Algo trading, the buzzword that has revolutionized the financial landscape, holds immense potential for savvy investors in South Africa. Picture a sophisticated system that automates trading decisions based on predefined algorithms, unlocking a new dimension of market participation.

Image: algofuturestrader.com

Harnessing the Edge in Algo Trading

Algo trading offers a unique edge in navigating complex and fast-paced markets. By leveraging algorithms that continuously monitor market data, investors can execute trades in an optimal manner, often with higher precision and speed than manual trading.

Precision and Speed

Algo trading algorithms eliminate human emotions and biases, ensuring objective and timely execution of trades. With lightning-fast response times, these systems can identify and capitalize on market opportunities even at the millisecond level, where human traders may fall short.

Risk Management

Algo trading enables investors to implement sophisticated risk management strategies through automated monitoring and adjustment of positions. The algorithms constantly evaluate market conditions, adjusting trades to minimize potential losses and maximize gains, providing a level of risk mitigation not easily achieved through manual trading.

Image: www.luxalgo.com

A Historical Perspective

Algo trading has its roots in the early days of electronic trading, when pioneers recognized the potential of computers to process vast amounts of data and execute trades quickly. Over the years, technological advancements and the availability of sophisticated algorithms have propelled algo trading to the forefront of modern finance.

Types of Algo Trading

Algo trading encompasses a wide range of strategies, from simple trend followers to complex algorithms that incorporate machine learning and artificial intelligence. Common types include:

- Trend following: Algorithms identify and trade in line with prevailing market trends.

- High-frequency trading: Ultra-fast algorithms execute numerous trades per second, exploiting tiny market discrepancies.

- Statistical arbitrage: Algorithms identify discrepancies in the prices of similar assets and execute trades to capitalize on the difference.

Getting Started with Algo Trading

Venturing into algo trading requires careful preparation. Consider these tips for a successful journey:

- Understand your goals: Define your investment objectives and risk tolerance before choosing an algo trading strategy.

- Choose a reliable platform: Select a reputable platform that offers a range of algo trading tools and features.

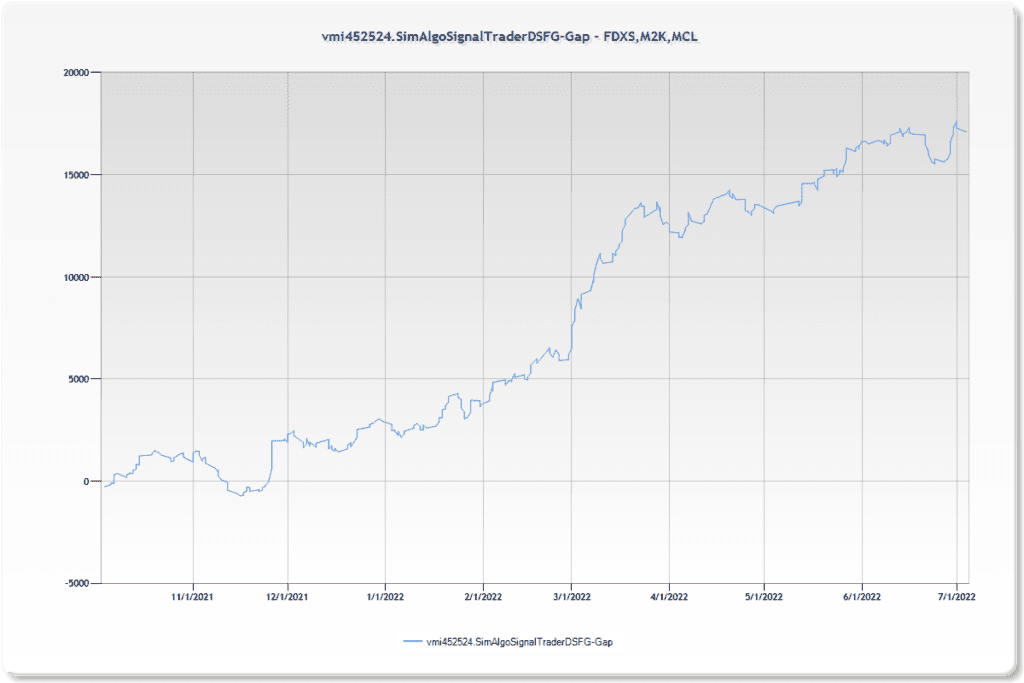

- Test your algorithms: Thoroughly test your algorithms using historical data and simulations to ensure they perform as intended.

Remember, algo trading is not a magic bullet that guarantees success. It requires knowledge, experience, and continuous monitoring to achieve optimal results.

FAQs

Q: Can I use algo trading with any stockbroker?

A: Most larger stockbrokers offer algo trading capabilities. However, it’s essential to choose a broker that aligns with your specific requirements.

Q: Is algo trading legal in South Africa?

A: Yes, algo trading is completely legal in South Africa. The Financial Sector Conduct Authority (FSCA) has regulatory oversight over the industry.

Q: Is algo trading only for professional traders?

A: While algo trading was once exclusive to professional traders, advances in technology and broker services have made it accessible to a wider range of investors.

Algo Trading Indexes South Africa

Conclusion

Algo trading offers an array of benefits for investors in South Africa, from enhanced precision and speed to advanced risk management. While it requires preparation and continuous monitoring, the potential rewards make it a valuable tool for sophisticated investors seeking to maximize their market opportunities.

Ready to explore the world of algo trading? Engage with the topic further by exploring additional resources, consulting with industry experts, and joining online forums and communities.