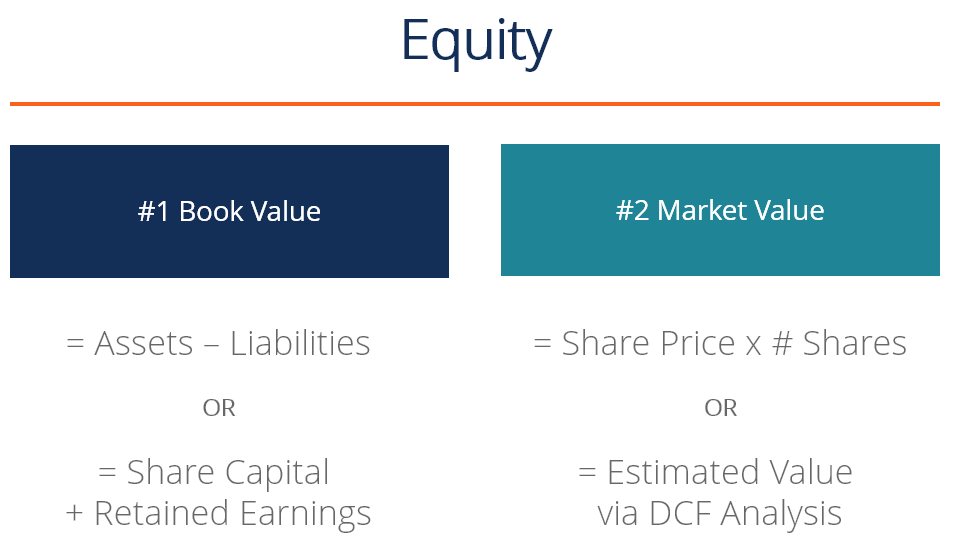

Navigating the world of forex trading can be daunting, but understanding key concepts like equity is imperative for success. Forex equity represents the balance of your trading account, reflecting the difference between your total assets (e.g., funds, open positions) and total liabilities (e.g., margin used).

Image: corporatefinanceinstitute.com

Maintaining a positive equity balance is paramount, as it serves as a buffer against potential losses. A negative equity balance, on the other hand, indicates an account deficit that requires immediate attention to prevent further financial setbacks.

Monitoring and Managing Equity

Regularly monitoring your equity balance is essential for risk management. It provides insights into the health of your trading account and allows you to make informed decisions.

To manage equity effectively, consider the following strategies:

- Set Realistic Trading Goals: Avoid overleveraging or taking excessive risks that could deplete your equity excessively.

- Use Stop-Loss Orders: Implement automated orders that limit potential losses and preserve equity.

- Hedging and Diversification: Spread your risk across multiple currencies or trading strategies to minimize the impact of adverse market conditions.

- Review and Monitor Regularly: Track your equity balance closely, especially during periods of heightened market volatility.

Contemporary Developments in Forex Equity

In recent years, technological advancements have impacted forex equity management practices. Automated trading systems and risk management algorithms have emerged to enhance efficiency and reduce manual intervention.

Social trading platforms have also gained popularity, enabling traders to connect, share strategies, and mirror each other’s trades. This collaborative approach can provide insights into effective equity management and market sentiment analysis.

Expert Advice for Equity Management

Seasoned forex traders advocate the following principles for effective equity management:

- Preserve Capital: Prioritize the longevity and growth of your trading account over short-term profits.

- Understand Your Risk Tolerance: Determine your financial capacity for risk and trade accordingly to minimize the impact on your equity.

- Use Margin Prudently: Leverage can magnify both profits and losses. Employ it responsibly to avoid overextending your trading capital.

- Learn from Experience: Analyze your trading history to identify areas for improvement and refine your equity management strategies.

Image: sashares.co.za

FAQs on Equity in Forex

Q: What is the importance of maintaining a positive equity balance?

A: A positive equity balance acts as a safety net against market fluctuations and ensures the sustainability of your trading account.

Q: How can I calculate my forex equity?

A: Equity = Total Assets (Account Balance + Unrealized PnL) – Total Liabilities (Used Margin)

Q: What measures should I take if my equity balance becomes negative?

A: Reduce your position size, close unprofitable trades, and consider additional funding to restore a positive equity balance.

Meaning Of Equity In Forex

Conclusion

Comprehensively understanding equity in forex empowers traders to navigate the market complexities and optimize their trading strategies. By implementing effective equity management practices, monitoring their accounts diligently, and seeking expert advice when necessary, traders can enhance their risk management and pave the way for sustainable trading success.

We invite you to further explore the topic of equity in forex and engage with our community of traders to exchange insights and broaden your understanding.