The world of currency exchange, known as forex, offers investors the opportunity to trade currencies and unlock the potential for lucrative returns. However, before delving into the forex market, it’s paramount to grasp the concept of margin, a double-edged sword that can amplify both profits and risks.

Image: gogoheh.web.fc2.com

Margin: The Foundation of Leveraged Trading

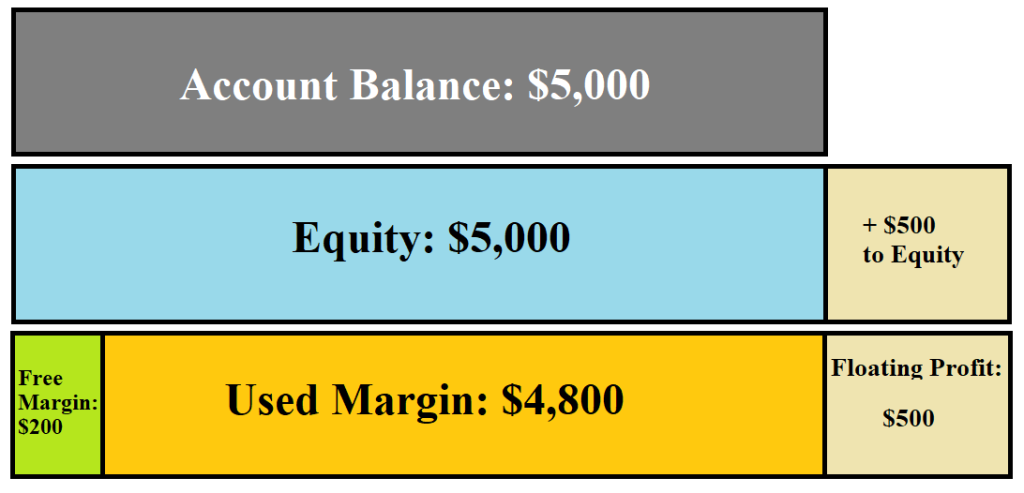

Margin in forex refers to the deposit required by a broker to enter a trade. Unlike traditional stock trading, forex brokers provide leverage, allowing traders to control a larger position size than their account balance permits. This leverage is expressed as a ratio, such as 1:100, indicating that for every $1,000 in your account, you can trade $100,000 worth of currency.

Benefits and Risks of Margin Trading

The allure of margin trading lies in its potential to magnify profits. With leverage, traders can amplify their returns significantly, making the prospect of substantial gains tantalizing. However, it’s crucial to remember that leverage is a two-way street, as it also exponentiates potential losses.

Forex trades are always settled in pairs, involving the simultaneous purchase of one currency and the sale of another. When the value of the purchased currency rises relative to the sold currency, the trader makes a profit. Conversely, if the value depreciates, losses can accumulate rapidly. The extent of these losses is magnified by the leverage employed, making it essential to manage risk prudently.

Margin Call and Liquidation

Typically, forex brokers impose a margin call when an account’s equity falls below a certain threshold, indicating that additional funds are required to maintain the position. Failure to meet the margin call within the stipulated timeframe may result in forced liquidation of the trade, realizing any losses incurred.

Strategies for Managing Margin Risk

To mitigate the risks associated with margin trading, several strategies can be employed:

- Set Realistic Expectations: Recognize that leverage can amplify both profits and losses, and trade only with an amount you can afford to lose.

- Use Stop-Loss Orders: Predetermine the point at which a trade will be automatically closed to limit potential losses.

- Manage Position Size: Carefully consider the size of your position relative to your account balance and risk tolerance.

- Diversify Your Trades: Spread your risk across multiple currency pairs to reduce the impact of adverse movements in any single currency.

- Monitor Market Conditions: Stay abreast of economic news, interest rate decisions, and other events that may affect currency values.

Conclusion

Margin in forex trading can be a powerful tool but must be handled with caution. By understanding the potential benefits and risks, practicing sound risk management strategies, and seeking guidance from reputable brokers, traders can harness the leverage to their advantage and navigate the forex market more effectively. Remember, while the lure of amplified profits is tempting, protecting your investment remains paramount.

Image: www.bank2home.com

What Is Margin In Forex