Title:

Image: howtotradeonforex.github.io

Introduction

Navigating the intricate world of foreign exchange can be a daunting task, especially when your hard-earned money is on the line. In the competitive realm of forex trading, securing the best rates can make or break your financial endeavors. This comprehensive guide aims to unravel the secrets of finding the most favorable forex rates in India, empowering you with the knowledge to save money and optimize your forex transactions.

Understanding the dynamics of forex is crucial. Forex refers to the exchange of one currency for another at an agreed-upon rate. These rates constantly fluctuate, influenced by economic factors, central bank policies, and geopolitical events. By staying informed about these factors, you can make informed decisions about when to exchange your funds.

Where to Find the Best Forex Rates:

1. Currency Conversion Services:

Specialized currency conversion services offer competitive rates and a convenient way to exchange money. Compare rates from multiple providers to find the best deals. Look for companies offering low commissions and no hidden fees.

Image: eaforexnosleep.blogspot.com

2. Banking Institutions:

Banks are a traditional option for forex transactions. While they may have wider spreads (the difference between the buy and sell rate), banks can offer the stability and security of established financial institutions.

3. Non-Banking Financial Companies (NBFCs):

NBFCs, regulated by the Reserve Bank of India (RBI), provide competitive exchange rates and cater specifically to the needs of forex traders. Explore different NBFCs to find the most advantageous offerings.

4. Online Forex Brokers:

For frequent traders, online forex brokers offer cutting-edge platforms that enable quick execution and access to real-time exchange rates. Research reputable brokers with low spreads and reliable execution speeds.

Negotiation and Market Monitoring:

Negotiating with forex providers can often yield better rates. Don’t hesitate to inquire about discounts or special offers. Additionally, constantly monitoring the forex market empowers you to capitalize on favorable exchange rate fluctuations.

Factors to Consider:

###1. Transaction Volume:

Larger transactions typically qualify for better forex rates. Consider aggregating your transactions to secure more favorable terms.

2. Currency Pairing:

The exchange rate for a currency pair varies based on its demand and supply in the market. Research the currency pairs you need and identify those with the most competitive rates.

3. Transfer Fees:

Be aware of additional costs such as bank transfer fees or wire transfer charges. These fees can vary depending on the service provider and the transfer amount.

The Advantage of Information:

Staying updated with economic news, geopolitical events, and central bank policies can provide valuable insights into exchange rate trends. Use this information to make informed decisions and capitalize on potential market movements.

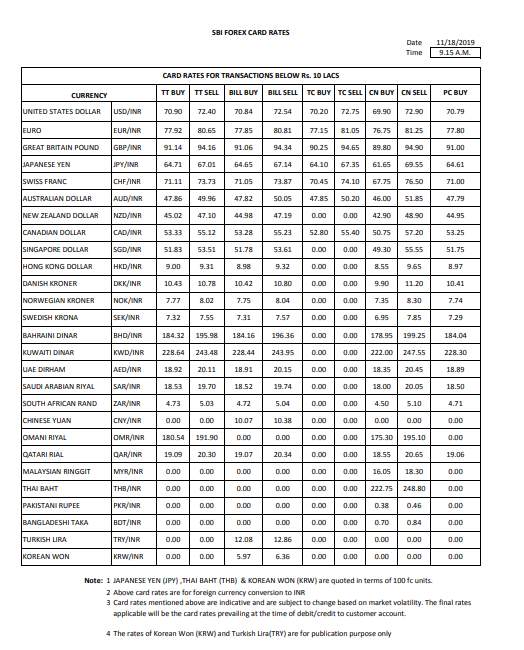

Best Forex Rates In India

Conclusion:

Securing the best forex rates requires a combination of knowledge, comparison, and strategic decision-making. By following the tips outlined in this article, you can optimize your forex transactions and make informed choices that maximize your financial returns. Remember, staying informed and exploring different options empowers you to make the most of your hard-earned currency.