Imagine the thrill of investing your hard-earned money without the burden of hefty taxes eating into your profits. In the realm of trading, South Africa offers a unique opportunity to do just that – through the wonders of tax-free trading platforms.

Image: buyshares.co.za

Embracing the Tax-Free Trading Haven

The South African Revenue Service (SARS) has introduced a revolutionary tax exemption for individuals engaging in trading activities. This exemption allows traders to accumulate capital gains of up to ZAR 40,000 per year without paying a single cent in capital gains tax (CGT). This transformative policy has opened up a world of possibilities for aspiring investors seeking to maximize their financial returns.

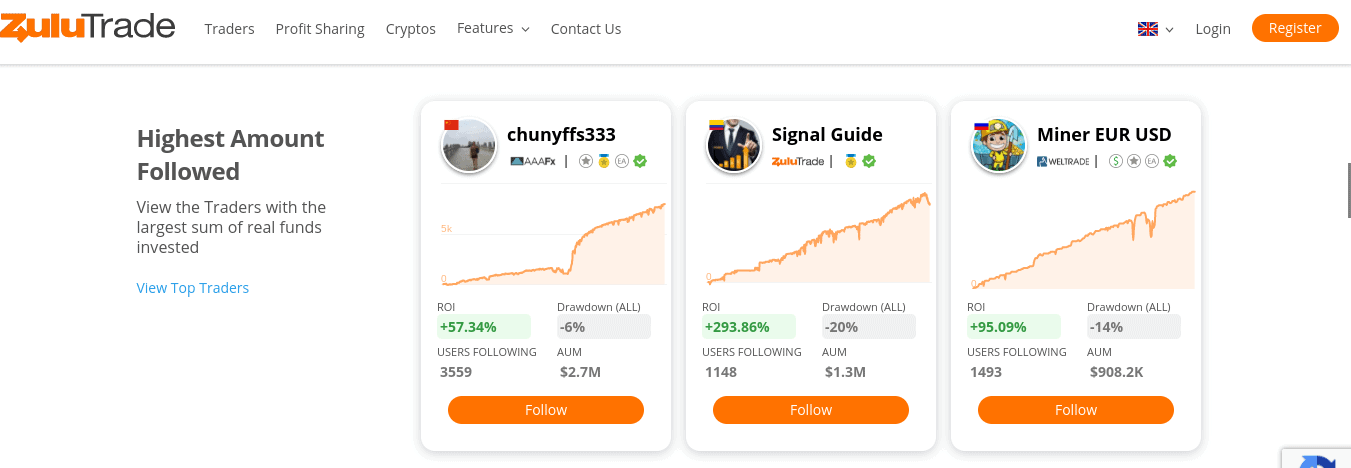

Navigating the Best Tax-Free Trading Platforms

The South African trading landscape boasts an array of reputable platforms that cater specifically to the needs of tax-free traders. Each platform offers its own unique advantages and drawbacks, so it’s crucial to thoroughly research and select the one that aligns best with your trading style and financial goals.

1. EasyEquities:

EasyEquities is a user-friendly platform that caters to both novice and experienced traders. Its intuitive interface and mobile app make it a breeze to buy and sell shares, ETFs, and other financial instruments. EasyEquities charges a low commission fee and offers access to a wide range of investment options, making it a popular choice among tax-free traders.

Image: www.quickread.co.za

2. SatrixNOW:

SatrixNOW is an affordable and accessible platform that specializes in exchange-traded funds (ETFs). ETFs are baskets of stocks or bonds that track a specific index or market sector, providing investors with instant diversification. SatrixNOW offers low fees and allows traders to invest in a variety of ETFs, making it an ideal option for those seeking a passive investment strategy.

3. STANLIB Tax-Free Investment Plan:

STANLIB’s Tax-Free Investment Plan is designed specifically for tax-free trading. It offers access to a range of unit trusts, which are professionally managed investment funds that invest in a variety of assets. STANLIB charges a management fee, but it provides investors with the benefit of professional portfolio management and tax-free investment growth.

4. PSG Wealth:

PSG Wealth is a full-service financial advisory firm that offers a wide range of investment products and services, including tax-free trading. PSG Wealth charges a higher commission fee than some other platforms, but it provides personalized investment advice and tailored portfolio management solutions to meet the unique needs of each client.

Best Tax Free Trading Platform South Africa

Harnessing the Power of Tax-Free Trading

Embracing the benefits of tax-free trading can significantly enhance your investment returns. By sheltering your capital gains from taxation, you’ll retain more of your hard-earned profits and accelerate your wealth-building journey. Remember, the key to successful tax-free trading lies in choosing the right platform and implementing a sound investment strategy.

In the vibrant trading landscape of South Africa, the tax man takes a back seat, allowing savvy investors to unleash their financial potential. Embrace the power of tax-free trading platforms and unlock the doors to a brighter financial future. Remember, the path to financial freedom is paved with smart investment decisions and a deep understanding of the tax-free trading landscape.