The world of finance is evolving rapidly, with innovative investment strategies emerging constantly. One such strategy that has gained significant attention in South Africa is bitcoin arbitrage trading. This technique harnesses the price discrepancies of bitcoin across various exchanges, creating opportunities for savvy investors to capitalize on market inefficiencies.

Image: bgr.com

Bitcoin arbitrage trading involves buying bitcoin on one exchange at a lower price and simultaneously selling it on another exchange at a higher price. The resulting profit, known as the arbitrage spread, can be substantial, depending on the market conditions.

The Mechanics of Bitcoin Arbitrage Trading

To understand how bitcoin arbitrage trading works, it’s essential to recognize the fragmented nature of the cryptocurrency market. Bitcoin is traded on numerous exchanges worldwide, and each exchange operates independently, setting its own prices. These price differences arise from various factors such as supply and demand, liquidity, and trading fees.

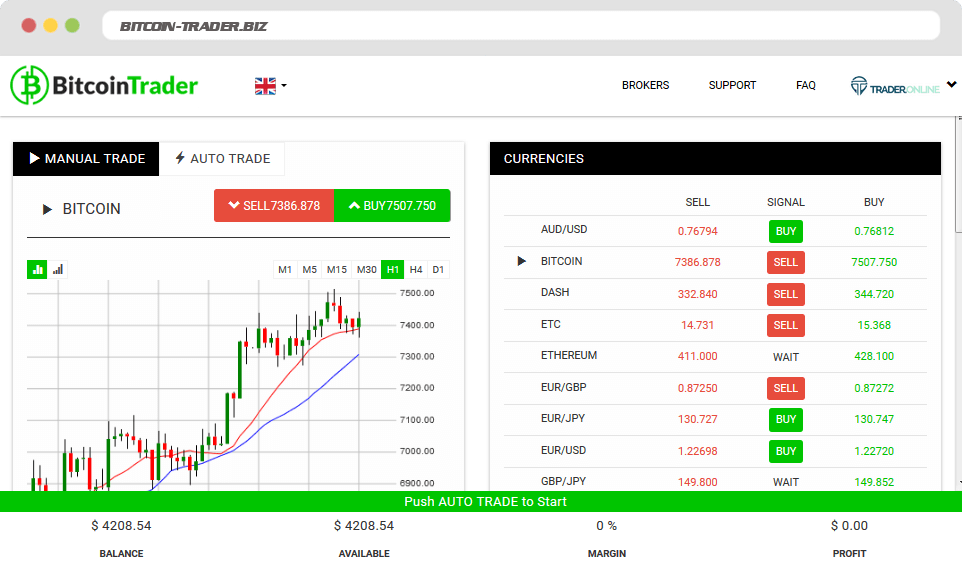

Bitcoin arbitrage traders capitalize on these price discrepancies by simultaneously buying and selling bitcoin on different exchanges. They identify price gaps using high-frequency trading software or specialized platforms that monitor multiple exchanges in real-time. Once a profitable arbitrage opportunity is detected, the trader initiates the trade, aiming to minimize execution time and maximize potential profits.

Benefits of Bitcoin Arbitrage Trading

The appeal of bitcoin arbitrage trading lies in its unique advantages:

-

Low Risk: Compared to traditional financial instruments, the risk involved in bitcoin arbitrage trading is generally lower as it leverages price discrepancies rather than market fluctuations. However, it’s crucial to note that the cryptocurrency market remains volatile, and sudden price changes can impact profitability.

-

Accessibility: Participation in bitcoin arbitrage trading is open to anyone with an internet connection and access to bitcoin exchanges. It eliminates barriers to entry often associated with other investment strategies.

-

Profit Potential: The potential profitability of bitcoin arbitrage trading stems from capturing the price differential between exchanges. While profit margins may vary, dedicated traders can accumulate significant returns over time.

Challenges in Bitcoin Arbitrage Trading

Despite its allure, bitcoin arbitrage trading also presents its share of challenges:

-

Competition: The growing popularity of bitcoin arbitrage trading has attracted a large pool of participants, increasing competition and narrowing profit margins.

-

Execution Speed: Timing is paramount in bitcoin arbitrage trading. Traders must execute trades swiftly to secure the best possible price before the arbitrage opportunity diminishes.

-

Fees and Expenses: Bitcoin arbitrage trading involves multiple transactions across exchanges, each of which may incur fees. Accumulated trading fees can eat into potential profits.

Image: opinion-fr.com

Tips for Successful Bitcoin Arbitrage Trading in South Africa

To maximize success in bitcoin arbitrage trading in South Africa, consider these tips:

-

Conduct Thorough Research: Familiarize yourself with the bitcoin market, its nuances, and regulatory landscape in South Africa. Understand the different exchanges and their trading policies.

-

Choose Reliable Exchanges: Select trustworthy and reputable bitcoin exchanges that offer stable platforms, competitive fees, and robust security measures.

-

Use Suitable Software: Utilize high-quality trading software or platforms specifically designed for bitcoin arbitrage trading. They can automate the identification and execution of arbitrage opportunities.

-

Monitor Market Conditions: Stay abreast of the latest market news, price fluctuations, and industry trends that may impact arbitrage opportunities.

-

Prepare for Execution: Ensure you have sufficient liquidity on your exchange accounts to execute arbitrage trades promptly. Also, consider partnering with liquidity providers to minimize delays.

Bitcoin Arbitrage Trading South Africa

Conclusion

Bitcoin arbitrage trading in South Africa offers a lucrative investment opportunity for individuals seeking to profit from market inefficiencies. By understanding the mechanics and challenges involved, and implementing sound strategies, traders can exploit the arbitrage spread and accumulate substantial returns. However, due diligence, risk management, and the ability to adapt to a dynamic market are essential for long-term success in this dynamic investment landscape.