It was a pivotal moment in my trading journey. Having faced countless losses, I stumbled upon a lifeline—trading signals from a reputable South African provider. The results were transformative. Within weeks, I witnessed a significant turnaround, turning my losing streak into a string of steady profits.

Image: www.forexsignals.com

The allure of trading signals in South Africa is undeniable. They provide invaluable guidance to both novice and experienced traders, enabling them to identify profitable trading opportunities without the need for extensive technical analysis or market surveillance.

Decoding Trading Signals: A Simplified Explanation

Trading signals are essentially recommendations generated by automated systems or financial professionals, indicating potential buy or sell opportunities in the markets. They are based on a comprehensive analysis of market data, including historical trends, price patterns, and technical indicators.

By subscribing to a reputable signal provider, traders receive timely alerts via various platforms such as SMS, email, or trading platforms. These signals typically contain specific information, such as the recommended asset, entry price, exit price, and potential profit targets.

Unlocking the Potential of Trading Signals

The advantages of trading signals are multifaceted. For one, they save traders a considerable amount of time and effort by eliminating the need for extensive market research and analysis. This is particularly beneficial for busy individuals who may not have the luxury of spending countless hours observing market dynamics.

Furthermore, trading signals enhance trading discipline by providing clear and actionable recommendations. Traders are more likely to adhere to their trading plans and avoid emotional decision-making when they have access to professional guidance.

Navigating the Complexities of Trading Signals

While trading signals offer significant benefits, it is crucial to approach their usage with caution. Here are a few tips for maximizing the value of trading signals:

– Verify the provider: Ensure that the signal provider has a proven track record of success and transparent performance metrics. Reputable providers will typically disclose their historical performance data and trading methodologies on their websites.

– Supplement with your research: While trading signals provide valuable guidance, it is important not to rely solely on them. Conduct your research, understand the signals, and assess their suitability within your trading strategy.

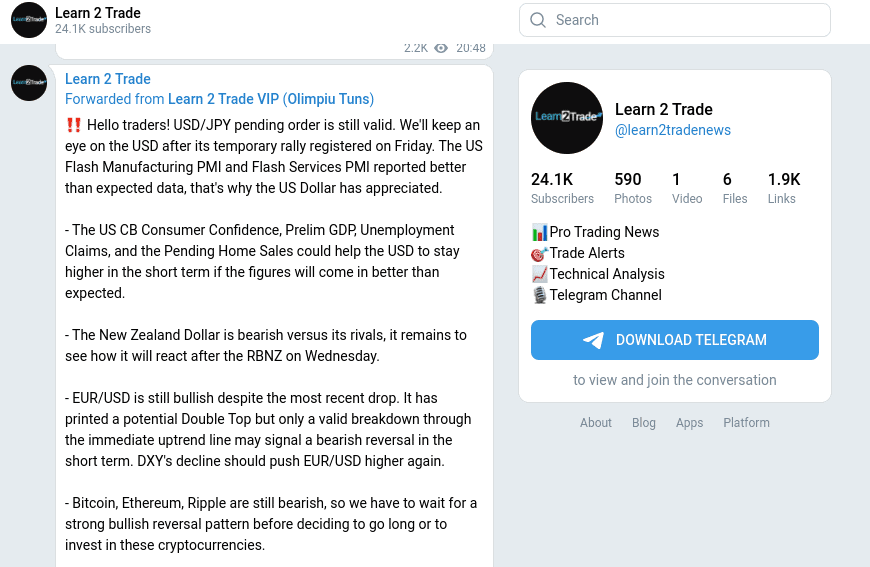

Image: buyshares.co.za

Frequently Asked Questions

– What types of trading signals are available?

Trading signals can cover a wide range of assets, including forex, stocks, commodities, and cryptocurrencies.

– How much do trading signals cost?

The cost of trading signals varies depending on the provider and the level of service. Some providers offer monthly subscription plans, while others charge for each signal generated.

– Are trading signals guaranteed to generate profits?

While trading signals enhance trading success, they do not guarantee profits. Market conditions and trading circumstances play a significant role in the outcome of any trade.

Trading Signals South Africa

Conclusion: Empowering Traders with Confidence

Trading signals South Africa offer an invaluable tool for traders of all levels. They empower traders with timely and actionable recommendations, enabling them to navigate complex market conditions and unlock winning opportunities.

If you are looking to enhance your trading performance, exploring reputable trading signal providers is highly recommended. With proper due diligence and a strategic approach, trading signals can unlock the potential for consistent profits and long-term trading success.

Are you ready to embark on the path to profitable trading? Discover the world of trading signals South Africa and take your trading journey to new heights.