR/USD has a high liquidity and volatility, making it suitable for both long-term and short-term trading strategies. The currency pair often experiences strong trend reversals, providing opportunities for both trend and breakout traders.

2. USD/JPY: The US Dollar against the Japanese Yen

The USD/JPY currency pair, also known as the “Yen,” is the second most traded currency pair in the world. It represents the value of the US Dollar against the Japanese Yen and is heavily influenced by the economic policies of the United States and Japan.

The USD/JPY is known for its long-term trending behavior, making it ideal for trend-following trading strategies. However, the currency pair can also experience periods of high volatility, especially during times of market uncertainty or geopolitical events.

3. GBP/USD: The British Pound against the US Dollar

The GBP/USD currency pair, also known as the “Cable,” is the third most traded currency pair in the world. It represents the value of the British Pound against the US Dollar and is influenced by a wide range of economic and political factors.

The GBP/USD has a reputation for its volatility and high trading volume, making it suitable for day traders and scalpers. The currency pair often experiences significant price fluctuations due to news and events related to the UK economy and politics.

Image: yvilopup.web.fc2.com

4. AUD/USD: The Australian Dollar against the US Dollar

The AUD/USD currency pair, also known as the “Aussie,” is the fourth most traded currency pair in the world. It represents the value of the Australian Dollar against the US Dollar and is heavily influenced by the economic fortunes of Australia and the United States.

The AUD/USD is characterized by its strong correlation with the global commodity market, especially the demand for iron ore and other raw materials. This makes the currency pair a popular choice for traders looking to hedge their exposure to the commodity market.

5. USD/CAD: The US Dollar against the Canadian Dollar

The USD/CAD currency pair, also known as the “Loonie,” is the fifth most traded currency pair in the world. It represents the value of the US Dollar against the Canadian Dollar and is heavily influenced by the economic and trade policies of both countries.

The USD/CAD has a moderate liquidity and volatility, making it suitable for a wide range of trading strategies. The currency pair often experiences trending behavior but can also be susceptible to sudden price reversals due to news and events related to the Canadian economy.

Top 5 Forex Currency Pairs

Conclusion

The Forex currency market offers a plethora of opportunities for savvy traders. By understanding the nuances of the top five currency pairs and employing effective trading strategies, traders can increase their chances of success and navigate the FX markets with confidence.