Navigating international monetary exchanges can be a daunting task, but HDFC Bank’s Forex Card Application Form simplifies the process, allowing you to carry multiple currencies conveniently and securely. In this comprehensive guide, we’ll delve into the details of this essential travel companion, guiding you through the application process and exploring its benefits.

Image: allimagesmetric.blogspot.com

Benefits of HDFC Bank Forex Card

Equipped with an HDFC Bank Forex Card, you’ll unlock a myriad of advantages that make international travel effortless and cost-effective:

- Multi-currency convenience: Carry up to 10 currencies on a single card, eliminating the need for multiple currency exchanges and minimizing exchange rate fluctuations.

- Competitive exchange rates: Enjoy competitive exchange rates offered by HDFC Bank, ensuring maximum value for your money.

- Enhanced security: The card is backed by HDFC Bank’s trusted security measures to safeguard your funds, providing peace of mind while traveling.

- Cashless transactions: Make purchases and withdraw cash at ATMs worldwide without incurring any additional charges, saving on cash withdrawal fees.

- Easy tracking: Track your expenses and manage your card conveniently through HDFC Bank’s online banking portal and mobile app.

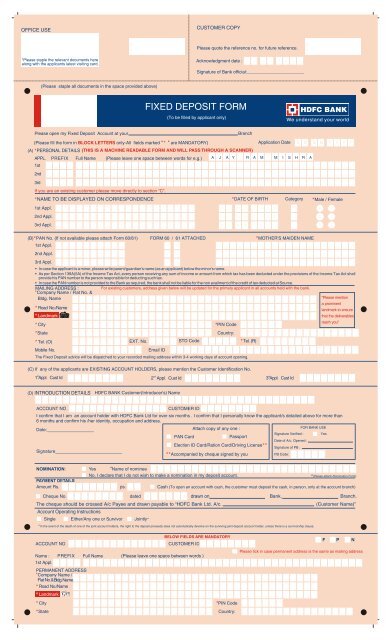

HDFC Bank Forex Card Application Process

Applying for an HDFC Bank Forex Card is a straightforward process:

- Visit your nearest HDFC Bank branch.

- Request an HDFC Bank Forex Card Application Form.

- Complete the form with your personal and travel details.

- Attach required documents, such as your passport, visa (if applicable), and proof of address.

- Submit the completed application form to the bank representative.

Once your application is processed, you will receive your HDFC Bank Forex Card within a few business days.

Tips and Expert Advice

To optimize your experience with an HDFC Bank Forex Card, consider these tips from travel experts:

- Load multiple currencies: Avoid exchange rate losses by loading different currencies onto your card based on your travel destinations.

- Use it wisely: Reserve your HDFC Bank Forex Card for large purchases to minimize transaction charges and maximize exchange rate benefits.

- Keep track of expenses: Monitor your expenses regularly using your online banking portal or OTP-based balance inquiries to avoid overspending.

Image: www.studocu.com

FAQs

- Q: What is the minimum amount I can load onto my HDFC Bank Forex Card?

A: The minimum amount varies depending on the currency, but typically ranges from INR 10,000 to INR 50,000. - Q: Are there any fees associated with loading or withdrawing money from my HDFC Bank Forex Card?

A: HDFC Bank charges a nominal transaction fee for loading or withdrawing funds, which may vary based on the amount. - Q: Where can I use my HDFC Bank Forex Card?

A: HDFC Bank Forex Card is accepted worldwide at millions of POS terminals and ATMs.

Conclusion

HDFC Bank Forex Card is an indispensable travel companion that empowers you with efficient and cost-effective currency management on your international excursions. By applying for it conveniently through the HDFC Bank Forex Card Application Form and following our expert tips, you can make your travels effortless, budget-friendly, and memorable. Embark on your next adventure with confidence, knowing that your currency exchanges are taken care of securely and conveniently.

Hdfc Bank Forex Card Application Form

Are you excited to experience the world with the HDFC Bank Forex Card? Apply today!