Introduction

Navigating the world of finance can be a daunting task, especially when it comes to trading stocks and managing money. In the vibrant economy of South Africa, understanding basic economics is crucial for individuals seeking financial success. This comprehensive guide will delve into the fundamentals of trading, providing clear explanations, real-world examples, and actionable tips to empower you in your financial journey.

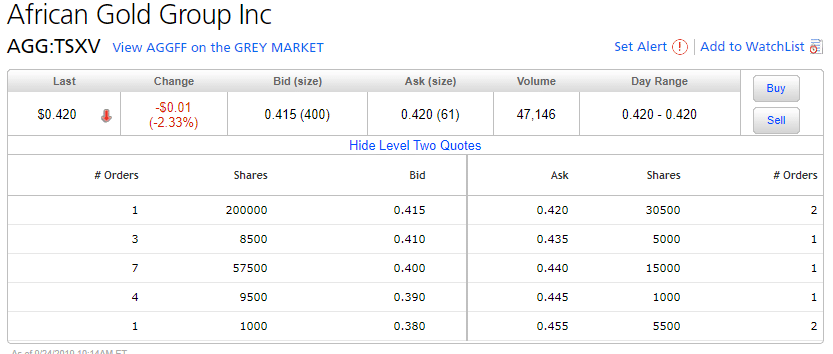

Image: www.newcurrencyfrontier.com

The Basics of Trading

Trading involves the buying and selling of assets, such as stocks, bonds, or currencies, in financial markets. The primary objective of trading is to profit from price fluctuations. Traders analyze market data, including charts, news, and financial statements, to make informed decisions about when to enter or exit a trade. Success in trading requires a combination of knowledge, skill, and discipline.

Types of Trading

There are various types of trading strategies, depending on the trader’s risk appetite and investment horizon. Day trading involves buying and selling stocks within a single trading day. Swing trading seeks to capitalize on short-term price movements over several days or weeks. Position trading aims for long-term profits, holding stocks for an extended period.

Understanding Stock Markets

Stock markets are where stocks are traded. The Johannesburg Stock Exchange (JSE) is the largest stock exchange in South Africa, offering a wide range of listed companies. Stocks represent ownership shares in companies, and their prices fluctuate based on market conditions, company performance, and investor sentiment.

Image: debtrescue.co.za

Investing in Stocks

Investing in stocks requires careful research and due diligence. Consider the company’s financial health, industry outlook, and management team. Evaluate the stock’s price-to-earnings (P/E) ratio and other financial metrics to assess its value. Diversify your portfolio by investing in various stocks from different sectors to manage risk.

Managing Risk in Trading

Risk management is essential in trading. Employ risk-limiting techniques such as setting stop-loss orders to limit potential losses. Leverage trading wisely, as it magnifies both profits and losses. Start with smaller trades and gradually increase your position size as you gain experience.

The Role of Money in Economics

Money plays a crucial role in an economy, facilitating transactions, storing value, and determining the prices of goods and services. The central bank of South Africa, the South African Reserve Bank (SARB), regulates the monetary system and manages the supply of money. Inflation, the rate at which prices rise, must be carefully monitored and controlled to maintain economic stability.

Managing Personal Finances

Managing personal finances wisely is fundamental for long-term financial well-being. Create a budget to track your income and expenses. Reduce unnecessary expenditures and consider saving and investing a portion of your income to build wealth. Seek professional financial advice when necessary.

Basic Economics In South Africa About Trading Stock And Money

Conclusion

Understanding basic economics is empowering. By grasping the fundamentals of trading and money management, you can make informed decisions that can positively impact your financial future. Remember, patience and discipline are key, and continuous learning is essential. Stay abreast of economic news and trends to stay ahead in this dynamic and ever-changing landscape.