The world of forex trading is an exhilarating yet daunting one, where every decision can have a profound impact on your financial trajectory. One of the most critical yet often overlooked aspects of successful trading is calculating the appropriate position size for your trades. This comprehensive guide will lead you through the intricate world of forex position sizing, empowering you to mitigate risk, optimize returns, and master the art of responsible trading.

Image: learnpriceaction.com

What is Forex Position Size and Why Does it Matter?

Forex position size refers to the amount of a currency pair you purchase or sell in a single trade. And just like Goldilocks’ porridge, finding the “just right” position size is essential for achieving trading success. Too small a position, and you may fail to cover transaction costs and realize meaningful profits. Too large a position, and you risk exposing yourself to excessive risk, potentially jeopardizing your entire trading capital. It’s a balancing act that can make or break your trading endeavors.

Calculating Your Optimal Forex Position Size: A Step-by-Step Breakdown

Calculating your ideal forex position size is not rocket science, but it does require careful consideration of your risk tolerance, trading strategy, and account balance. Here’s a step-by-step breakdown of the key factors involved:

1. Determine Your Risk Tolerance:

Before you venture into the trading arena, take some time to assess your risk tolerance, that fine line between thrill-seeking and caution. Ask yourself: how much of your capital are you willing to risk on a single trade? This will serve as the foundation for calculating your position size.

2. Define Your Trading Strategy:

Different trading strategies have different risk profiles. For example, scalping involves numerous small trades with minimal risk per trade, while swing trading involves holding positions for longer durations and potentially exposing yourself to greater risk. Choose a strategy that aligns with your risk tolerance and trading style.

3. Calculate Your Percentage Risk:

Once you have a handle on your risk tolerance, it’s time to determine the percentage of your account balance you are willing to risk on each trade. This is known as your percentage risk. As a general rule, most traders recommend risking no more than 1-2% of their account balance per trade.

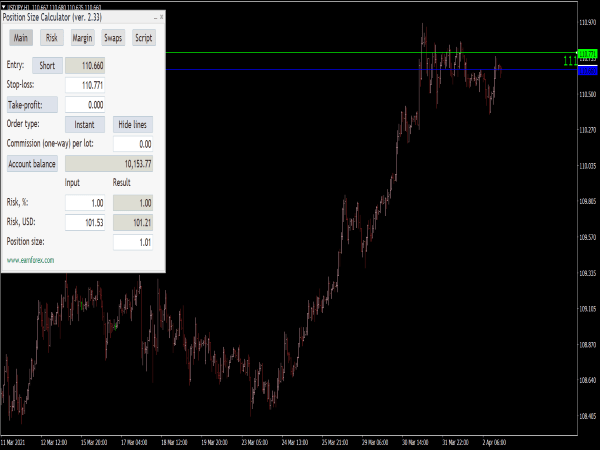

4. Pick Your Entry and Stop-Loss Levels:

Identify the entry and stop-loss levels for your intended trade. The entry level is the price at which you plan to enter the trade, while the stop-loss level is the price at which you will exit the trade if it moves against you. This information is vital for calculating your potential profit and risk.

5. Calculate Your Position Size:

Now, let’s put it all together to calculate your optimal position size. Here’s the formula:

Position Size = (Account Balance x Percentage Risk) / (Entry Price – Stop-Loss Price)

Simply plug in your numbers, and you’ll have your position size in lots. A lot is a standardized unit of measurement in forex trading, typically representing 100,000 units of the base currency.

Fine-Tuning Your Position Sizing: Considerations for Enhanced Precision

While the above formula provides a solid starting point, fine-tuning your position sizing can further enhance your risk management and profit optimization. Here are some additional factors to consider:

1. Leverage and Margin:

Forex trading often involves the use of leverage, which can amplify your potential profits and losses. Understand the concept of leverage and margin, and use it judiciously to magnify your returns without exposing yourself to undue risk.

2. Order Types:

Different order types, such as market orders and limit orders, can impact your position sizing. Market orders execute trades at the current market price, while limit orders only execute when the price reaches a predetermined level. Choose the order type that aligns with your trading strategy and risk tolerance.

3. Currency Pair Volatility:

Currency pairs have varying levels of volatility, which can influence your position sizing. More volatile pairs require smaller position sizes, while less volatile pairs allow for larger positions. Research the volatility of the currency pair you intend to trade and adjust your position size accordingly.

Image: howtotradeonforex.github.io

Calculate Forex Position Size

Conclusion: Master the Art of Forex Position Sizing

Forex trading is an exciting and potentially lucrative endeavor, but it also comes with inherent risks. Calculating the appropriate position size for your trades is paramount for mitigating risk, maximizing profits, and preserving your trading capital. By following the steps outlined in this comprehensive guide, you can develop a robust position sizing strategy that empowers you to trade with confidence and achieve consistent success in the ever-evolving world of forex trading.