In today’s interconnected global economy, the foreign exchange (forex) market plays a pivotal role in facilitating the seamless exchange of currencies worldwide. As the largest financial market, it offers traders and investors an opportunity to profit from the ceaseless fluctuations in currency values. Understanding how the forex market functions is paramount for navigating its complexities and realizing potential trading gains.

Image: www.youtube.com

Deconstructing the Forex Market: An Overview

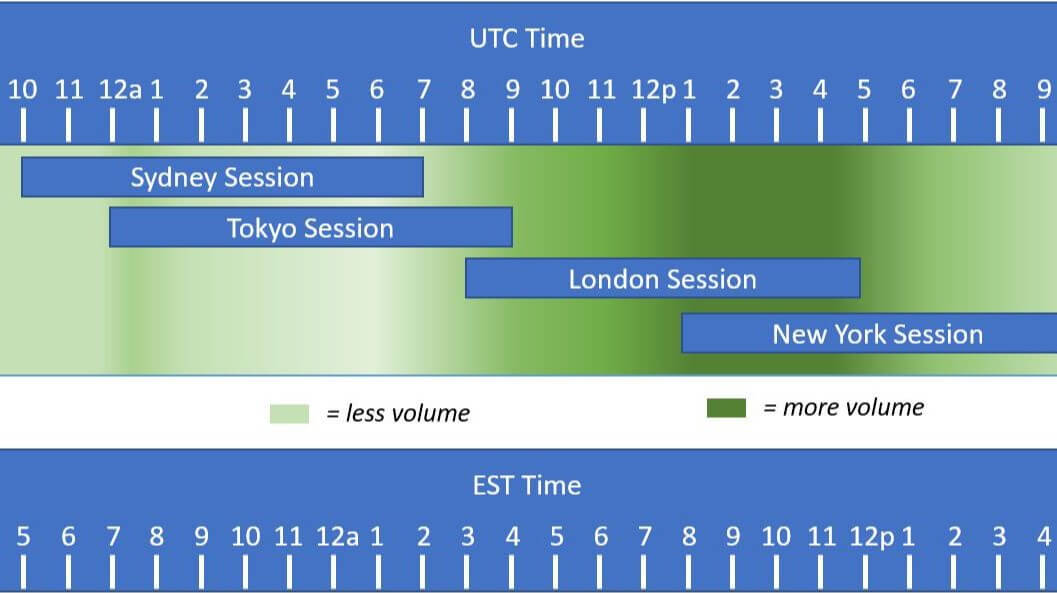

The forex market is an over-the-counter (OTC) market, meaning there is no centralized exchange. Instead, traders buy and sell currencies through a global network of banks, brokerage firms, and other financial institutions. This decentralized nature allows for continuous trading 24 hours a day, from Monday morning in Sydney to Friday evening in New York, making it accessible to traders around the globe. Forex market participants include banks, central banks, corporations, hedge funds, and retail traders, who engage in currency trading for various purposes such as international commerce, hedging against currency risk, and speculative trading.

Currencies: The Building Blocks of Forex Trading

At the heart of the forex market lies the exchange of currency pairs. A currency pair consists of two currencies, where the first is the base currency and the second is the quote currency. For instance, the EUR/USD pair represents the Euro (EUR) and the United States Dollar (USD) exchange rate. Traders speculate on the relative value of one currency against another, anticipating price movements and profiting from the spread between the buying and selling prices. The forex market offers a wide range of currency pairs, catering to diverse trading strategies and market preferences.

Key Players and Transactions

Banks serve as the backbone of the forex market, acting as primary dealers in currency trading. They provide liquidity to the market by quoting bid and ask prices for various currency pairs. Brokerage firms facilitate transactions between traders and banks, executing orders and providing access to trading platforms. Currency transactions occur in standardized amounts known as lots, with the most common lot size being the mini lot, equivalent to 10,000 units of the base currency. Traders can enter into spot transactions, where currencies are exchanged at the current market rate for immediate delivery, or forward contracts, where currencies are traded at a predetermined exchange rate for future delivery.

Image: app.jerawatcinta.com

Factors Influencing Currency Valuations

The dynamic nature of the forex market is influenced by a multitude of economic and geopolitical factors. Economic data, such as GDP, inflation, interest rates, and employment figures, play a crucial role in determining currency values. Political stability, government policies, and central bank actions can also significantly impact forex rates. Unforeseen events like natural disasters, political crises, or trade disputes can induce volatility in the market, offering both opportunities and risks to traders. Keeping abreast of these factors and their potential impact on currency valuations is essential for successful forex trading.

Leverage: A Double-Edged Sword

One defining characteristic of the forex market is the use of leverage, which allows traders to control larger positions with a smaller initial investment. Leverage can amplify both profits and losses, making it a powerful tool that should be wielded with caution. It is crucial for traders to understand the risks associated with leveraged trading and manage their risk exposure prudently. Employing risk management techniques, such as stop-loss orders and position sizing, is instrumental in mitigating potential losses and preserving trading capital.

Trading Strategies and Approaches

The forex market offers a plethora of trading strategies tailored to different market conditions, trader preferences, and risk profiles. Scalping involves taking small profits from short-term price fluctuations, while day trading focuses on profiting from intraday price movements. Carry trading entails holding positions in currencies with high interest rates to earn interest income. Trend following strategies aim to capture profits from sustained price trends, and range trading seeks opportunities in markets with defined price ranges. Diversifying trading strategies and adapting to changing market dynamics can enhance trading outcomes and mitigate risks.

How The Forex Market Really Works

Conclusion: Harnessing Forex Market Opportunities

Navigating the complexities of the forex market requires a comprehensive understanding of its mechanics, currency dynamics, and risk management strategies. By delving into the intricacies of the market, traders can gain valuable insights into currency valuations and market movements. Armed with this knowledge, they can develop trading strategies that align with their risk tolerance and financial objectives. Remember, mastering the forex market is an ongoing journey of learning, adaptation, and prudent risk management.