In today’s volatile financial landscape, navigating the myriad of investment options can be daunting. Two prominent avenues that have captured the attention of investors are forex and stocks. While both offer avenues for potential profit, their characteristics, risks, and potential returns diverge significantly. This comprehensive guide delves into the intricate realm of forex versus stocks, unraveling the intricacies of each market and empowering you with the insights necessary to make informed investment decisions.

Image: www.stockamj.com

Forex: The Unstoppable Giant

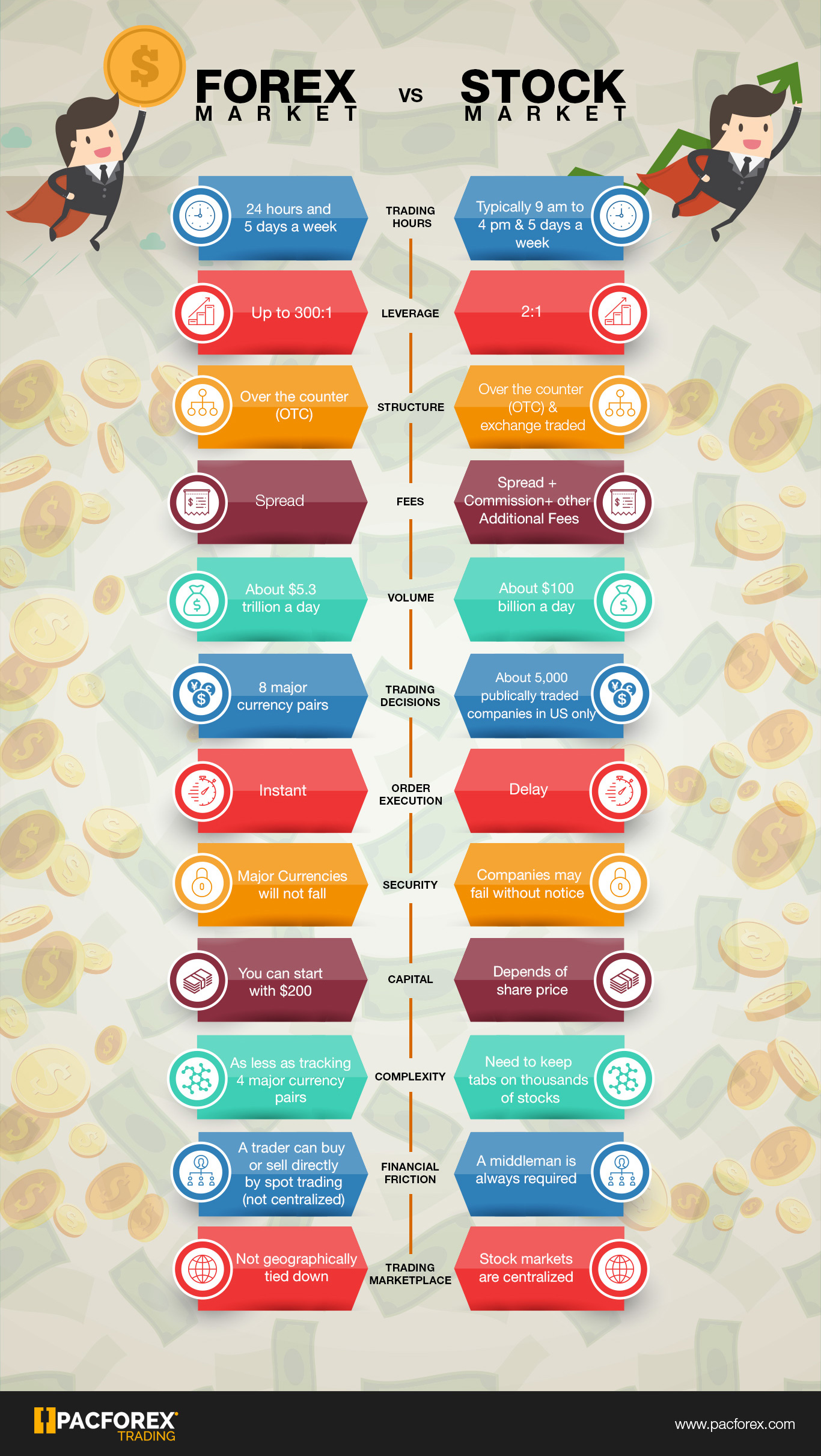

The foreign exchange market, commonly known as forex, is the largest and most liquid financial market globally, with an awe-inspiring daily turnover exceeding $5 trillion. It serves as a global marketplace where currencies are traded, facilitating international commerce and capital flows. Unlike traditional markets that operate during specific hours, forex operates continuously, 24 hours a day, five days a week, offering unparalleled flexibility and accessibility.

Stocks: The Pillars of Ownership

The stock market, or equity market, is a marketplace where shares of ownership in publicly traded companies are bought and sold. By purchasing stocks, investors become part-owners of these companies, entitling them to a share of the company’s profits and potential capital appreciation. Unlike forex, stock markets typically operate during specific business hours and entail a higher level of volatility due to company-specific factors and economic fluctuations.

Profitability: A Question of Risk and Reward

The profitability of forex versus stocks hinges on a delicate balance between risk and reward. Forex trading offers the allure of potentially high returns due to the market’s high leverage, which allows traders to magnify their gains. However, this leverage also amplifies losses, increasing the potential for significant capital erosion. Stocks, on the other hand, tend to offer more stable returns over the long term, albeit with lower profit margins compared to forex.

Image: www.newtraderu.com

Risk: The Inherent Uncertainty

No investment endeavor is devoid of risk, and both forex and stocks come with their inherent uncertainties. Forex trading, with its fast-paced nature and the utilization of leverage, exposes traders to the risk of rapid and substantial losses. Stocks, while generally perceived as less volatile, are susceptible to market downturns, company-specific setbacks, and geopolitical events. Understanding and mitigating these risks are crucial for aspiring investors in either market.

The Role of Brokerage Platforms

Navigating the world of forex and stocks requires a reliable and reputable brokerage platform. These platforms provide access to the financial markets, facilitate trade executions, and offer educational resources and trading tools. Choosing a regulated and well-established brokerage is paramount to safeguard your investments and enhance your trading experience.

Education: The Foundation of Success

Venturing into the world of forex or stocks without a solid foundation in financial knowledge is tantamount to playing a game of chance. Invest time in educating yourself on the dynamics of these markets, trading strategies, risk management techniques, and market analysis. Seek guidance from reputable sources, attend webinars or seminars, and never cease exploring the vast realm of financial knowledge.

Forex Vs Stocks Which Is More Profitable

Experience: The Crucible of Mastery

While education provides the blueprints, experience transforms them into tangible outcomes. Engage in demo trading accounts or start with small investments to gain practical hands-on experience in the markets. Embrace the inevitable ups and downs of investing, for they are the crucible that forges true market wisdom and resilience.