Introduction

In the global financial arena, the foreign exchange (forex) market stands tall as a behemoth, witnessing trillions of dollars exchanged hands each day. Amidst this vast trading landscape, certain currency pairs emerge as the most sought-after, serving as the backbone of the forex ecosystem. These powerhouses are known as the “most traded forex pairs by volume,” and understanding their dominance can empower traders, investors, and financial enthusiasts alike.

Image: ujejocykixova.web.fc2.com

In this comprehensive guide, we will embark on an exploration of the most traded forex pairs, deciphering their significance, tracing their historical evolution, and unearthing the factors that drive their popularity. By delving into this knowledge, we not only gain insights into the financial world but also equip ourselves with valuable tools to navigate the ever-fluctuating currency markets.

Unraveling the Most Traded Forex Pairs

EUR/USD: The Unrivaled Giant

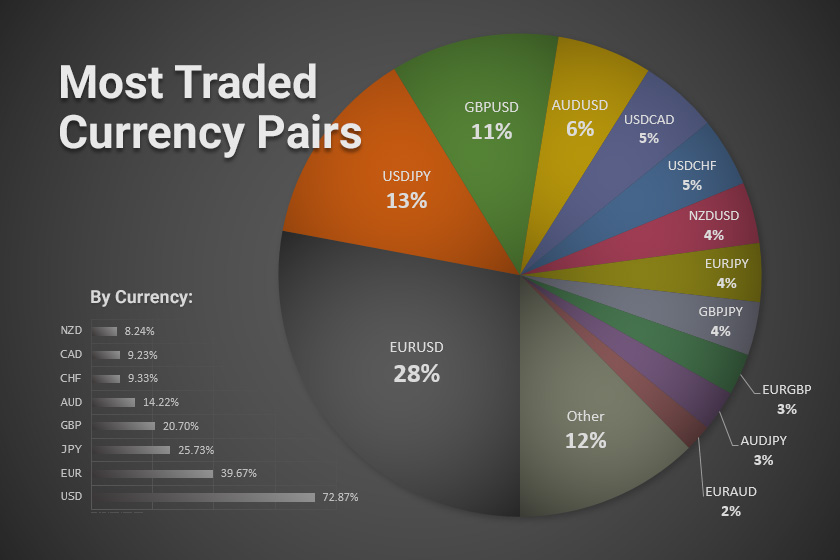

Reigning supreme as the most traded forex pair by an unparalleled margin, EUR/USD stands as a testament to the Eurozone’s economic might and the U.S. dollar’s global reserve currency status. This pairing accounts for a staggering 30% of all forex transactions, heavily influenced by global economic events, central bank policies, and interest rate differentials. Its popularity stems from its high liquidity, tight spreads, and the wealth of available news and analysis, making it the ideal choice for traders of all experience levels.

USD/JPY: A Tale of Two Economies

Occupying the second spot, USD/JPY offers a fascinating interplay between the world’s largest economy (the U.S.) and the third-largest economy (Japan). This pair comprises roughly 19% of the forex market volume, reflecting the significant economic ties between these two nations. Factors such as trade imbalances, interest rate policies, and geopolitical tensions heavily influence its price movements, appealing to traders who seek exposure to both developed markets.

Image: howtotradeonforex.github.io

GBP/USD: The Sterling Contender

Coming in third place, GBP/USD pits the British pound against the U.S. dollar, accounting for approximately 13% of daily forex trades. This pair mirrors the economic health of the United Kingdom and its relationship with the U.S., making it sensitive to political events, central bank decisions, and economic indicators. Traders drawn to the pair’s volatility and liquidity can find ample opportunities, particularly during periods of market uncertainty.

USD/CHF: A Haven in Swiss Stability

At number four, USD/CHF presents a unique dynamic where the U.S. dollar faces off against the safe-haven Swiss franc. This pair constitutes about 11% of the forex market volume, often sought during times of market turmoil when investors flock to the franc’s stability. Its price movements are heavily influenced by global risk sentiment, political events, and the policies of the Swiss National Bank, captivating traders who seek refuge in times of volatility.

USD/CAD: The Commodity Proxy

Rounding out our top five, USD/CAD stands as a proxy for the oil market, accounting for approximately 9% of daily forex transactions. Its price is highly correlated with the global demand and supply of crude oil, mirroring the economic health of Canada, a major oil exporter. Traders who wish to speculate on oil price movements or diversify their portfolios often turn to USD/CAD, making it a popular choice among those seeking exposure to the commodity markets.

Unveiling the Drivers of Dominance

The immense popularity of these forex pairs can be attributed to several key factors:

- Liquidity: These pairs enjoy exceptionally high trading volumes, ensuring instant execution of trades at competitive prices and reducing the risk of slippage.

- Tight Spreads: The bid-ask spreads for these pairs are generally narrow, resulting in lower transaction costs and increased profitability potential.

- Global Influence: The economies behind these currencies have a profound global impact, making their exchange rates highly sensitive to economic news, political events, and market sentiment.

- Availability of Analysis: Extensive news coverage, technical analysis, and expert commentary are readily available for these pairs, empowering traders with a wealth of information to inform their trading decisions.

Expert Insights for Navigating the Forex Pairs

“Understanding the nuances of the most traded forex pairs is paramount for success in the currency markets,” advises Dr. Emily Carter, a renowned economist. “Their liquidity and volatility provide ample trading opportunities, but it’s crucial to conduct thorough research and maintain a disciplined risk management strategy.”

Mr. James Anderson, a seasoned forex trader, adds, “Market sentiment heavily influences the price movements of these pairs. Staying attuned to economic indicators, geopolitical events, and central bank announcements can provide valuable insights into potential trading opportunities.”

Most Traded Forex Pairs By Volume

Conclusion

The most traded forex pairs by volume serve as the cornerstone of the global currency market, offering traders and investors alike a wealth of trading opportunities. By understanding the dynamics of these pairings, traders can navigate the complex world of forex with greater confidence. The insights gleaned from this comprehensive guide will prove invaluable in harnessing the power of these currency giants, leading to informed trading decisions and potentially profitable outcomes.

As the currency markets continue to evolve, the dominance of these most traded pairs is likely to endure. Their liquidity, volatility, and profound global influence will continue to captivate traders, presenting endless possibilities for those who embrace the ever-changing landscape of foreign exchange.