Bitcoin, the digital currency that has taken the financial world by storm, presents a unique opportunity for traders in South Africa. With its inherent volatility and round-the-clock availability, determining the optimal time to buy and sell Bitcoin is paramount for maximizing returns and mitigating risks.

Image: www.youtube.com

In this comprehensive guide, we will delve into the intricacies of the Bitcoin market in South Africa, exploring the factors that influence trading patterns and revealing the secrets to identifying the best time to trade. From understanding market trends to leveraging technical indicators, this guide will empower you with the knowledge and strategies necessary to navigate the Bitcoin market like a seasoned professional.

Navigating Market Trends

The Bitcoin market is a complex and dynamic landscape, subject to various factors that can influence price fluctuations. Understanding the market trends is crucial for predicting price movements and making informed trading decisions.

Economic Conditions

Global economic conditions can have a significant impact on the price of Bitcoin. Positive economic news, such as strong economic growth or rising inflation, tends to boost the value of Bitcoin, while negative news can lead to a decline.

Political and Regulatory Landscape

Political and regulatory developments related to Bitcoin can also influence its price. Positive news, such as supportive government policies or increased regulatory clarity, can boost confidence in Bitcoin, while negative news can lead to uncertainty and sell-offs.

Image: www.trustnodes.com

Supply and Demand

The balance between supply and demand is a fundamental determinant of Bitcoin’s price. When demand for Bitcoin exceeds supply, its price tends to rise, while the opposite occurs when supply exceeds demand.

Utilizing Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that can help predict future price movements. Various technical indicators and chart patterns can be used to identify potential trading opportunities.

Moving Averages

Moving averages smooth out price fluctuations by calculating the average price over a specific period. Traders use moving averages to identify trends and potential areas of support and resistance.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to gauge whether an asset is overbought or oversold. Traders use the RSI to identify potential turning points in the market.

Bollinger Bands

Bollinger Bands are a set of three lines that show the range or volatility of an asset’s price. Traders use Bollinger Bands to identify potential areas of consolidation and breakouts.

Timing Your Trades

Now that we have explored the factors that influence Bitcoin’s price, let’s turn our attention to strategic timing. The best time to trade Bitcoin in South Africa depends on various factors, including:

Market Sentiment

Market sentiment refers to the overall mood of the market participants. A bullish sentiment, characterized by positive expectations, often leads to rising prices, while a bearish sentiment can result in falling prices.

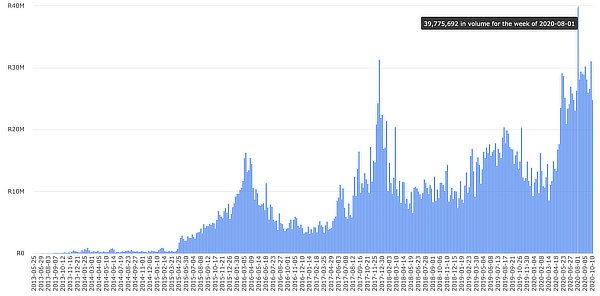

Daily Volume

Trading volume refers to the number of Bitcoin transactions occurring in a given period. Higher volume indicates increased market activity and can signal potential volatility.

Support and Resistance Levels

Support and resistance levels are crucial points where the price of Bitcoin tends to find obstacles or support. Identifying these levels can help traders anticipate areas where the price may bounce or reverse.

Mastering the Best Trading Times

Combining market analysis with strategic timing techniques can yield significant advantages in Bitcoin trading. Here are some key tips for mastering the best trading times:

Early Morning Hours

The early morning hours in South Africa, typically between 6 and 9 AM, often coincide with lower volatility and higher liquidity in the Bitcoin market. This can be an optimal time for executing trades as spreads tend to be tighter.

Lunchtime Trading

The period around lunchtime, between 12 and 2 PM, can also provide trading opportunities as market activity tends to pick up and volatility increases.

Market Open and Close

The opening and closing hours of the major Bitcoin exchanges, typically around 7 AM and 5 PM South African time, can present increased volatility and potential trading opportunities.

Weekends and Holidays

Due to reduced market activity, weekends and holidays can offer more stable trading conditions and potentially wider spreads. However, it is important to note that liquidity may be lower during these times.

Best Time To Trade Bitcoin South Africa

Conclusion

Unveiling the best time to trade Bitcoin in South Africa requires a deep understanding of market trends, technical analysis, and strategic timing techniques. By mastering these concepts and applying the insights provided in this guide, you can significantly enhance your trading performance and maximize your potential returns. Remember, the Bitcoin market is constantly evolving, so it is essential to stay informed about the latest developments and adjust your trading strategies accordingly. With patience, practice, and a disciplined approach, you can unlock the full potential of Bitcoin trading in South Africa.