Unlocking the Secrets of Global Financial Stability

In the intricate tapestry of the global financial landscape, foreign exchange (forex) reserves stand as a testament to a nation’s economic strength and resilience. These vast troves of foreign currencies, primarily consisting of U.S. dollars, euros, and other major currencies, serve as a buffer against external economic shocks and provide a crucial safety net for international trade and investment.

Image: howtotradeonforex.github.io

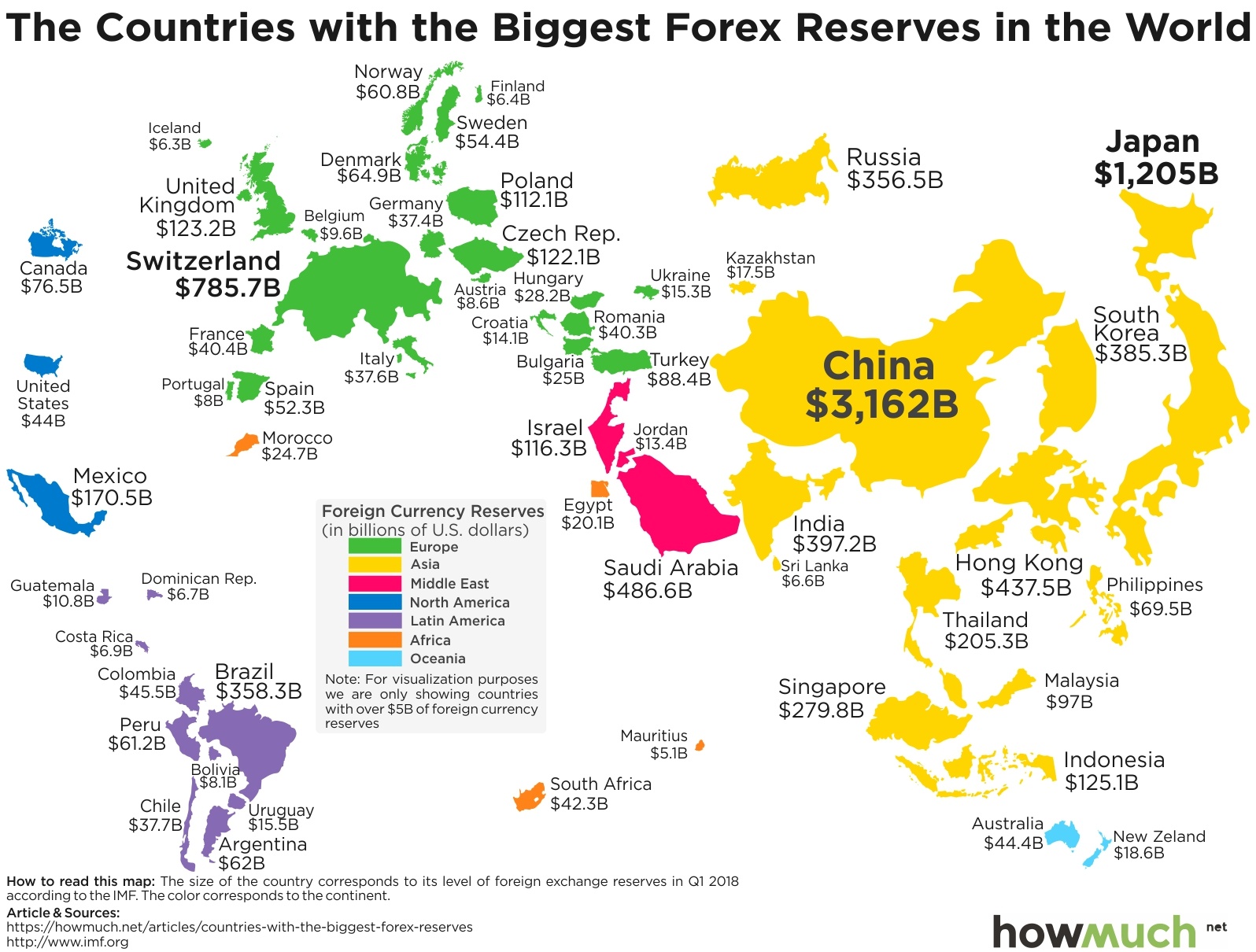

Understanding the distribution of forex reserves around the world unveils intriguing insights into a country’s economic standing, geopolitical influence, and global financial stability. Embark on a captivating journey as we unveil the top countries by forex reserves, deciphering the intricate dance of monetary policy, international trade, and geopolitical factors that shape these rankings.

