As the sun rises on Monday mornings, markets worldwide awaken to the commencement of the vibrant Forex (Foreign Exchange) market. From bustling financial hubs to remote trading screens, traders eagerly anticipate the opening bell, marking the start of a new week filled with opportunities and challenges.

Image: www.forextraders.com

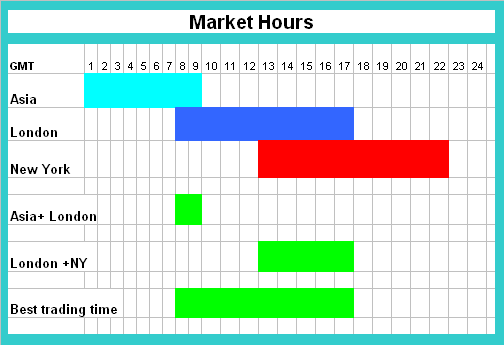

The precise time of the Forex market open on Monday varies depending on the specific time zone of the trading venue. The majority of Forex trading activity occurs in the overlap of major financial centers, such as London, New York, Tokyo, and Sydney. Understanding these time differences is crucial for traders looking to seize the best trading conditions.

The Global Forex Market Landscape

The Forex market operates 24 hours a day, five days a week, with the exception of weekends and public holidays. However, the market’s liquidity and volatility fluctuate throughout the day and across different time zones.

The following are the key trading sessions for the Forex market:

- Sydney Session (10 pm – 7 am GMT): Opens the week with a quieter session, offering opportunities for strategic positioning.

- Tokyo Session (12 am – 9 am GMT): Often characterized by increased trading volume and volatility.

- London Session (8 am – 4 pm GMT): The most active period, coinciding with the overlap of European and U.S. traders.

- New York Session (1 pm – 9 pm GMT): High liquidity and volatility due to the significant number of financial institutions and traders in the region.

- Post-New York Session (9 pm – 4 am GMT): Lower volume and generally less volatility.

Tips for Optimizing Forex Trading

Understanding the Forex market open on Monday and throughout the trading week can significantly enhance trading strategies.

Here are some expert tips to help you make the most of the market’s different trading sessions:

- Identify high-volatility periods: Focus on trading during the overlap of major trading sessions (London and New York) to experience the best trading conditions.

- Manage risk: Volatility can also lead to increased risks. Implement proper risk management strategies, such as using stop-loss orders and position sizing.

- Monitor news events: The Forex market is highly sensitive to breaking news and economic data. Stay informed about key events to make informed trading decisions.

- Be patient: The Forex market can be unpredictable. Stay disciplined with your trading strategy and avoid overtrading or chasing losses.

- Utilize trading tools: Take advantage of analytical tools, such as technical indicators and economic calendars, to enhance your decision-making process.

FAQs on Forex Market Monday Open Time

1. What is the exact time the Forex market opens on Monday?

The precise time depends on the trading venue’s time zone. Generally, the following applies:

- London: 8 am GMT (Winter)/7 am GMT (Summer)

- New York: 1 pm EST (Winter)/12 pm EDT (Summer)

- Tokyo: 12 am JST (Winter)/11 pm JST (Summer)

- Sydney: 10 pm AEDT (Winter)/9 pm AEDT (Summer)

2. Is the Forex market open on weekends?

No, the Forex market is closed on weekends.

3. What factors influence the volatility of the Forex market?

Economic data, central bank announcements, political events, and geopolitical factors are all key influencers of Forex market volatility.

Image: www.tradeforextrading.com

Forex Market Monday Open Time

Conclusion

The Forex market open on Monday marks the commencement of a new week of trading possibilities. By understanding the global trading landscape, optimizing your strategies, and following expert advice, you can position yourself for success in this dynamic market. Stay informed, make informed decisions, and embark on the path to Forex trading mastery.

Are you ready to explore the exciting world of Forex trading? Share your questions and experiences in the comments section below.