In the volatile world of financial markets, predicting price movements can be a daunting task. However, technical analysis provides a powerful tool for investors to navigate the complexities of the market landscape: chart patterns. These graphical representations of historical price data offer invaluable insights into market trends, potential reversals, and trading opportunities.

Image: www.newtraderu.com

Navigating Chart Patterns: A Technical Trader’s Toolkit

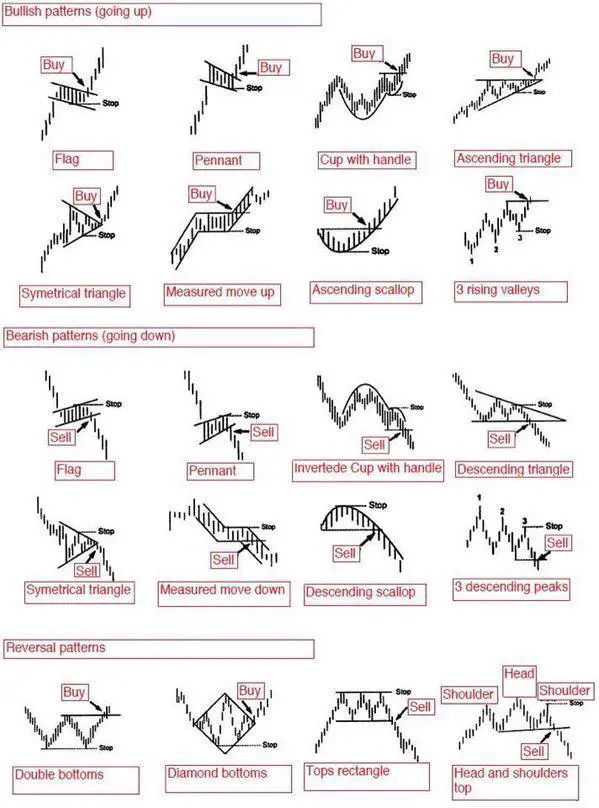

Chart patterns are formed by the intersection of support and resistance levels, which represent areas where buy and sell orders have clustered, respectively. By identifying these key levels, traders can gain insight into the current market sentiment and anticipate future price movements. Common chart patterns include bullish patterns like the cup and handle, rectangle, and double bottom, as well as bearish ones like the head and shoulders, triangle, and double top.

Unveiling the Power of Support and Resistance

Support and resistance levels are the foundation upon which chart patterns are built. Support represents a price level below which buyers have repeatedly stepped in to prevent further decline, while resistance indicates a price level above which sellers have repeatedly stepped in to limit advances. Identifying these levels is crucial for identifying entry and exit points in the market.

Real-World Applications: Unlocking Trading Opportunities

Technical analysis chart patterns are not merely theoretical abstractions; they have real-world applications that can empower traders. For instance, a trader recognizing a cup and handle pattern may anticipate a breakout to the upside, signaling a potential buying opportunity. Conversely, a trader observing a head and shoulders pattern may foresee a potential reversal to the downside, prompting a selling decision.

Image: rockyourbodyyy.blogspot.com

The Evolution of Chart Patterns: Embracing the Dynamic Market

Chart patterns are not static entities; they evolve over time as prices fluctuate and market conditions change. Understanding the different variations of each pattern is crucial for accurate analysis. For example, a symmetrical triangle pattern may evolve into a bullish continuation pattern or a bearish reversal pattern depending on its breakout direction.

Harnessing the Power of Chart Patterns: A Step-by-Step Approach

Utilizing chart patterns effectively requires a systematic approach:

- Identify relevant chart patterns: Familiarize yourself with the different types of patterns and their typical behaviors.

- Recognize support and resistance levels: Pinpoint areas where price has repeatedly bounced or stalled.

- Confirm with volume: Look for increased trading volume to validate the strength of the pattern.

- Set your parameters: Determine entry and exit points based on the pattern’s anticipated breakout or reversal.

- Manage risk: Implement stop-loss orders to mitigate potential losses if the pattern fails.

Technical Analysis Chart Patterns Pdf

Conclusion: Empowering Traders with Technical Foresight

Technical analysis chart patterns provide a valuable framework for understanding market trends, identifying trading opportunities, and making informed investment decisions. By comprehending the principles of support and resistance, traders can harness the power of chart patterns to anticipate price movements and navigate the financial markets with greater confidence. Remember, while chart patterns offer valuable insights, they are only a part of a comprehensive trading strategy that also incorporates other factors such as risk management, market news, and fundamental analysis.