Forex trading, the global marketplace for currency exchange, offers traders in India both opportunities and challenges. Identifying the ideal time to trade can significantly impact profitability. Let’s delve into the intricacies of the Indian forex market to determine when the trading conditions are most favorable.

Image: sandyqsharlene.pages.dev

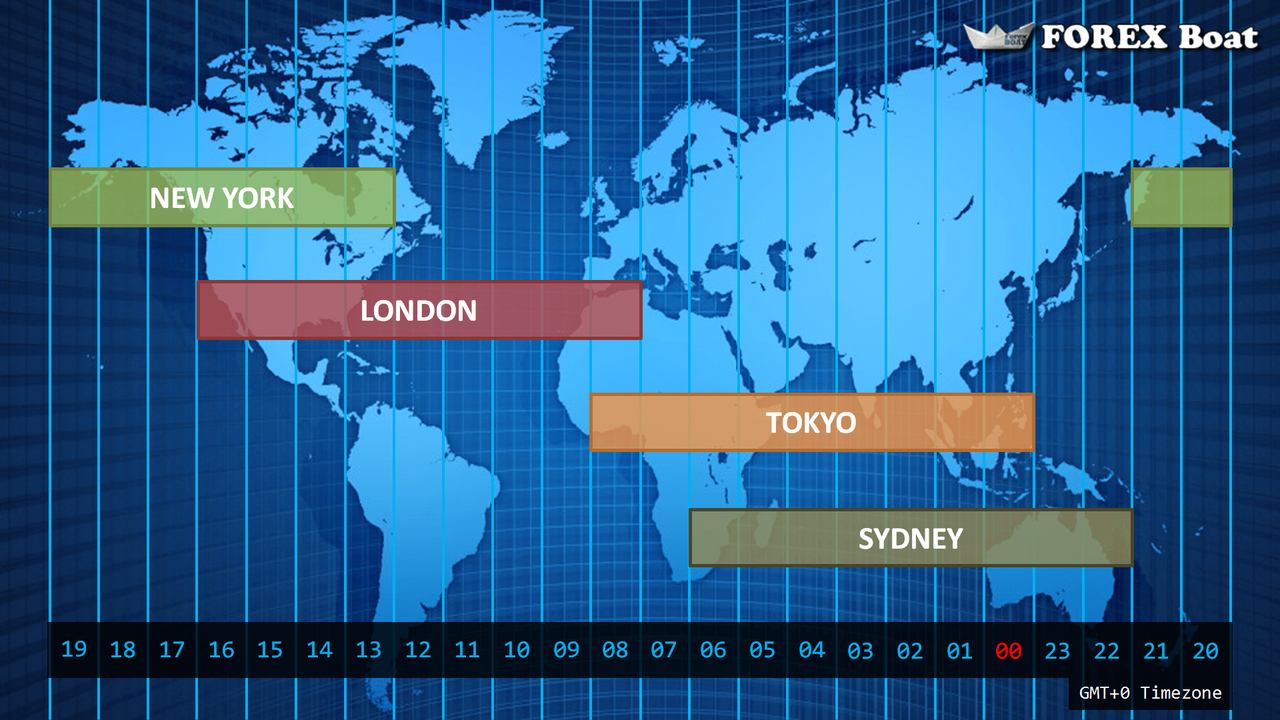

Trading Sessions in the Indian Forex Market

The Indian forex market operates within the UTC+5:30 time zone. Trading sessions are segregated into three distinct segments:

- Indian Session (09:00 AM – 05:00 PM): During this session, traders can capitalize on market activity influenced by domestic economic data releases and events.

- European Session (03:00 PM – 11:00 PM): This session coincides with the opening of major European financial markets, leading to increased liquidity and price volatility.

- American Session (08:00 PM – 04:00 AM): This session, overlapping with the opening of the New York Stock Exchange, witnesses significant market movements due to the participation of institutional players.

Optimal Trading Times

The optimal time to trade forex in India largely depends on individual trader preferences and trading strategies. However, certain time slots are generally considered more favorable based on liquidity and volatility levels:

- Indian Session (09:00 AM – 05:00 PM): This session offers opportunities for traders who prefer to trade on domestic news and events that can influence the value of the Indian rupee.

- European Session (03:00 PM – 05:00 PM): The overlap between the Indian and European sessions provides a period of increased liquidity, making it an ideal time for scalping or short-term trading strategies.

- American Session (08:00 PM – 10:00 PM): This session marks the peak trading activity in the global forex market. Traders can take advantage of high liquidity and volatility to execute larger trades or employ swing trading strategies.

- Identify Your Trading Style: Whether you prefer scalping, day trading, or swing trading, determine the appropriate time slots that align with your strategies.

- Monitor Economic Calendars: Stay informed about upcoming economic news and events that can impact currency values.

- Analyze Market Trends: Use technical analysis tools to identify market trends and potential trading opportunities.

- Consider Time Zones: Be aware of the time zone differences when trading with international partners or brokers.

- Practice Risk Management: Implement proper risk management techniques, including stop-loss orders and position sizing, to mitigate potential losses.

Understanding Currency Pair Volatility

In addition to trading session times, understanding the volatility of specific currency pairs is crucial. Major currency pairs such as EUR/USD, USD/JPY, and GBP/USD tend to exhibit higher volatility during the European and American sessions. Traders can monitor currency pair volatility through indicators like the average true range (ATR) or Bollinger Bands.

Image: nhdelta.weebly.com

Tips for Optimal Forex Trading Times

FAQs on Forex Trading in India

Q: What are the main factors to consider when choosing the best time to trade forex in India?

A: Trading session times, currency pair volatility, economic events, and personal trading preferences.

Q: Which currency pairs are most suitable for trading during the Indian session?

A: Currency pairs involving the Indian rupee (INR), such as EUR/INR, GBP/INR, and USD/INR.

Q: What are the potential risks associated with forex trading?

A: Market volatility, leverage, and lack of proper risk management can lead to financial losses.

Best Time For Forex Trading In India

Conclusion

Determining the optimal time for forex trading in India requires a comprehensive understanding of trading sessions, currency pair volatility, and personal trading strategies. By carefully considering these factors, traders can maximize their chances of profitability in this dynamic and lucrative market. So, are you ready to unlock the potential of forex trading in India?