Unlock the Secrets of Forex Trading and Elevate Your Financial Literacy

In the labyrinthine world of international finance, the foreign exchange market, or forex, stands as a colossal tapestry of currency exchanges. For the uninitiated, navigating this complex landscape can seem daunting, but armed with the right knowledge, beginners can decipher the market’s intricate workings and unlock its potential rewards. Welcome to our comprehensive PDF guide to forex trading, specifically tailored for beginners seeking to establish a solid foundation in this dynamic arena.

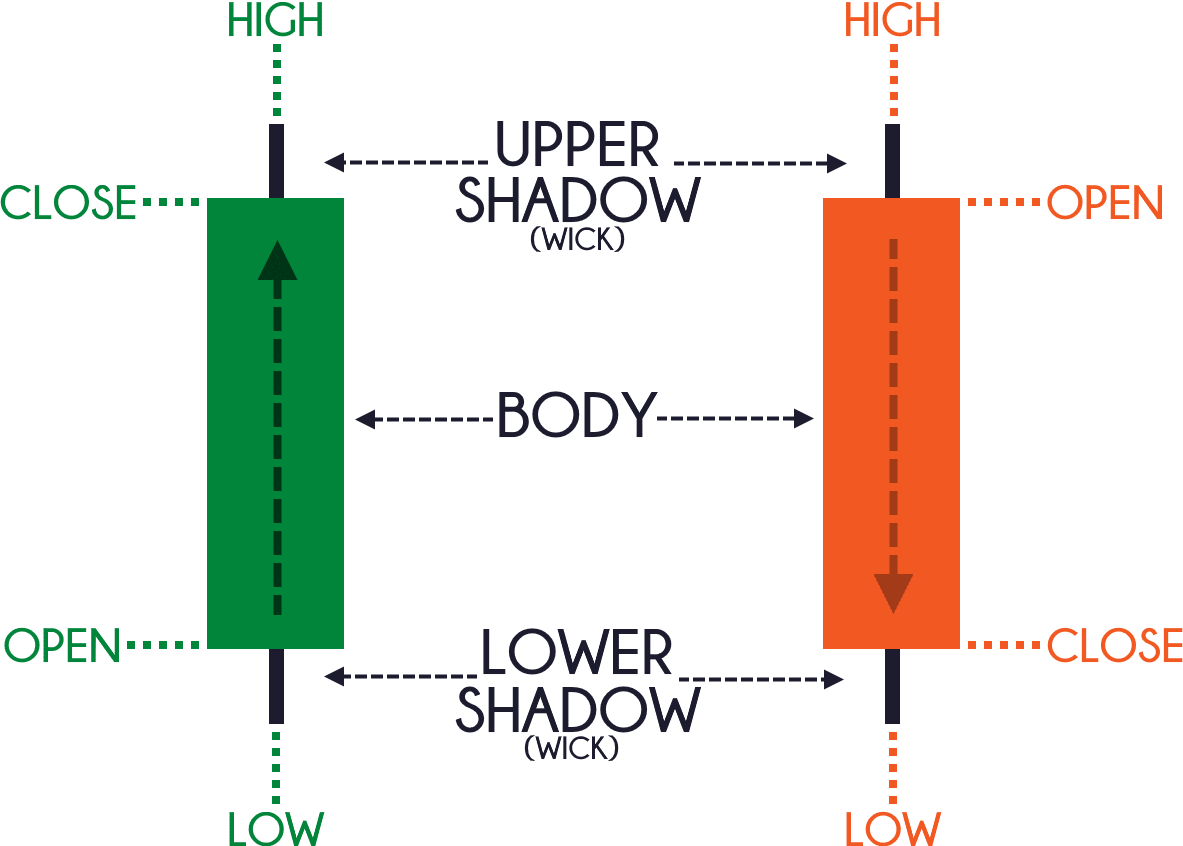

Image: cuahangbakingsoda.com

Understanding the Basics of Forex Trading

At its core, forex trading involves the simultaneous buying and selling of currencies. Traders speculate on the fluctuations in exchange rates between pairs of currencies, aiming to profit from the resulting price movements. The forex market operates 24 hours a day, 5 days a week, making it one of the most accessible and liquid markets globally. Unlike traditional stock or bond markets, forex trading does not take place on a centralized exchange but rather through a decentralized network of brokers and financial institutions. This decentralized nature provides traders with unparalleled flexibility and the ability to react swiftly to market movements.

