The convenience of electronic fund transfers has undeniably transformed our financial landscapes, facilitating seamless movement of funds between different bank accounts. Here’s an analysis of the transfer time between Capitec and ABSA, providing insights into the intricacies of this transaction.

Image: katadata.co.id

Understanding Capitec to ABSA Transfers

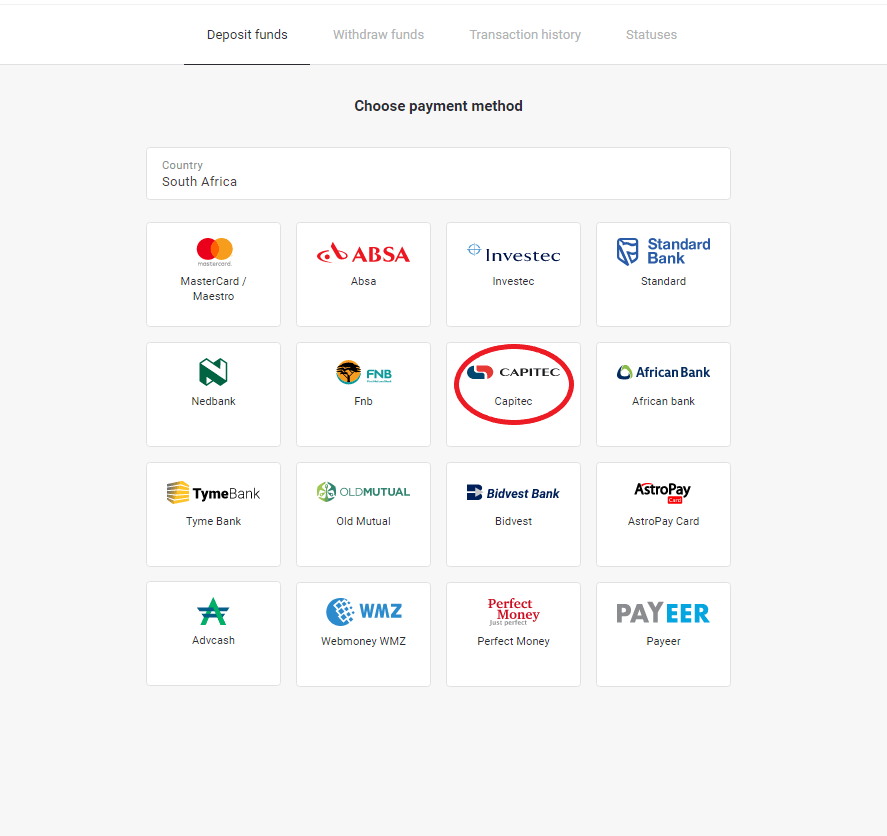

When transferring funds from a Capitec account to an ABSA account, the processing time is dependent on several factors, including the method of transfer and the time of transaction. Generally, there are two primary methods for initiating a transfer:

Online Banking

Utilizing internet banking platforms provides a convenient way to transfer funds. Initiating a transfer typically involves logging into the Capitec online banking portal, selecting the “Transfers” option, providing the ABSA account details, and confirming the transaction. Once processed, the funds will usually reflect in the ABSA account within a few minutes.

Instant EFT

For immediate fund transfers, Instant EFT is a suitable option. By accessing the Capitec banking app or via the USSD (*120*3279#), users can effortlessly initiate an Instant EFT transfer. Upon confirmation, the funds are immediately credited to the ABSA account. It’s worth noting that Instant EFT transactions may incur additional fees.

Image: binomoclub.com

Factors Influencing Transfer Times

Aside from the chosen transfer method, other factors can influence the transfer time from Capitec to ABSA. These factors include:

- Transaction Volume: Large volumes of transactions during peak business hours can occasionally impact transfer speeds.

- Network Availability: Internet connectivity and network stability play a crucial role in ensuring a seamless transfer process.

- Account Verification: First-time transfers or large-value transactions may trigger additional verification procedures, which can extend the transfer time.

- Weekend and Holiday Impact: Banking operations during weekends or public holidays may result in delayed transfers.

Tips and Expert Advice

To expedite Capitec to ABSA transfers, consider the following tips:

- Scheduled Transfers: For non-urgent transfers, utilize the scheduled transfer feature to initiate payments during off-peak hours when network traffic is generally lighter.

- Transfer Limit: Become familiar with your daily transfer limits to avoid unexpected delays caused by exceeding these thresholds.

- Contact Customer Support: If you encounter any issues or prolonged delays, don’t hesitate to contact Capitec or ABSA customer support for assistance.

FAQs on Capitec to ABSA Transfer Times

Q: What is the typical timeframe for a Capitec to ABSA transfer via online banking?

A: Under normal circumstances, funds transferred via online banking are credited to the ABSA account within minutes.

Q: Are there any fees associated with Capitec to ABSA transfers?

A: Standard EFT transfers between Capitec and ABSA are free of charge. However, Instant EFT transfers may incur additional fees.

Q: What happens if my Capitec to ABSA transfer is delayed?

A: In case of a delayed transfer, contact the respective banks to report the issue and seek assistance in expediting the process.

Capitec To Absa Transfer Time

https://youtube.com/watch?v=8l302yepQqE

Conclusion

Understanding the nuances of Capitec to ABSA transfer times is essential for seamless electronic fund transfers. By utilizing the right transfer method and considering the influencing factors, you can optimize your transactions for efficiency.

Are you interested in learning more about money transfers between different banks? Explore our additional articles for valuable insights and recommendations.