Open the Gates to Forex Trading at the Perfect Hour

The global forex market, an arena where currencies are traded incessantly, presents a lucrative opportunity for both novice and seasoned traders. However, the path to Forex mastery is paved with two fundamental inquiries: “What is the essence of this enigmatic market?” and “When should I make my move?”

Image: www.easycashbackfx.com

In this comprehensive guide, we’ll unravel the secrets of the forex market, exploring its intricacies and unveiling the optimal times to execute profitable trades.

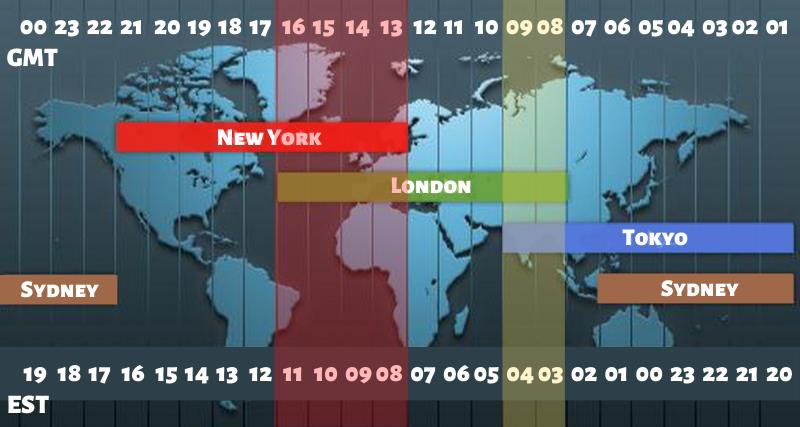

Time Zones and Market Overlaps

The Forex Market’s Perpetual Rhythm

Unlike traditional stock markets, forex trading operates around the clock, spanning multiple time zones and creating distinct market sessions characterized by varying liquidity and volatility.

The three major trading sessions, each with its unique dynamics, are:

- **Asian Session (12 AM – 8 AM UTC):** Marked by moderate liquidity, it’s a popular time for trading Asian currencies like the Japanese Yen.

- **European Session (7 AM – 1 PM UTC):** The most active session, characterized by high liquidity and volatility, especially for major currency pairs like EUR/USD.

- **American Session (12 PM – 8 PM UTC):** Although less liquid than the European session, it offers ample opportunities for trading USD pairs.

Capitalizing on Market Overlaps

The overlaps between trading sessions provide optimal trading conditions due to increased liquidity and volatility.

The most prominent overlap occurs during the European and American sessions, also known as the “London Fix,” where major currency pairs like EUR/USD exhibit heightened activity.

Image: www.pinterest.co.uk

Identifying Market Activity Patterns: Seasoned Trader Secrets

Understanding market activity patterns can significantly enhance trading decisions. Here are some valuable insights from experienced traders:

- Peak Trading Hours: The forex market typically experiences peak activity during overlapping trading sessions, such as London-New York overlap (7 AM – 12 PM UTC).

- Low-Volume Periods: Periods of low trading volume, like weekends and holidays, can result in reduced liquidity and increased volatility, making it prudent to exercise caution.

- **News and Economic Events:** Major news releases and economic events can trigger significant market movements. Traders should closely monitor these events and adjust their strategies accordingly.

- **Liquidity Providers:** The presence of major liquidity providers, such as banks and large financial institutions, also influences market activity. Their trading activities can impact currency pair prices.

Forex Trading Hacks: A Toolkit for Success

Tips for Maximizing Profits

To optimize your forex trading success, consider these expert tips:

- Choose Liquid Pairs: Focus on trading major currency pairs like EUR/USD or GBP/USD, which offer high liquidity and tight spreads.

- Trade During Peak Hours: Execute trades during periods of high market activity to capitalize on liquidity and volatility.

- Monitor Economic Events: Keep abreast of major economic news and events that can significantly impact currency prices.

- Manage Risk: Implement robust risk management strategies, including stop-loss orders and position sizing, to protect your capital.

Frequently Asked Questions: Unraveling the Forex Enigma

- What are the benefits of trading during peak hours?

Trading during peak hours provides increased liquidity, tighter spreads, and higher volatility, enhancing profit potential.

- Which time zone is considered the most profitable for forex trading?

The London-New York overlap, during European and American trading sessions, is generally regarded as the most profitable due to heightened market activity.

- How can I identify periods of market volatility?

Monitor economic news, central bank announcements, and major geopolitical events that can trigger increased price fluctuations.

- What strategies should I employ to minimize risk in forex trading?

Utilize stop-loss orders to limit potential losses, diversify your portfolio, and avoid overleveraging your trades.

Best Time To Trade Forex

Conclusion: Embark on Your Forex Trading Journey

Navigating the forex market requires a keen understanding of market dynamics and the optimal times to trade. By leveraging the insights outlined in this comprehensive guide, you can confidently identify profitable trading opportunities and embark on a successful forex trading journey.

Are you eager to delve deeper into the world of forex trading and unlock its wealth of possibilities? Let us guide you with our invaluable resources and expert insights.