Introduction

Airtel Money is a popular mobile money service in Uganda, enabling users to send and receive money, make payments, and access financial services conveniently. Understanding the withdrawal charges associated with this service is crucial for responsible financial management. This article provides a detailed exploration of Airtel Money withdrawal charges in Uganda, empowering you to make informed decisions and minimize expenses when accessing your funds.

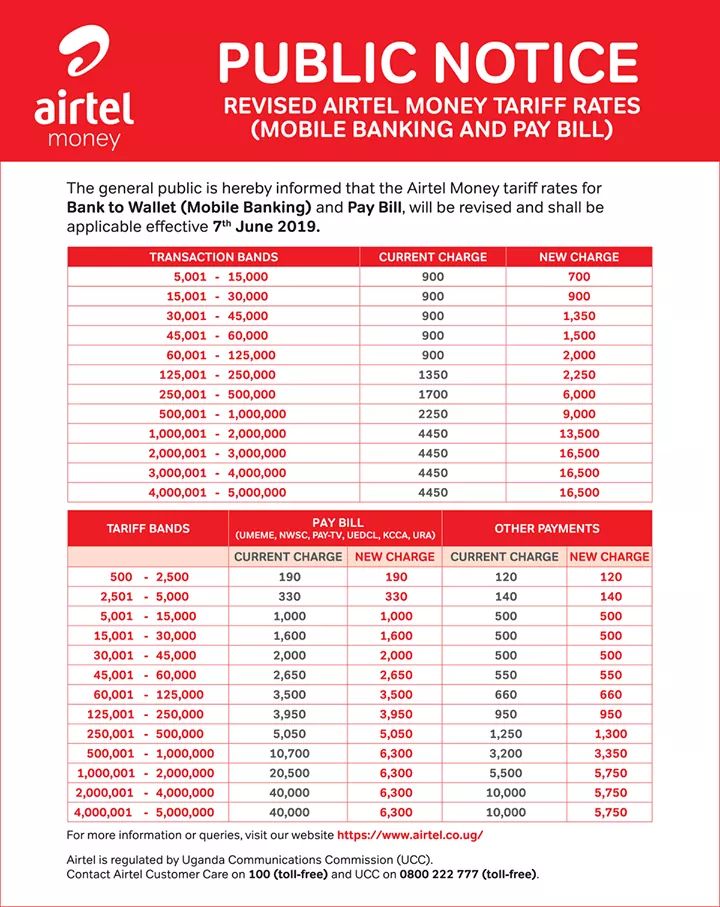

Image: spinnearnmoney1.blogspot.com

Breakdown of Withdrawal Charges

Airtel Money withdrawal charges vary depending on the withdrawal method:

1. Airtel Money Agent Withdrawal:

- Withdrawal Amount: Up to UGX 1,000,000 per transaction

- Charge: UGX 1,000

2. Airtel Money Express Withdrawal:

- Withdrawal Amount: Up to UGX 5,000,000 per transaction

- Charge: UGX 3,500

3. Airtel Money Bank Withdrawal:

- Withdrawal Amount: UGX 10,000 to UGX 10,000,000 per transaction

- Charge: A flat fee of UGX 1,000

4. ATM Withdrawal:

- Withdrawal Amount: Up to the ATM’s daily withdrawal limit (typically UGX 2,000,000)

- Charge: A combination of Airtel Money withdrawal charge (UGX 1,000) and ATM operator fee (typically around UGX 500 per transaction)

Factors Influencing Withdrawal Charges

Certain factors can影响 withdrawal charges:

- Network: MTN Mobile Money withdrawals are generally cheaper than Airtel Money withdrawals.

- Agent Location: Airtel Money agents in remote areas may charge higher withdrawal fees.

- Transaction Amount: Withdrawal charges increase with the amount withdrawn.

- Third-Party Fees: ATM operators and banks may impose additional fees for withdrawals.

Minimizing Withdrawal Charges

To minimize withdrawal charges, consider the following strategies:

- Opt for Agent Withdrawals: Airtel Money agent withdrawals have lower charges for smaller amounts.

- Withdraw Larger Amounts: Consolidate multiple withdrawals into a single transaction to reduce per-transaction charges.

- Negotiate with Agents: Politely request a lower withdrawal fee, especially if you are a frequent customer.

- Compare Charges: Check the charges of different withdrawal methods and choose the most cost-effective option.

Image: allglobalupdates.com

Benefits of Using Airtel Money

Despite withdrawal charges, Airtel Money offers numerous benefits:

- Convenience: Instant and convenient access to financial services at your fingertips.

- Security: Secure transactions with PIN-based authentication and fraud detection systems.

- широчайшая сеть: Wide network of agents and merchants for fácil transactions.

- Access to Financial Services: Borrow airtime, pay bills, and save money all on one platform.

- Promotions and Rewards: Enjoy occasional promotions and rewards for using Airtel Money services.

Airtel Money Withdraw Charges Uganda

Conclusion

Understanding Airtel Money withdrawal charges in Uganda is essential for prudent financial management. By selecting the most appropriate withdrawal method and optimizing your transactions, you can minimize these charges and fully utilize the benefits of Airtel Money. Remember, convenience and security come at a slightly higher cost, but by making informed choices, you can ensure that your money is withdrawn safely and efficiently.