In the era of globalization, international travel and cross-border transactions have become an integral part of our lives. Navigating foreign currencies and unfamiliar financial systems can be daunting, but the Bank of India Forex Card offers a seamless solution, empowering you with financial flexibility and peace of mind during your global adventures.

Image: thepienews.com

What is a Bank of India Forex Card?

The Bank of India Forex Card is a prepaid travel card linked to your bank account, allowing you to carry multiple currencies simultaneously. Instead of carrying bulky cash or relying on unreliable exchange rates, you can effortlessly make purchases, withdraw local currency, and conduct online transactions with the convenience of a single card.

Benefits of Using a Bank of India Forex Card

Convenience: Say goodbye to long queues at currency exchange counters. The Bank of India Forex Card allows you to manage your foreign exchange needs swiftly with just a swipe or a few taps on your mobile device.

Multiple Currencies: Eliminate the hassle of managing different currencies. The Bank of India Forex Card supports multiple popular currencies, allowing you to switch between them effortlessly and avoid exchange rate losses.

Competitive Exchange Rates: Benefit from competitive exchange rates offered by the Bank of India, ensuring that you get the most value for your money.

Safety and Security: Rest assured that your funds are safe with the Bank of India Forex Card. It comes with advanced security features like EMV chip technology and PIN protection, safeguarding your financial information and preventing unauthorized transactions.

Acceptance Worldwide: Enjoy the convenience of using your Bank of India Forex Card at millions of establishments worldwide, from retail stores and restaurants to hotels and travel agencies.

How to Use Your Bank of India Forex Card

1. Load Your Card: Easily transfer funds from your bank account to your Bank of India Forex Card through net banking or mobile banking.

2. Select Your Currency: Choose the currency you need before making a transaction. You can switch between currencies anytime, providing maximum flexibility.

3. Make Purchases: Swipe your card or use contactless payment for seamless transactions at merchant outlets globally.

4. Withdraw Cash: Access local currency by withdrawing cash from ATMs accepting Visa or MasterCard.

5. Online Transactions: Conveniently conduct online shopping or make payments for services using your Bank of India Forex Card, ensuring ease and security.

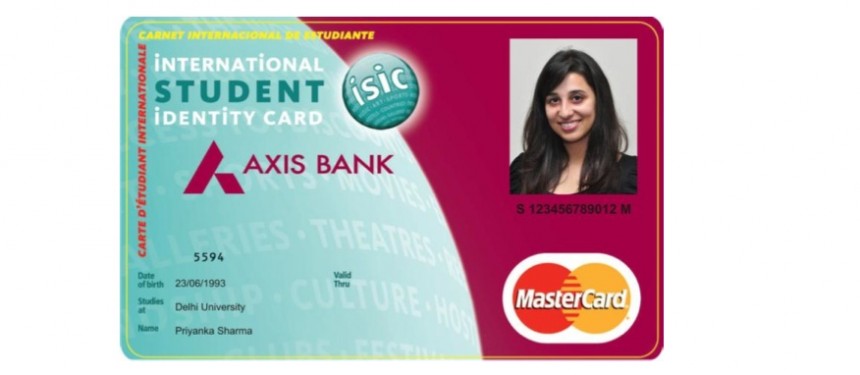

Image: cardinfo.in

Expert Insights and Practical Tips

“The Bank of India Forex Card is an indispensable tool for international travelers, offering convenience, safety, and cost savings,” says financial expert Sanjeev Kumar. “By eliminating the need to carry cash or incur high exchange fees, you can maximize your travel budget and enjoy peace of mind.”

Here are some practical tips to optimize your Bank of India Forex Card experience:

- Plan your currency needs in advance and load your card accordingly to avoid unnecessary exchange rate fluctuations.

- Keep track of your expenses to avoid overspending. Many banks offer transaction alerts to help you stay within your budget.

- Store your card securely and always have a backup payment method available in case of emergencies.

- Inform your bank about your travel itinerary to prevent your card from being blocked due to suspicious activity.

Bank Of India Forex Card

Conclusion

The Bank of India Forex Card is the ultimate solution for global travelers, opening up a world of financial convenience and flexibility. With its multiple currency capabilities, competitive exchange rates, and advanced security features, you can confidently navigate the complexities of international finance and embrace your travels without worry. Experience the freedom and ease of a truly borderless financial experience with the Bank of India Forex Card.