Introduction

Traveling abroad can be an enriching experience, but it can also come with its share of financial concerns. One important aspect to consider is how to access your funds while overseas. Axis Bank offers a convenient solution with its Forex Card, a prepaid card that allows you to withdraw cash in foreign currencies from ATMs worldwide. However, it’s essential to understand the associated charges to make informed decisions about your expenses.

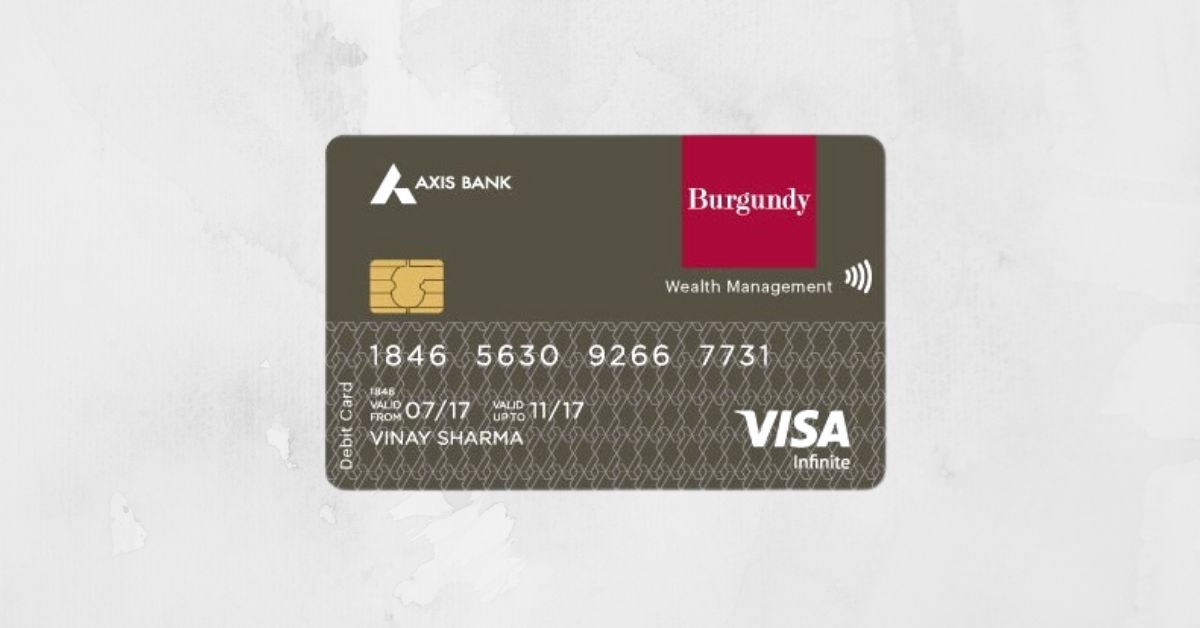

Image: brokerreview.net

Understanding Axis Bank Forex Card ATM Withdrawal Charges

Axis Bank charges a fixed fee of INR 150 plus 3.5% of the transaction amount for each ATM withdrawal made using the Forex Card. This fee is applicable regardless of the withdrawal amount or country where the transaction is made. For instance, if you withdraw USD 100 from an ATM in the United States, you will incur a charge of INR 150 + 3.5% of USD 100, which equates to approximately INR 385.

Additional Charges to Consider

In addition to the ATM withdrawal fee, you may also encounter other charges associated with using your Axis Bank Forex Card:

-

Currency Conversion Charges: When you withdraw funds from an ATM in a foreign currency, Axis Bank will convert the transaction amount from the local currency to Indian Rupees (INR) based on the prevailing exchange rate. This conversion may result in a marginal difference in the final amount debited from your card.

-

Bank Charges: Some foreign banks or ATM operators may charge additional fees for using their services. These charges vary depending on the bank and the country of withdrawal. It’s advisable to inquire about any potential bank charges before making a withdrawal.

-

Lost or Stolen Card: If your Axis Bank Forex Card is lost or stolen, you will be responsible for any unauthorized transactions made before reporting the loss or theft to the bank. Axis Bank may charge a fee for replacing the card.

Foreign Currency Withdrawal Limit

The Axis Bank Forex Card has a daily withdrawal limit of USD 5,000 or equivalent in other currencies. This limit is set to minimize the risk of fraudulent activities and protect your funds. If you need to make a withdrawal exceeding the limit, you can contact Axis Bank to request an increase.

Image: fincards.in

Avoiding Excessive Charges

To minimize the impact of ATM withdrawal charges, consider the following strategies:

-

Plan Withdrawals Wisely: Avoid making multiple small withdrawals as the charges will accumulate. Instead, plan your withdrawals and make larger transactions less frequently.

-

Use ATMs within Axis Bank’s Network: Axis Bank has partnerships with several banks worldwide, allowing you to make ATM withdrawals without incurring additional bank charges. Look out for ATMs displaying the Axis Bank or Visa logo.

-

Consider Alternative Withdrawal Methods: If possible, explore alternative withdrawal methods such as using local bank branches or money transfer services. These options may offer lower fees or more favorable exchange rates.

Axis Bank Forex Card Atm Withdrawal Charges

Conclusion

Axis Bank’s Forex Card provides a convenient way to access funds overseas, but it’s crucial to be aware of the associated charges before using it. By understanding the ATM withdrawal fees, additional charges, and foreign currency withdrawal limit, you can make informed decisions about your expenses and avoid excessive fees. By following the tips outlined in this guide, you can minimize your ATM withdrawal charges and enjoy a hassle-free travel experience.