Benefits of Forex Trading for Beginners

Stepping into the forex market as a beginner can ignite a transformative journey, unlocking an array of advantages:

- High Liquidity: Forex is renowned for its exceptional liquidity, ensuring that traders can enter and exit positions quickly and efficiently without encountering significant slippage or excessive spreads.

- Round-the-Clock Accessibility: As we mentioned earlier, the forex market operates continuously, providing traders with the opportunity to trade at their convenience 24 hours a day, 5 days a week.

- Low Transaction Costs: Forex brokers generally offer competitive spreads and low commissions, translating to substantial savings for traders, especially when trading frequently.

- Leverage Opportunities: Forex brokers allow traders to utilize leverage, which can amplify both profits and losses. However, it’s crucial to exercise caution and employ leverage judiciously to manage risk effectively.

- Global Scope: The forex market encompasses the currencies of all nations, enabling traders to diversify their portfolios geographically and mitigate geopolitical risks.

Essential Forex Trading Strategies

Now that you’re equipped with a foundational understanding of forex trading, let’s delve into some essential strategies that can aid beginners in their quest for consistent profitability:

- Trend Following: This strategy involves aligning one’s trades with the prevailing market trend, whether uptrending or downtrending. By identifying chart patterns, technical indicators, and support and resistance levels, traders can position themselves to ride the momentum of the trend.

- Range Trading: Range trading capitalizes on the price action within a defined range or channel. The goal is to buy near the lower boundary of the range and sell near the upper boundary, profiting from price fluctuations within that range.

- Scalping: Scalping involves executing a high volume of small trades within a short timeframe, typically capturing profits from small price movements. Scalpers rely on scalping strategies and order execution efficiency to turn small profits into substantial returns.

- News Trading: News trading revolves around capitalizing on market reactions to economic news releases and events. By staying abreast of economic calendars and analyzing market sentiment, traders can anticipate price movements and place informed trades.

- Copy Trading: Copy trading allows beginners to emulate the trading strategies of successful traders, reducing the learning curve and enabling them to benefit from the experience of seasoned professionals.

Image: forexlucrativo.com

Risk Management in Forex Trading

While the prospect of financial gain in forex trading can be alluring, it’s paramount to prioritize risk management to preserve your capital and maximize your chances of long-term profitability. Here are key risk management principles:

- Set Realistic Trading Goals: Define clear and achievable trading goals, such as a target return or maximum drawdown, to avoid overtrading and excessive risk-taking.

- Implement a Trading Plan: Establish a comprehensive trading plan that outlines your trading strategy, risk tolerance, and entry and exit criteria. Discipline and adherence to your plan are crucial for consistent success.

- Use Stop-Loss Orders: Stop-loss orders automatically exit your trades when the market moves against you to a predefined level, protecting your capital from catastrophic losses.

- Manage Leverage Prudently: Leverage can enhance profits but also magnify losses. Use leverage cautiously, with a deep understanding of its implications, and ensure it aligns with your risk appetite.

Forex Trading For Beginners Pdf

Conclusion

Embarking on the forex journey as a beginner can be an empowering and rewarding experience with the right guidance. This comprehensive PDF guide has provided you with the foundational knowledge and strategies to navigate the complexities of the forex market. Remember, trading success doesn’t happen overnight, but through continuous learning, disciplined risk management, and a relentless pursuit of mastery.