The foreign exchange (forex) market, where currencies are traded against each other, is the largest and most liquid financial market in the world. The euro (EUR) and US dollar (USD), being the currencies of two major economies, account for a significant portion of forex trading volume.

Image: howtotradeonforex.github.io

EUR/USD Forex Trading: A Gateway to Profit

Trading the EUR/USD currency pair can be lucrative, offering opportunities to capitalize on market fluctuations. However, success in forex trading requires a solid understanding of the market and effective trading strategies.

Understanding the EUR/USD Pair

The EUR/USD exchange rate indicates how many US dollars it takes to buy one euro. Factors influencing the rate include economic data, political events, and central bank decisions. Understanding these drivers is crucial for predicting price movements and making informed trading decisions.

Essential Strategies for EUR/USD Trading

- Trend following: This strategy involves identifying the prevailing trend and trading in the direction of the trend.

- Mean reversion: This strategy seeks to profit from price fluctuations that deviate from the historical mean or moving average.

- Range trading: This strategy involves trading within a defined range, buying near support levels and selling near resistance levels.

- Carry trading: This strategy involves borrowing a low-interest currency and investing it in a high-interest currency, profiting from the interest rate differential.

- News trading: This strategy involves trading on the volatility caused by news events and economic data releases.

Image: www.slicktrade.net

Expert Advice and Insights

Successful EUR/USD trading requires a combination of technical analysis, fundamental analysis, and risk management. Expert advice can prove valuable in navigating market complexities:

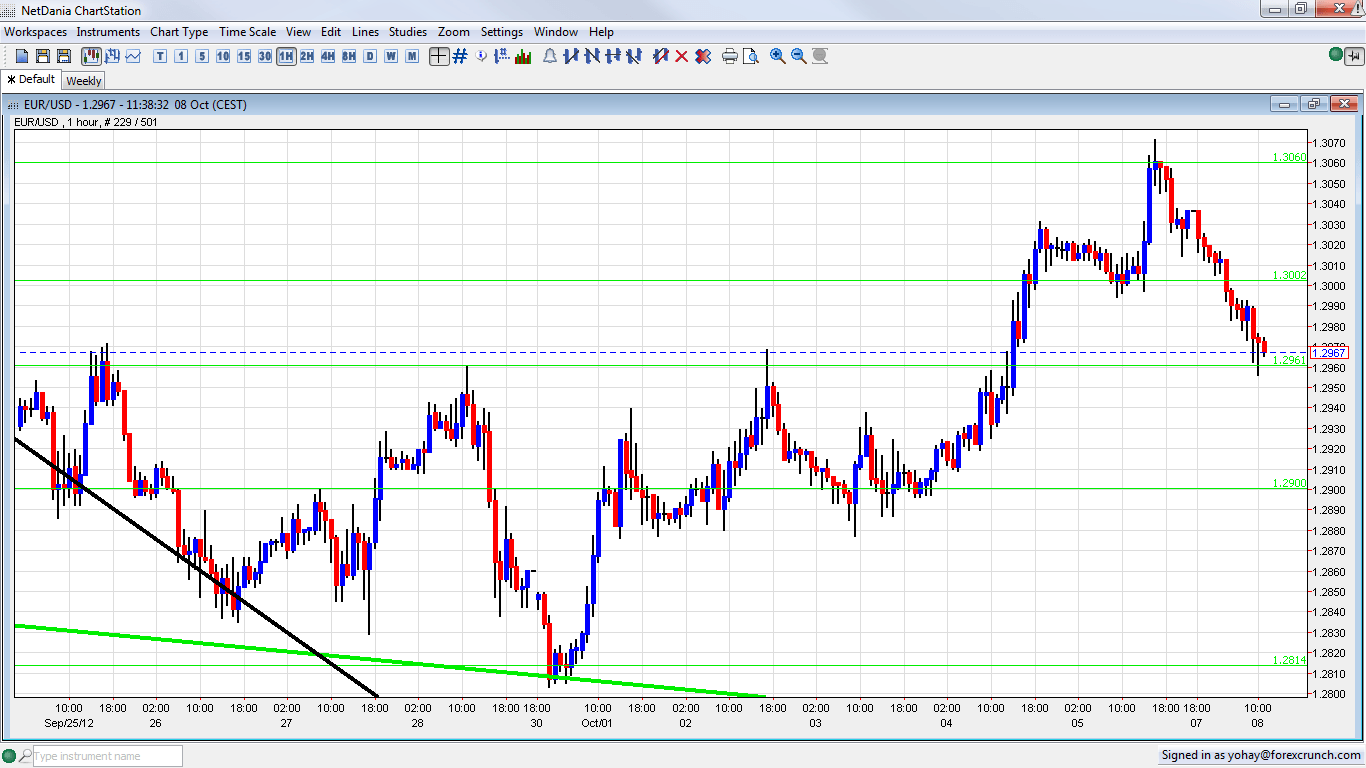

- Technical analysis involves studying historical price data to identify trends, support and resistance levels, and other patterns.

- Fundamental analysis involves examining economic indicators, interest rates, and geopolitical events that impact currency values.

- Risk management includes setting stop-loss orders, limiting leverage, and managing emotions to prevent significant losses.

FAQs on EUR/USD Trading

- What factors affect the EUR/USD exchange rate?

Economic data, political events, and interest rate differentials. - What is the most effective EUR/USD strategy?

There is no single “best” strategy. The optimal strategy depends on your trading style and risk tolerance. - How much capital do I need to trade EUR/USD?

The initial capital required varies depending on your trading strategy and risk management. It is recommended to start with a small amount and gradually increase your exposure. - Where can I trade EUR/USD?

You can trade EUR/USD through online brokers, banks, and currency exchanges. - What are the risks of EUR/USD trading?

Forex trading involves risk, including the potential for significant losses. It is crucial to understand the market and manage your risk effectively.

Forex Trading Eur Usd Strategies

Conclusion

EUR/USD trading offers opportunities for profit if approached with the right strategies and knowledge. By understanding the market dynamics, implementing effective trading techniques, and utilizing expert advice, you can increase your chances of success in this competitive market.

Are you interested in exploring the world of EUR/USD trading? Dive into our resources and connect