Measuring the Ebb and Flow of Stocks: A Comprehensive Guide to Volatility

Image: thesecretmindset.com

In the fast-paced world of stock trading, understanding a stock’s volatility is crucial for making informed decisions and mitigating risks. Volatility, simply put, is a measure of how much a stock’s price swings over time. It’s akin to a heartbeat, mirroring the ups and downs of the underlying company’s performance, market conditions, and investor sentiment.

Understanding Volatility: Beyond the Numbers

Volatility is often quantified through statistical measures like standard deviation or variance. However, behind these mathematical formulas lies a deeper story. High volatility indicates significant price fluctuations, reflecting a stock’s susceptibility to wild swings. This can be both a boon and a bane, promising substantial gains but also exposing investors to potential losses.

Conversely, low volatility suggests more stable price movements, implying a stock’s resistance to drastic changes. While such stocks offer a smoother ride, they also limit the potential for rapid appreciation. The optimal volatility level depends on an investor’s risk tolerance and investment goals.

The Impact of Volatility on Stock Value

Volatility plays a pivotal role in determining a stock’s value. In general, higher volatility stocks tend to command higher prices due to their inherent risk. Investors demand a premium for the potential of larger swings, both up and down. Conversely, lower volatility stocks typically trade at lower prices, reflecting their more stable behavior.

However, volatility can also be a double-edged sword. While it can boost returns during bullish market conditions, it can also amplify losses during market downturns. Navigating the volatility landscape requires a careful balance of risk management and potential rewards.

Key Volatility Indicators: Unraveling the Secrets

A myriad of volatility indicators exist, each providing unique insights into a stock’s price fluctuations. Some commonly used measures include:

- Standard Deviation: A common indicator that measures the average deviation of a stock’s price from its mean. A higher standard deviation indicates higher volatility.

- Beta: Beta compares a stock’s volatility to the volatility of the overall market. A beta above 1 suggests a stock is more volatile than the market, while a beta below 1 indicates less volatility.

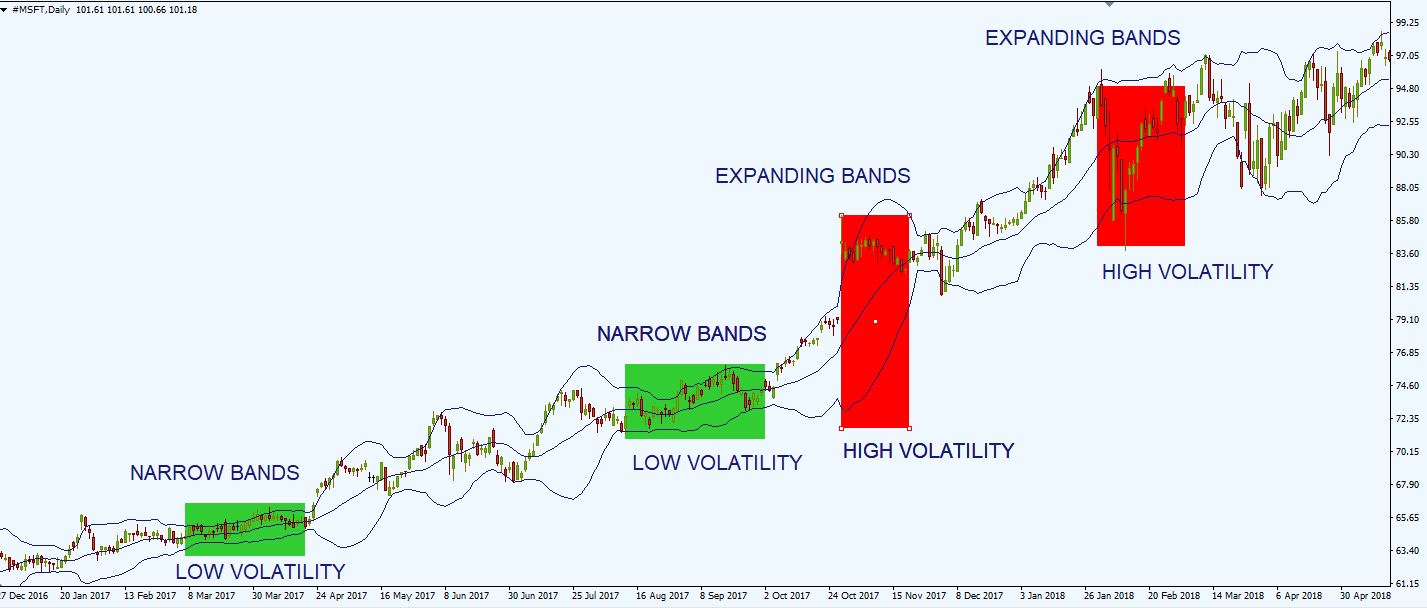

- Bollinger Bands: Bollinger Bands plot a stock’s price within two standard deviations of its moving average. When prices approach or exceed these bands, it can signal approaching volatility.

- Relative Volatility: This measure compares a stock’s volatility to the volatility of its sector or industry. Identifying stocks with higher or lower relative volatility can help diversify a portfolio.

Taming Volatility: Strategies for Risk Mitigation

While volatility is an inherent part of stock investing, there are strategies to mitigate its risks:

- Diversification: Spreading investments across different stocks, sectors, and asset classes can reduce the overall volatility of a portfolio.

- Dollar-Cost Averaging: Investing regular amounts in a stock over time can smooth out the impact of price fluctuations.

- Hedging: Using financial instruments like options or futures can help reduce the risk associated with stock price swings.

- Investment Horizon: Investing with a long-term perspective can mitigate the potential impact of short-term volatility on portfolio returns.

Embracing Volatility: The Opportunity in the Chaos

While volatility can be daunting, it also presents opportunities for savvy investors. Identifying stocks with underestimated volatility can potentially lead to substantial gains. It’s also worth noting that volatility tends to decline as stocks mature and establish a track record of stability.

The Essence of Volatility: A Dynamic Embrace

In the tapestry of stock investing, volatility is an ever-present thread, shaping the ebb and flow of prices. Understanding volatility, its impact, and the available risk management strategies empowers investors to navigate market fluctuations with greater confidence. Whether embraced or tamed, volatility remains an inseparable companion on the journey towards financial success.

Image: en.fxbangladesh.com

Measures A Stock’S Volatility