Gold Trading: A Journey of Insights

Step into the world of gold trading, an endeavor that has sparked the interests of countless individuals. Gold, a precious metal revered throughout history, continues to hold immense value in the global economy. Trading gold in the forex market offers numerous opportunities, yet it also demands substantial knowledge and strategic planning to navigate its dynamic landscape successfully. In this comprehensive guide, we’ll unravel the intricacies of gold trading, empowering you with the insights and techniques necessary to make informed decisions.

Image: www.freepik.com

Throughout the centuries, gold has served as a haven asset, a beacon of stability amid economic storms. Its enduring allure stems from its scarcity, intrinsic value, and historical significance. Today, gold plays a crucial role in the global financial system, functioning as a store of value and a hedge against inflation. With its liquidity and accessibility, the forex market has emerged as the primary venue for gold trading.

Understanding Gold Trading in Forex

Forex trading involves buying and selling currencies, and gold is essentially treated as a currency pair against major currencies like the US dollar or the euro. The price of gold fluctuates constantly, influenced by various factors such as supply and demand, interest rates, economic data, geopolitical events, and market sentiment. Traders capitalize on these price movements by speculating on the future value of gold.

Leverage: A Double-Edged Sword

One of the key aspects of forex trading, including gold trading, is leverage. Leverage allows traders to amplify their profits while also potentially magnifying their losses. By utilizing leverage, traders can control a larger position with a relatively small initial investment. However, it’s crucial to approach leverage with caution, as it can lead to significant financial risks if not managed prudently.

Risk Management: The Cornerstone of Success

Risk management is paramount in gold trading. Implementing sound risk management strategies can help traders mitigate potential losses and preserve their capital. Setting stop-loss orders, carefully calculating position sizes, and diversifying portfolios are essential components of effective risk management. Additionally, continuously monitoring market conditions and staying abreast of economic and geopolitical developments can help traders proactively adjust their strategies.

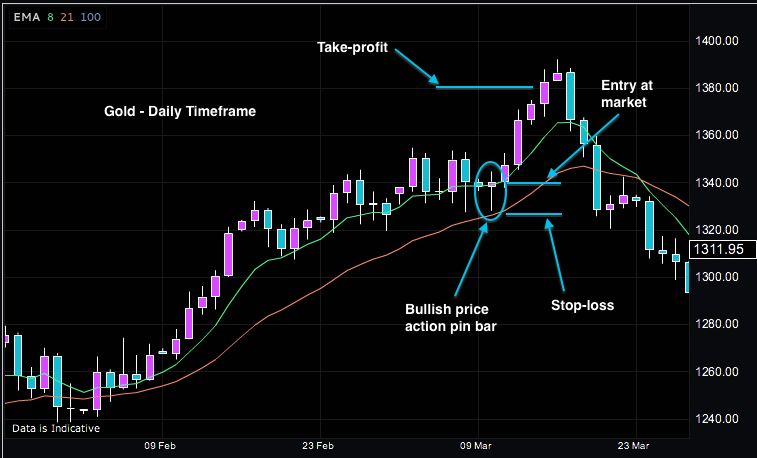

Image: www.tradegoldonline.com

Technical and Fundamental Analysis: Illuminating the Market

Successful gold traders employ a combination of technical and fundamental analysis to guide their trading decisions. Technical analysis involves studying historical price data to identify patterns and trends that may indicate future price movements. Fundamental analysis, on the other hand, focuses on economic indicators, geopolitical events, and market sentiment to assess the intrinsic value of gold and its potential price trajectory.

Tips for Flourishing in Gold Trading

Embarking on gold trading requires a comprehensive understanding of the market and a well-defined trading plan. Here are some tips to enhance your gold trading endeavors:

- Educate Yourself: Acquire a thorough understanding of gold trading concepts, technical and fundamental analysis, and risk management strategies.

- Start Small: Begin with small trades to manage your risk exposure and gain experience in the market.

- Monitor Market Conditions: Stay informed about economic developments, geopolitical events, and central bank decisions that may impact gold prices.

- Employ a Trading Plan: Define your trading strategy, identify entry and exit points, and stick to your plan to avoid emotional decision-making.

Frequently Asked Questions about Gold Trading

To enhance your understanding of gold trading, let’s address some commonly asked questions:

- Q: What are the benefits of trading gold in forex?

A: Forex trading offers high leverage, 24/7 accessibility, and the ability to profit from both rising and falling gold prices. - Q: What factors influence gold prices?

A: Gold prices are influenced by supply and demand, interest rates, inflation, economic growth, geopolitical events, and market sentiment. - Q: How can I start trading gold in forex?

A: Open a trading account with a reputable forex broker, educate yourself about gold trading, and develop a sound trading strategy. - Q: Is gold trading suitable for beginners?

A: While gold trading can be accessible to beginners, it’s essential to approach it with caution, educate yourself thoroughly, and manage your risk effectively.

How To Trade Gold In Forex

Conclusion: Unveiling a World of Golden Opportunities

Gold trading in forex offers a dynamic and rewarding opportunity for those who approach it with knowledge, skill, and a calculated approach. By embracing the principles outlined in this comprehensive guide, you can navigate the intricacies of the gold market and unlock its potential for financial success. Remember to continuously educate yourself, monitor market conditions, manage your risk, and execute your trading plan diligently. Embrace the journey of gold trading, and let the allure of the precious metal guide you towards achieving your financial aspirations.

Are you ready to delve into the captivating world of gold trading? Whether you’re a seasoned professional or an eager beginner, the pursuit of gold holds boundless possibilities.