In the fast-paced and adrenaline-inducing world of forex trading, leverage is an indispensable tool that can amplify your potential profits. However, wielding this double-edged sword requires a thorough understanding of its mechanics and potential risks.

Image: forexriver.blogspot.com

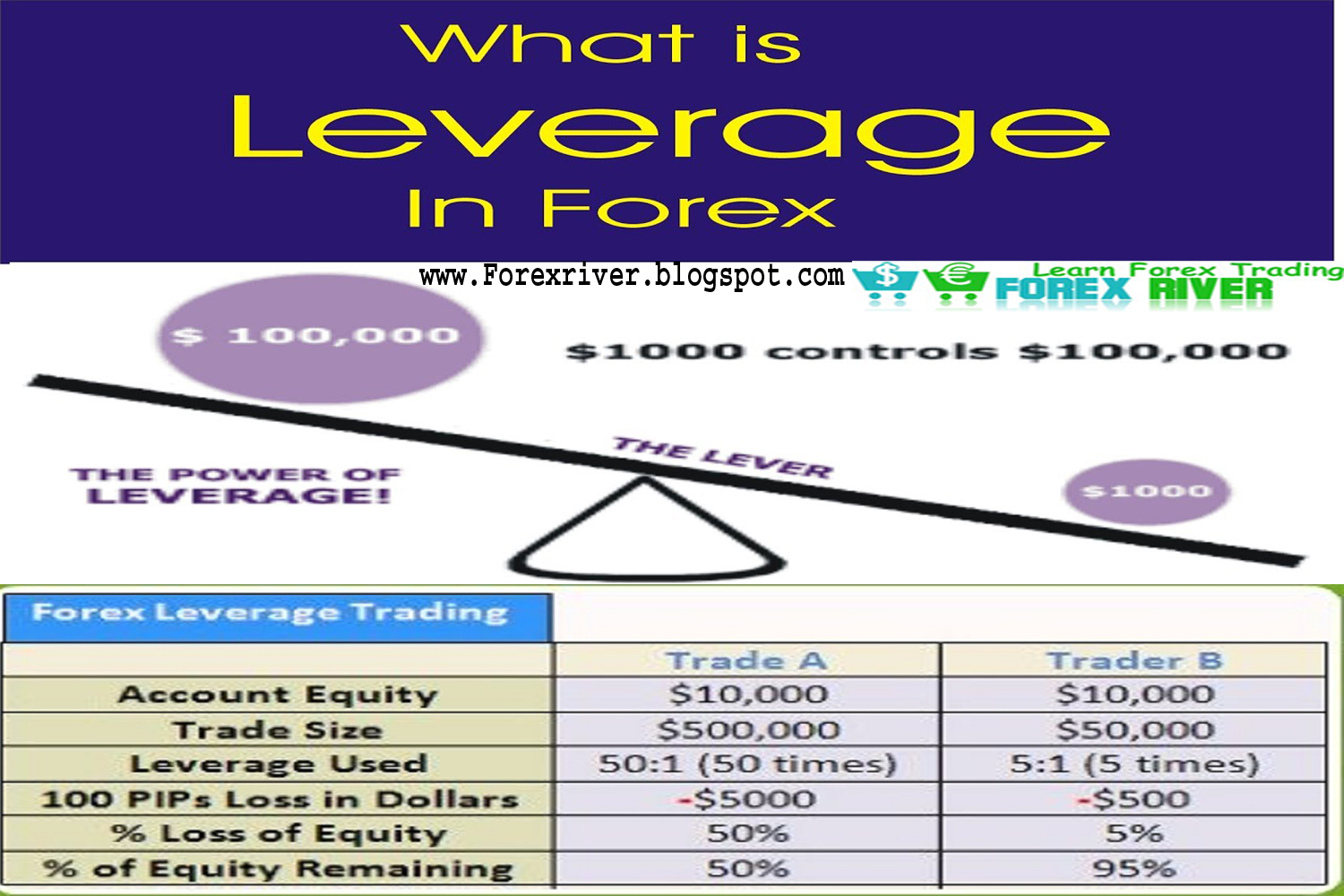

Leverage, in the context of forex trading, is a loan provided by your broker that allows you to control a larger position size than your trading capital. It’s like having a magnifying glass for your trades, allowing you to magnify your potential returns. However, it also comes with the responsibility of understanding the associated risks, as leverage can equally magnify losses.

Understanding Leverage Ratios

Leverage is expressed as a ratio, such as 50:1 or 100:1. A ratio of 50:1 means you can trade a position worth $50,000 with just $1,000 of your capital. This means your profits and losses are also amplified by the leverage ratio.

Benefits of Leverage

Leverage can boost your profits: A well-calculated application of leverage can enable you to multiply your profits. For instance, with a leverage of 50:1, a 1% gain on your $1,000 investment translates into a $50 profit, significantly higher than if you only invested the unleveraged amount.

Increase potential return on investment: Leverage can increase your potential return on investment (ROI). If you have a limited trading capital, using leverage effectively can maximize your ROI by allowing you to invest more.

Risks of Leverage

Magnification of losses: As mentioned earlier, leverage is a double-edged sword that can compound your potential losses. Similarly to how profits are amplified, losses are also multiplied by the leverage ratio.

Margin call danger: Leverage is a loan that has to be repaid eventually. When your trading account balance drops below a certain level, your broker may issue a margin call. At this point, you’ll need to deposit additional funds to cover the deficit or face the risk of liquidation at a significant loss.

Image: www.axi.com

Choosing the Right Leverage

Choosing an appropriate leverage level is crucial based on your trading style, risk tolerance, and account size. Beginners should generally start with lower leverage ratios (e.g., 10:1 or 20:1) to familiarize themselves with the market.

Experienced traders may opt for higher leverage (e.g., 50:1 or 100:1) to potentially amplify their profits. It’s important to remember that higher leverage comes with significantly amplified risks.

Smart Leverage Management

Using leverage responsibly is essential in forex trading. Manage your risks effectively using these techniques:

Adopt a risk-management plan: Define a clear risk-management plan based on your risk tolerance. This plan should guide your leverage decisions and protect you from making impulsive trades under emotional or FOMO (fear of missing out) circumstances.

Use stop-loss orders: Stop-loss orders are an invaluable risk-management tool. They automatically close your positions when prices reach a predetermined level, limiting your potential losses.

Hedging strategies: Hedging involves taking offsetting positions in the market to reduce overall risk. This can be done through various hedging methods like correlated pairs trading or currency options.

What Is Leverage In Forex Trading

Conclusion

Leverage is a powerful tool in forex trading, capable of boosting profits and maximizing returns. However, it’s crucial to approach leverage with caution, as it can also amplify losses. By understanding the mechanics and risks of leverage, and employing sound risk-management strategies, you can harness this tool to maximize your trading potential while minimizing risks.

Remember, leverage is not a magic formula for success but rather a double-edged sword that needs careful handling. Make sure you have a robust trading plan, a clear understanding of your risk tolerance, and a disciplined approach to managing leveraged positions. With the right knowledge and prudent use of leverage, you can navigate the forex markets with confidence and unlock the potential for financial success.