China: A Financial Colossus with Unrivaled Reserves

Commanding an astounding $3.31 trillion in forex reserves, China reigns supreme as the undisputed global leader. This colossal stockpile represents a testament to China’s export prowess, robust economic growth, and prudent macroeconomic management. By amassing such a formidable war chest, China has effectively bolstered its financial resilience, shielded its currency from volatile market fluctuations, and strengthened its standing as a major player in the global financial system.

Japan: A Monetary Powerhouse with Ample Reserves

Trailing closely behind China is Japan, boasting $1.25 trillion in forex reserves. These substantial reserves reflect Japan’s export-oriented economy, its aging population, and the Bank of Japan’s aggressive quantitative easing policies. By maintaining such a significant cushion of foreign currencies, Japan can safeguard its financial system from external shocks and ensure the stability of its currency, the yen.

Switzerland: A Safe Haven with a Fortress-like Economy

Nestled amidst the towering Swiss Alps, Switzerland has rightfully earned its reputation as a bastion of financial stability. With a staggering $997.3 billion in forex reserves, Switzerland’s financial fortitude is a testament to its thriving banking sector, strong export performance, and commitment to sound economic policies. These ample reserves provide a buffer against external economic headwinds and bolster Switzerland’s allure as a safe haven for investors seeking shelter during times of volatility.

Image: www.news9live.com

India: An Emerging Economic Powerhouse with Growing Reserves

India, a rising economic giant, has steadily ascended the ranks of forex reserve holders, currently amassing $612.7 billion. India’s burgeoning foreign exchange reserves reflect its robust economic growth, growing trade surplus, and the influx of foreign direct investment. By bolstering its forex reserves, India has fortified its financial system against global economic shocks and laid the groundwork for continued economic expansion.

Russia: A Complex Story Amidst Geopolitical Tensions

Russia’s forex reserves have undergone a turbulent journey, reaching a peak of $631.6 billion in 2014 before experiencing a sharp decline in the wake of Western sanctions. Despite recent recoveries, Russia’s forex reserves currently stand at $628.4 billion. These reserves provide a lifeline for Russia, enabling it to withstand external pressures and stabilize its economy amidst geopolitical challenges.

Saudi Arabia: An Oil-Fueled Reserve Giant

The sands of Saudi Arabia hold not only vast oil reserves but also a significant stockpile of forex reserves, amounting to $494.3 billion. This financial fortress has been carefully cultivated by the Saudi Arabian Monetary Authority and reflects the country’s substantial oil revenues, which have provided a steady stream of foreign exchange earnings. Saudi Arabia’s forex reserves serve as a buffer against oil price volatility and underpin the stability of the Saudi riyal.

South Korea: A Technological Powerhouse with Ample Reserves

South Korea’s rise as a technological powerhouse is mirrored by its growing forex reserves, currently standing at $474.5 billion. This formidable stockpile is a testament to South Korea’s export-oriented economy, particularly in the electronics and automotive sectors. By maintaining ample forex reserves, South Korea can effectively navigate global economic uncertainties and safeguard its financial stability.

Brazil: A Resource-Rich Nation with Growing Reserves

Brazil, endowed with abundant natural resources, has experienced steady growth in its forex reserves, which have reached $325.2 billion. This accumulation reflects Brazil’s strong export performance, particularly in commodities such as soybeans, iron ore, and coffee. Brazil’s forex reserves provide a buffer against external economic shocks and support the stability of the Brazilian real.

Taiwan: A Technological Hub with Robust Reserves

Taiwan, a global leader in the semiconductor industry, has amassed $546.3 billion in forex reserves, a reflection of its strong export performance and its prudent macroeconomic management. These substantial reserves bolstered Taiwan’s financial resilience during the global financial crisis of 2008 and have positioned the country as a key player in the global financial system.

List Of Countries By Forex Reserves

Conclusion: The Intricate Dance of Forex Reserves and Global Stability

The distribution of forex reserves across the globe offers a tantalizing glimpse into the intricacies of international finance, revealing the complex dance between economic strength, geopolitical dynamics, and monetary policy. Understanding these rankings is paramount for investors, policymakers, and anyone seeking to navigate the treacherous currents of global financial markets.

By exploring the world’s top countries by forex reserves, we uncover the hidden forces that shape the global economic landscape, empowering us to make informed decisions and navigate the ever-changing tapestry of international finance. As the world’s financial landscape continues to evolve, the rankings of countries by forex reserves will undoubtedly shift, ensuring that this captivating topic remains a source of fascination and intrigue in the years to come.