Introduction

Are you intrigued by the potential of over-the-counter (OTC) trading in IQ Options within the vibrant financial landscape of South Africa? If so, you are at the right place. In this comprehensive guide, we will delve into the intricacies of OTC trading in IQ Options, empowering you with the knowledge and insights to navigate this exciting financial market.

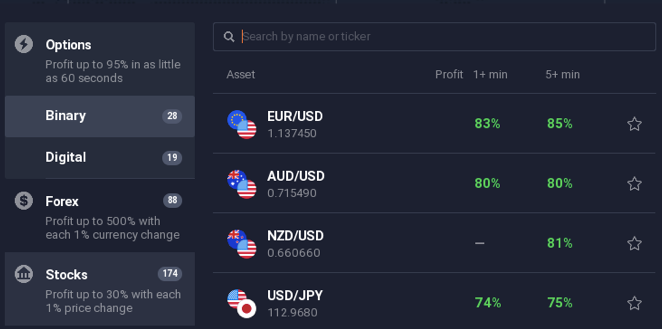

Image: www.binaryoptions.org.za

Prepare yourself for an enriching journey as we explore the history, strategies, and trends that shape the world of OTC trading in IQ Options. Through detailed explanations, expert advice, and practical tips, we will equip you with the necessary tools to succeed in this dynamic market.

What is OTC Trading in IQ Options?

OTC trading in IQ Options refers to the buying and selling of financial assets directly between two parties without involving a centralized exchange. Unlike exchange-traded products, OTC trades are conducted over-the-counter, meaning they occur outside of the traditional exchange framework.

This allows for greater flexibility and customization as the parties can negotiate the terms of the trade, including the price, quantity, and settlement date. OTC trading in IQ Options offers a wider range of financial instruments, such as forex, commodities, and stocks, providing traders with diverse investment opportunities.

Advantages of OTC Trading in IQ Options

- Flexibility and Customization: Tailor trades to your specific needs by negotiating trade parameters directly with your counterparty.

- Access to a Wider Range of Assets: Explore a diverse selection of financial instruments that may not be available on exchanges.

- Faster Execution: Avoid potential delays associated with exchange-based trading, ensuring swift order execution.

Strategies for OTC Trading in IQ Options

Mastering OTC trading in IQ Options requires a well-defined strategy. Here are a few effective approaches:

- Fundamental Analysis: Assess the underlying economic and financial factors influencing the value of an asset.

- Technical Analysis: Analyze price patterns and indicators to identify potential trading opportunities.

- News and Events: Stay informed about market-moving news and events that can impact asset prices.

Image: www.24forex.co.za

Tips for Successful OTC Trading in IQ Options

Enhance your OTC trading experience with these expert tips:

- Understand Your Risks: OTC trades are not subject to the same regulatory oversight as exchange-traded products. Carefully assess the risks involved before entering into any trades.

- Manage Your Leverage: Leverage can amplify both profits and losses. Use leverage judiciously to avoid excessive risk.

- Choose a Reputable Broker: Select an experienced and regulated broker who offers reliable trading platforms and customer support.

Frequently Asked Questions (FAQs)

Q: Is OTC trading in IQ Options legal in South Africa?

A: Yes, OTC trading in IQ Options is legal in South Africa as long as it is conducted through a licensed and regulated broker.

Q: What are the minimum capital requirements for OTC trading in IQ Options?

A: The minimum capital requirements vary depending on the broker and the instruments being traded.

Q: How do I withdraw my profits from OTC trading in IQ Options?

A: Withdrawals are typically processed through the same method used for deposits, such as bank transfers or e-wallets.

Best Otc Trade In Iq Options In South Africa

Conclusion

OTC trading in IQ Options presents a unique opportunity for South African traders to access a wider range of financial markets and potentially generate substantial returns. By understanding the basics, embracing proven strategies, and following expert advice, you can navigate this dynamic market with confidence.

Are you ready to embark on your OTC trading journey with IQ Options? Seize the opportunity today and unlock the potential of over-the-counter trading in South Africa.