As a seasoned forex trader, I’ve witnessed firsthand the transformative power of a well-defined trading plan. Like a roadmap to financial success, it charts the course for profitable trades and guards against impulsive decisions that can erode profits.

Image: db-excel.com

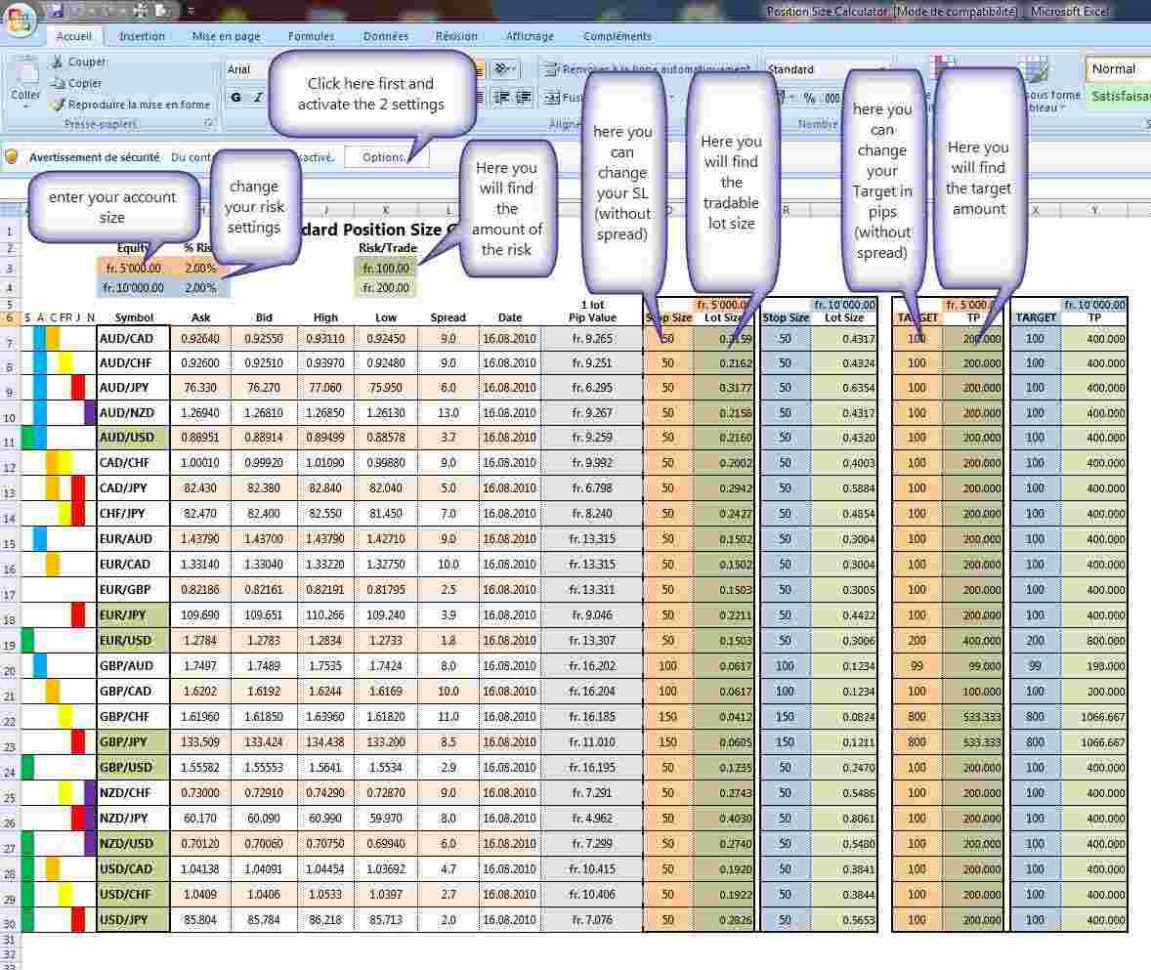

To empower aspiring forex traders, I’ve meticulously crafted an Excel template that embodies the very essence of a robust trading plan. This downloadable guide will lay the foundation for informed decision-making, ultimately propelling you towards consistent trading triumphs.

The Cornerstone of Your Trading Strategy

A trading plan is more than just a document; it’s a blueprint for success, outlining your trading goals, risk tolerance, and specific entry and exit strategies. By mapping out these crucial elements, you can approach each trade with a clear mindset, reducing uncertainty and fueling confidence.

Unveiling the Excel Template

Our Excel template is designed to be your indispensable trading companion. It encompasses five essential tabs that will guide you through every facet of your trading endeavors:

- Plan: Establish your trading goals, risk parameters, and preferred trading style.

- Watchlist: Monitor your preferred currency pairs and identify promising trading opportunities.

- Journal: Document your trades, capturing entry and exit points, profit and loss, and trade performance.

- Analysis: Perform in-depth market analysis, incorporating technical indicators and fundamental data.

- Optimization: Continuously review and refine your trading strategies, adapting to market conditions and maximizing profitability.

Insights from the Experts

Beyond the template, we’ve gathered invaluable tips and advice from seasoned traders that will enhance your trading prowess:

- Define Clear Goals: Establish specific, measurable, achievable, relevant, and time-bound (SMART) trading goals.

- Manage Risk Effectively: Determine your risk tolerance and adhere to strict stop-loss levels to safeguard your capital.

- Harness Technical Analysis: Utilize technical indicators such as moving averages, trendlines, and support/resistance levels to identify potential trading opportunities.

- Stay Informed: Monitor economic events, news, and market sentiment to gauge market direction and anticipate shifts.

- Practice Discipline: Adhere diligently to your trading plan, avoiding impulsive trades and emotional decision-making.

Image: forexadvi.blogspot.com

Frequently Asked Questions

Q: How detailed should my trading plan be?

A: Your trading plan should encompass every aspect of your trading strategy, including risk management, entry and exit strategies, and market analysis techniques.

Q: How often should I review my trading plan?

A: Regularly review and update your trading plan as market conditions evolve and your experience grows.

Forex Trading Plan Template Excel

Call to Action

Embark on the path to forex trading mastery today. Download our comprehensive Excel trading plan template and equip yourself with the tools and knowledge to unlock consistent profitability. Remember, your financial success lies within your ability to plan, execute, and refine your trading strategies. Are you ready to embrace the transformative power of a well-defined trading plan?