In the bustling world of finance, astute investors recognize the immense potential of trading during the London trading session. Falling within the ideal overlap between the European and American markets, this session presents prime opportunities for traders in South Africa to tap into global market dynamics.

Image: www.forexlive.com

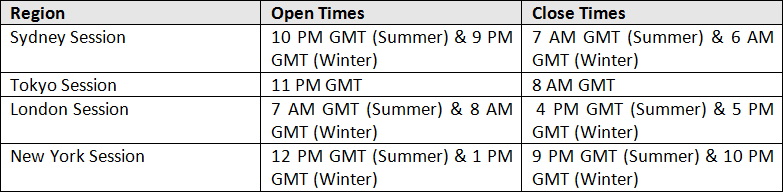

The London trading session officially commences at 8:00 AM South African time (SAST) and concludes at 4:30 PM SAST. This session coincides with the peak trading hours in Europe and the morning session in the United States, creating a window of elevated market activity and liquidity.

Unveiling the Advantages of Trading during the London Trading Session

Savvy traders in South Africa harness the London trading session to their advantage for several compelling reasons:

- Higher Liquidity: Overlapping with major financial hubs in Europe and the US, this session attracts a vast pool of buyers and sellers. As a result, traders benefit from increased market liquidity, enabling them to execute trades quickly and efficiently.

- Increased Volatility: The confluence of multiple market forces during the London session often results in higher volatility. While volatility presents risks, it also provides potential opportunities for active traders seeking to capitalize on market movements.

- Exposure to Global Events: The London session sees the release of numerous economic data and corporate announcements from both Europe and the US. These events can significantly influence market sentiment and currency value, allowing traders to make informed decisions.

- Correlation with Global Trends: Market movements during the London session often set the tone for the rest of the trading day. By trading during this session, South African traders can gauge the overall market direction and align their strategies accordingly.

Expert Insights for Navigating the London Trading Session

Seasoned traders recommend the following strategies for successful trading during the London session:

- Focus on Major Currency Pairs: Stick primarily to highly liquid currency pairs like EUR/USD, GBP/USD, and USD/JPY, which offer ample trading opportunities and low spreads.

- Identify Market Trends: Study historical data and use technical analysis to identify prevailing market trends. Trade in line with these trends to increase your chances of success.

- Manage Risk Wisely: Implement appropriate risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

- Stay Informed: Monitor economic indicators and news releases during the session to stay abreast of market-moving events. This will empower you to make informed trading decisions.

Image: khwezitrade.co.za

London Trading Session In South Africa Time

Unlocking the Power of the London Trading Session

For ambitious traders in South Africa seeking to elevate their trading game, the London trading session offers a fertile ground for success. By leveraging the heightened liquidity, volatility, and global market alignment during this session, traders can seize opportunities, mitigate risks, and reap the rewards of seamless execution.

Embrace the power of the London trading session and unlock the boundless possibilities that await you. With diligent preparation, informed decision-making, and effective risk management, you can navigate this dynamic market with confidence and emerge as a formidable force in the financial realm.