Introduction

The year 2008 marked a watershed moment in global economic history. The Subprime mortgage crisis that originated in the United States sent shockwaves across the globe, triggering a financial crisis of unprecedented proportions. South Africa, an emerging economy with close ties to the global financial system, was not spared from the fallout. This article delves into the impact of the 2008 financial crisis on South Africa’s trade, examining the challenges it posed and the resilience demonstrated by the nation.

Image: www.tradefinanceglobal.com

The Crisis Unfolds: South Africa’s Vulnerability Exposed

The Subprime mortgage crisis in the US ignited a chain reaction that spread like wildfire through the global financial system. The collapse of major financial institutions and the freezing of credit markets sent shockwaves through the world economy, causing a sharp decline in global trade. South Africa, a significant exporter of commodities such as minerals, metals, and agricultural goods, was particularly vulnerable to the downturn in global demand.

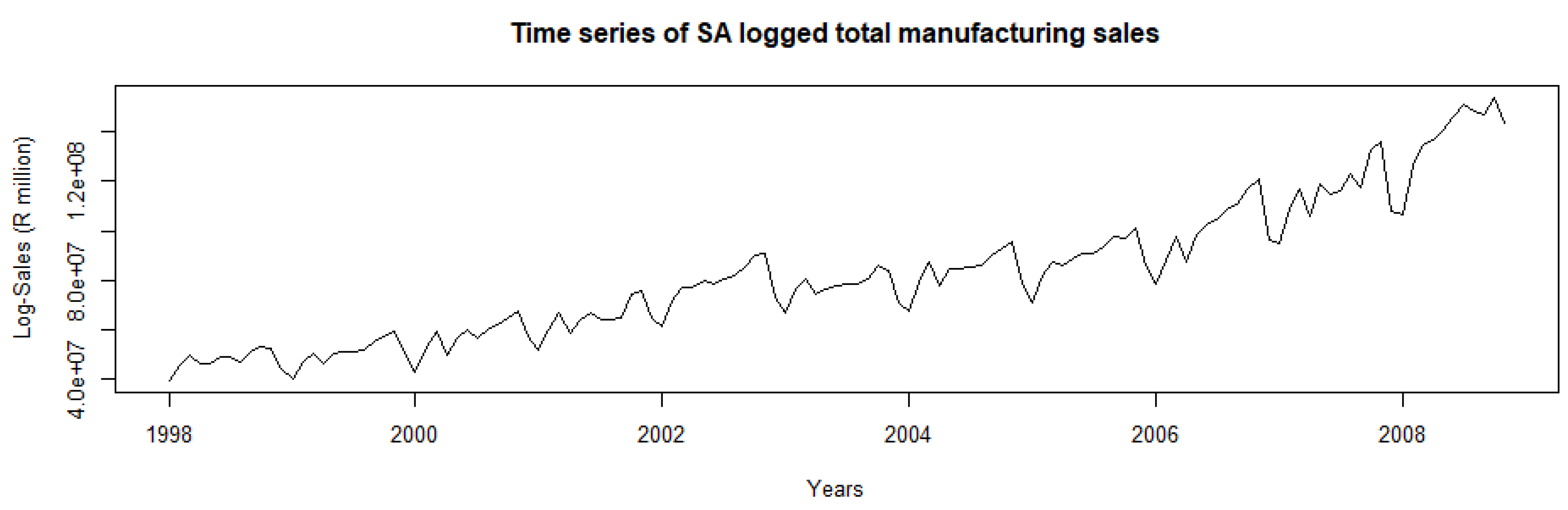

The decline in trade had a profound impact on South Africa’s economy. Export-oriented industries, such as mining and manufacturing, suffered as international orders dwindled. Unemployment rates rose as businesses laid off workers in response to the economic slowdown. The South African Rand (ZAR) depreciated significantly against major currencies, making imports more expensive and further straining the economy.

Adapting and Innovating: South Africa’s Response to the Crisis

Faced with these challenges, South Africa responded with a mix of fiscal and monetary policies aimed at mitigating the impact of the crisis. The government implemented stimulus measures to support businesses and boost economic activity. The South African Reserve Bank (SARB) cut interest rates to stimulate borrowing and investment.

Beyond government intervention, businesses in South Africa demonstrated remarkable resilience and adaptability. Export-oriented companies explored new markets and diversified their product offerings to offset the decline in demand from traditional markets. The development of new trade agreements with emerging economies, such as China and India, helped to cushion the impact of the crisis.

Lessons Learned: Strengthening South Africa’s Trade Resilience

The 2008 financial crisis taught South Africa valuable lessons about the importance of diversifying its economy and strengthening its trade resilience. The nation’s reliance on the exports of a few commodities left it vulnerable to external shocks. This experience underlined the need to develop a more diversified export base and to foster economic growth across various sectors.

The crisis also highlighted the importance of having a sound financial system. The collapse of major financial institutions in the US demonstrated the fragility of the global financial system and the need for robust regulation and oversight. South Africa has since implemented reforms to strengthen its financial system and reduce its vulnerability to future financial crises.

Image: www.mdpi.com

2008 Economic Crisis Trade And South Africa

Conclusion

The 2008 financial crisis was a defining moment for South Africa’s trade landscape. The decline in global trade and the depreciation of the Rand had a significant impact on the nation’s economy. However, South Africa’s resilience and adaptability allowed it to weather the storm and emerge stronger. The lessons learned from the crisis have shaped South Africa’s economic policies and helped to strengthen its trade resilience in the face of future challenges. As the world grapples with the economic fallout of the COVID-19 pandemic, South Africa’s experience during the 2008 crisis offers valuable insights for policymakers and businesses alike.