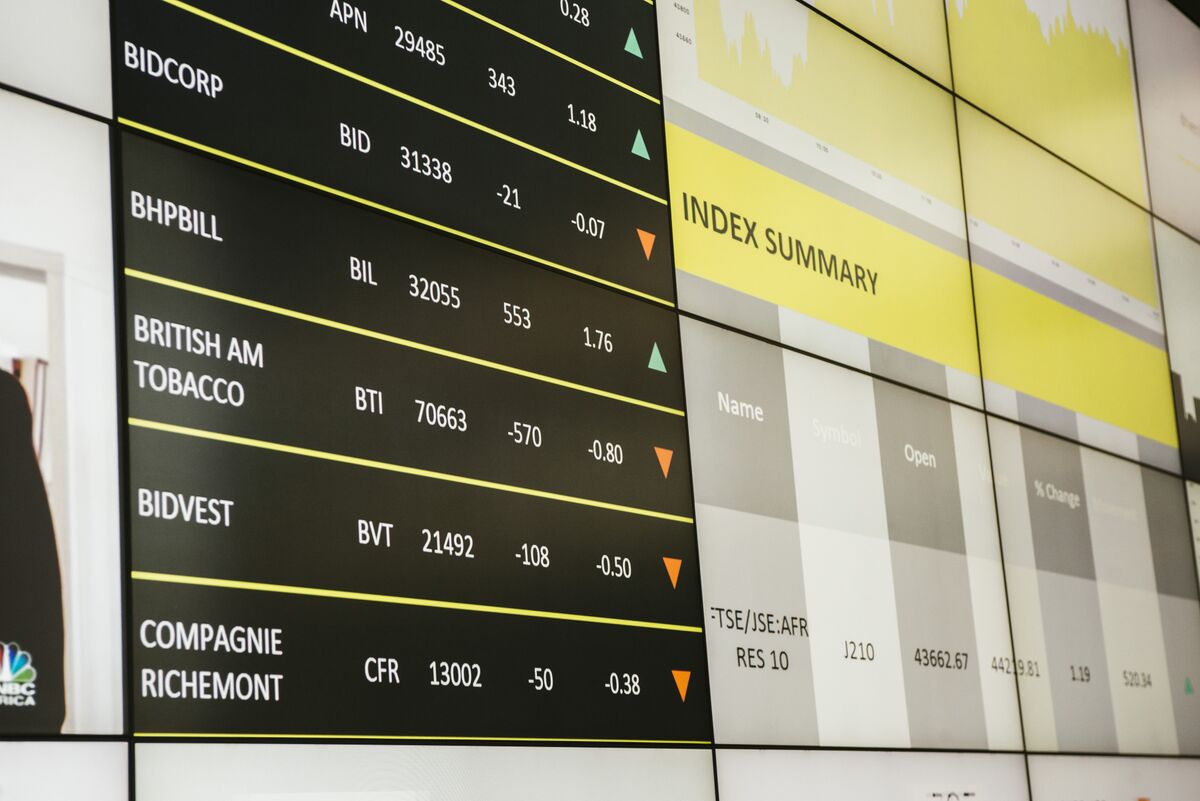

Stock trading in South Africa can be lucrative, with numerous companies listed on the Johannesburg Stock Exchange (JSE). Yet, timing is of paramount importance. This article delves into the best time to trade stocks in South Africa, based on comprehensive research and insights from experienced traders. Get ready to optimize your investment strategy and maximize your returns.

Image: www.bloomberg.com

Understanding the Market Dynamics

The South African stock market is influenced by a multitude of factors, including economic conditions, political stability, global markets, and corporate earnings. These variables create fluctuations in stock prices throughout the day and week. Therefore, it is crucial to grasp the dynamics of the market to identify the most opportune time slots for trading.

The Morning Miracle: Pre-Trading and Open Bells

Experienced traders often recommend initiating trades during the pre-trading session, which commences at 7:00 AM and extends until the official market opening at 9:00 AM. During this period, large institutional investors and algo traders actively place orders, affecting the market’s sentiment. By carefully observing order activity during pre-trading, you can gain a valuable edge and potentially capitalize on early movements.

Furthermore, the first hour after the market opens, known as the opening bell, frequently presents significant opportunities. Volatility tends to increase during this period due to a surge in orders and adjustments by market participants. By participating in the opening bell, traders can take advantage of potential price spikes or dips.

Midday Calm and Afternoon Activity

After the initial burst of activity, trading typically enters a calmer phase around midday. This lull can provide a strategic respite for traders to take stock of the market’s movement and reassess their positions. It is advisable to use this time for technical analysis, chart readings, and profit-taking if needed.

However, do not assume that midday equates to inactivity. The afternoon session often witnesses a resurgence in activity, driven by news releases, corporate announcements, or changes in the global market sentiment. Therefore, staying vigilant and monitoring price movements is imperative to capture late-day trading opportunities.

Image: brokstock.co.za

Capitalize on Post-Closing Changes

Even after the JSE closes at 5:00 PM, trading continues in the after-hours market, which lasts until 6:30 PM. This post-closing session offers opportunities for specific trades and allows investors to react to any significant news or economic events that occur after market hours.

After-hours trading poses some risks, including lower liquidity and wider bid-ask spreads. However, it can also provide chances for investors to adjust positions or execute strategies that may not be feasible during regular trading hours. Carefully weigh the pros and cons before participating in post-closing trading.

Tips and Expert Advice from the Trading Trenches

- Be Patient and Disciplined: Trading requires patience and adherence to a well-defined strategy. Avoid chasing short-term gains and instead focus on long-term returns.

- Manage Risk Effectively: Employ sound risk management practices, such as setting stop-loss orders and limiting position sizes. Risk management mitigates potential losses and preserves capital.

- Stay Informed and Adapt: Continuously monitor the market, analyze news, and read economic reports. Adapt your trading strategy to evolving market conditions.

- Emotionless and Objective: Maintain objectivity and avoid making emotional decisions. Stick to your trading plan and let logic guide your actions.

- Seek Professional Assistance: Consider consulting with a financial advisor or experienced trader for guidance and support in developing a personalized trading plan.

FAQ on South African Stock Trading

- Q: What is the best time to trade stocks in South Africa?

- The pre-trading session and opening bell typically provide advantageous trading opportunities, but opportunities exist throughout the trading day.

- Q: How can I stay ahead in South African stock trading?

- Stay informed about economic conditions, company fundamentals, and technical analysis. Develop a trading strategy that aligns with your risk tolerance and investment goals.

- Q: Is it advisable to trade after market hours?

- Post-closing trading offers unique opportunities but comes with increased risks. Weigh the potential rewards against the added volatility and liquidity concerns.

- Q: What are the top tips for successful stock trading?

- Stay patient, manage risks effectively, remain informed and adaptable, trade objectively, and consider seeking professional guidance when needed.

Best Time For South Africa To Trade Stocks

Conclusion: Navigating the South African Stock Market with Precision

Understanding the best time to trade stocks in South Africa is a critical component of successful investing. By exploiting the advantages of pre-trading, opening bell, midday, afternoon, and post-closing sessions, traders can optimize their strategies and position themselves for maximum returns in the ever-evolving stock market.

Remember, trading involves inherent risks, and there is no guarantee of success. Always conduct thorough research, consult with experts when necessary, and never invest more than you can afford to lose. With the knowledge and strategies outlined in this article, you are well-equipped to navigate the South African stock market with confidence and ingenuity.

Are you ready to delve deeper into the world of South African stock trading? Let the journey begin!