Unveiling a Path to Forex Success

Navigating the dynamic world of forex trading demands a keen understanding of risk management strategies. It is not just a safety net but a fundamental pillar ensuring your financial journey’s longevity. Embark on this comprehensive guide, where we unravel the complexities of risk management, empowering you to embrace the lucrative opportunities forex trading holds.

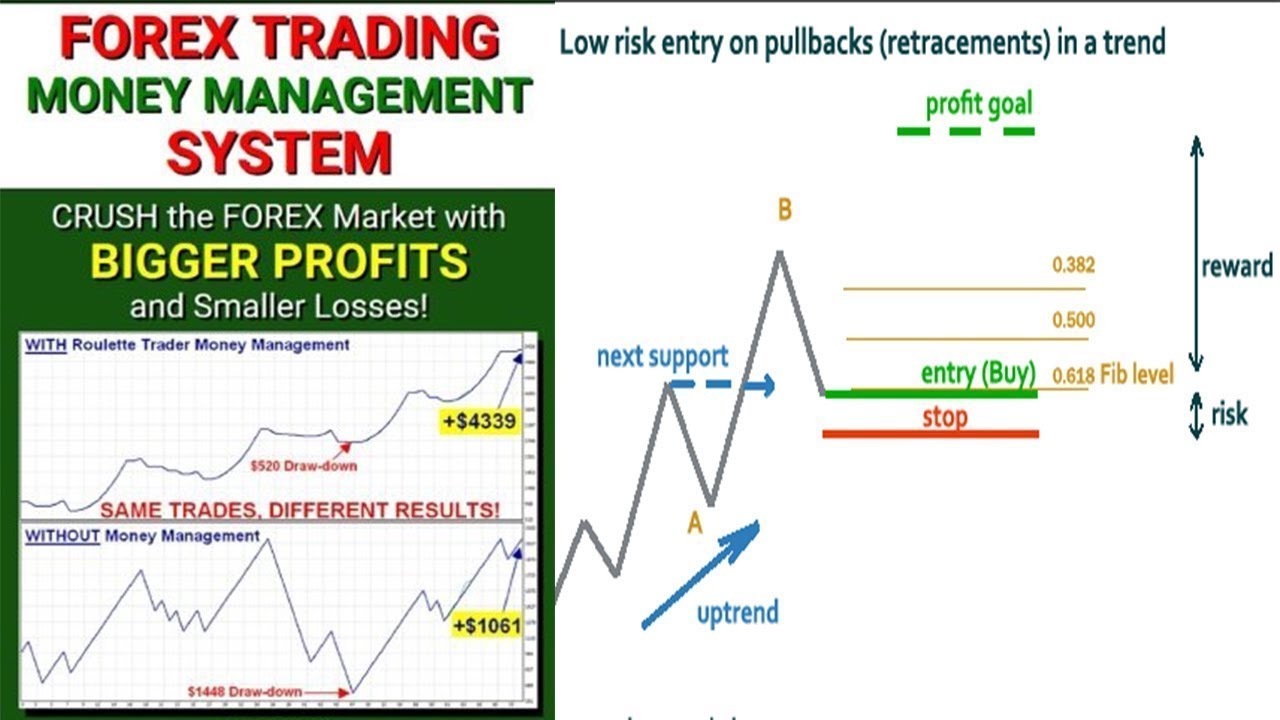

Image: www.youtube.com

A forex professional once shared, “Knowing the pitfalls and armoring yourself against them is the true secret to forex success.” Embracing this wisdom, we venture into the depths of risk management strategies, ensuring you emerge as an informed and astute trader.

Defining Risk Management: A Compass for Forex Traders

Risk management in forex trading encompasses the techniques and strategies employed to minimize potential losses while maximizing profit opportunities.

Managing risk involves:

- Identifying potential risks

- Assessing the severity of risks

- Continuous monitoring of risks

li>Developing mitigation plans

By adopting these principles, traders can navigate the forex market with greater confidence, knowing they have a roadmap to guide their decisions.

Exploring Risk Management Techniques: Unveiling Tactical Options

A multitude of risk management techniques stand at your disposal. Selecting the most suitable techniques for your trading style is crucial. Let’s explore some popular strategies:

- Stop Loss Orders: These orders automatically close your positions once a predefined loss threshold is reached.

- Take Profit Orders: Similar to stop loss orders, these orders execute trades when a specific profit target is met.

- Hedging: This involves opening multiple opposing positions to offset potential losses.

- Position Sizing: Determining the appropriate trade size based on your risk tolerance and account balance is essential.

- Trailing Stops: Stop orders that adjust their trigger price based on market movements, allowing you to lock in profits while managing risks.

Mastering these techniques empowers you to safeguard your capital, preserve profits, and make calculated decisions amidst market volatility.

Expert Insights: A Pathway to Prudent Trading

Seasoned forex traders offer invaluable advice for risk management:

- Control Leverage: Leverage can magnify both profits and losses. Use it cautiously, and only to the extent that your risk tolerance permits.

- Set Realistic Profit Goals: Avoid chasing excessive profits. Realistic targets minimize the likelihood of overtrading and unnecessary risks.

- Emotional Discipline: Refrain from making impulsive trades based on emotions. Stick to your trading plan and manage risk objectively.

- Continuous Education: Stay abreast of market trends, news, and risk management strategies. Knowledge is power in forex trading.

- Practice with Demo Accounts: Test your risk management strategies in a risk-free environment before implementing them in live trading.

Incorporating these expert recommendations into your trading approach will significantly enhance your financial resilience and decision-making.

Image: db-excel.com

FAQs: Addressing Common Queries

Q: How can I determine my risk tolerance?

Conduct a self-assessment considering your financial situation, investment goals, and emotional stability. Determine the maximum loss you are comfortable with and trade accordingly.

Q: Is stop loss an effective risk management tool?

Stop loss orders can indeed be an effective tool, but they should be used in conjunction with other risk management strategies. Setting appropriate stop loss levels is crucial.

Risk Management Strategies In Forex Trading

Conclusion: Unveiling the Path to Financial Empowerment

Embracing risk management strategies in forex trading empowers you to navigate market complexities, safeguard your capital, and harness profit potential. By implementing the techniques discussed herein, you unlock the gateway to a more resilient and successful trading journey. Remember, knowledge and discipline are your allies in the quest for forex mastery.

Are you ready to embark on your risk management journey in forex trading? Embrace the strategies and expert insights shared here, and witness your financial trajectory soar. Trade with confidence, knowing you have the tools and knowledge to mitigate risks and seize market opportunities.