In the tumultuous seas of trading, retracements are beacons of hope, helping traders navigate the ebb and flow of the markets with precision and confidence. Understanding these ephemeral pauses is paramount for budding investors eager to harness the power of market fluctuations.

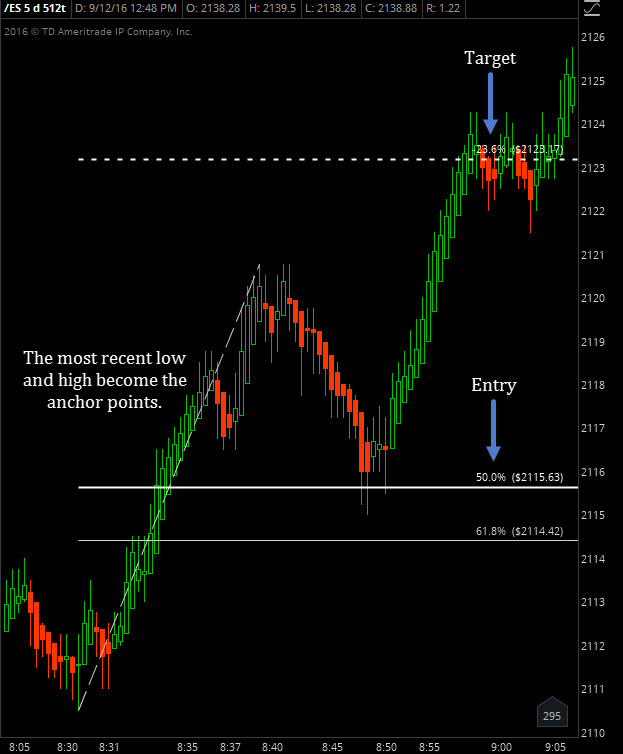

Image: www.seeitmarket.com

Defining Retracements: The Calm Before the Storm

At their core, retracements are brief periods of price reversal that occur following a significant market move. They represent a momentary pause in the prevailing trend, offering traders an opportunity to reassess their positions and plan their next course of action. These temporary pullbacks often occur in response to market events, profit-taking, or simply the natural ebb and flow of supply and demand.

Unveiling the Purpose of Retracements

While retracements can be disconcerting for novice traders, they play a vital role in the overall market ecosystem. These periods of consolidation provide crucial insights into market sentiment and momentum. By understanding retracement patterns, traders can:

-

Assess Trend Strength: Retracements test the strength of the underlying trend. A strong trend is likely to bounce back quickly from a retracement, while a weak trend may struggle to regain lost ground.

-

Identify Potential Reversal Points: Retracements can precede potential trend reversals. A sharp retracement that breaks through a key support or resistance level may indicate a shift in market direction.

-

Plan Trading Strategies: Retracements offer entry and exit points for trades. Traders can use retracements to buy at lower prices or sell at higher prices, depending on the underlying trend and their trading strategy.

Types of Retracements: A Smorgasbord of Market Whispers

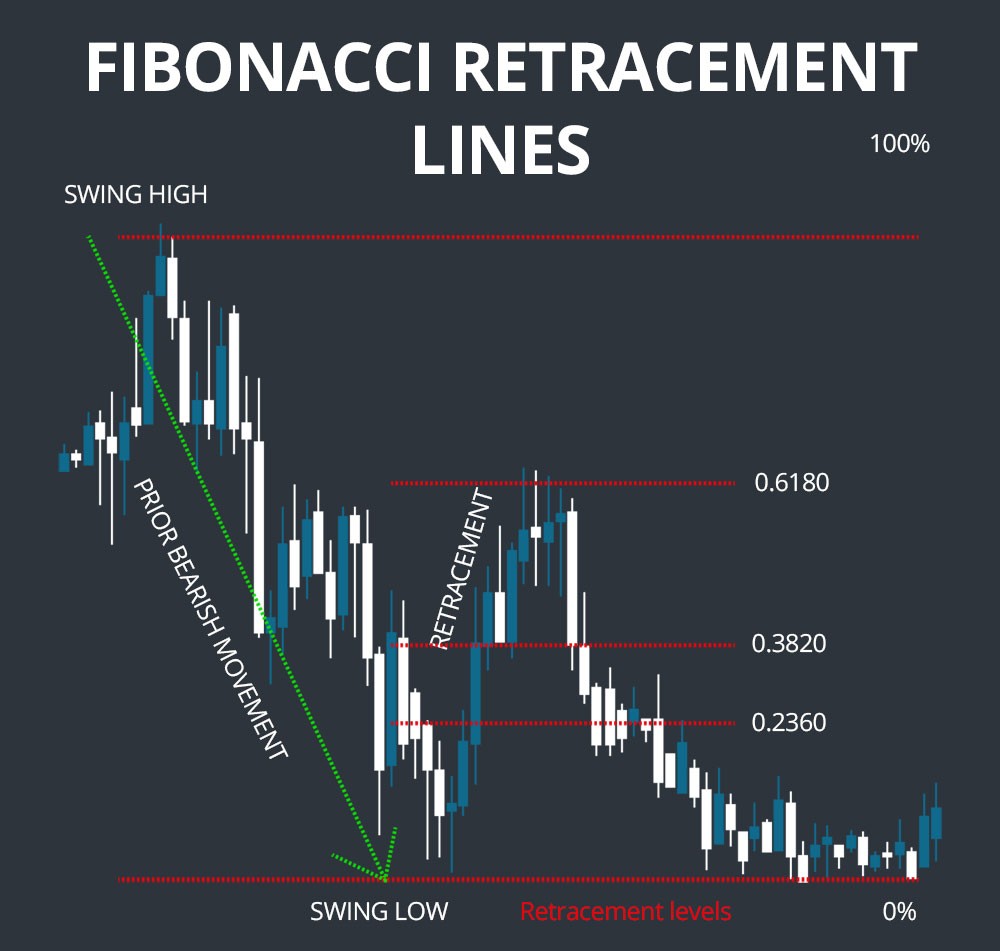

Retracements come in various guises, each with its unique characteristics and implications:

-

Fibonacci Retracements: Based on the Fibonacci sequence, these retracements occur at specific levels (23.6%, 38.2%, 50%, 61.8%, 78.6%), marking potential support and resistance areas.

-

Equal Leg Retracements: As the name suggests, these retracements measure the distance from the start to the end of the preceding move and divide it into equal legs.

-

Time Retracements: These retracements measure the time elapsed since the start of the preceding move and divide it into equal intervals.

Image: homecare24.id

Trading with Retracements: Harnessing the Power of Pause

Retracements are not merely passive observations; they are opportunities for traders to capitalize on market dynamics. Here are a few strategies for leveraging retracements:

-

Buy or Sell Retracements: By identifying retracements, traders can buy during downtrends (at support levels) or sell during uptrends (at resistance levels).

-

Trading Within Retracements: Combining trend analysis with retracement levels allows traders to trade within ongoing trends.

-

Using Retracements for Profit-Taking: Trailing stop-losses can be placed at retracement levels to secure profits.

What Is A Retracement In Trading

Conclusion: Embrace the Retracements

Retracements are an integral part of trading. Understanding their significance and leveraging their insights will elevate your trading skills and empower you to navigate the market with confidence. Remember, the ability to decipher retracements is a superpower for successful traders, enabling them to identify opportunities, assess risks, and ultimately enhance their profitability.