Candle Stick Chart Patterns: The Ultimate Guide to Enhance Your Trading Success

Image: priaxon.com

Unveiling the Secrets of Market Movements

In the dynamic realm of trading, candle stick charts stand as a beacon of clarity, providing traders with a visual roadmap to navigate the winding paths of market sentiment. From their origins in 18th century Japan to their present-day ubiquity, these graphical representations of price fluctuations hold the key to deciphering the cryptic signals whispering from the market.

A Radiant Guide to Candle Stick Patterns

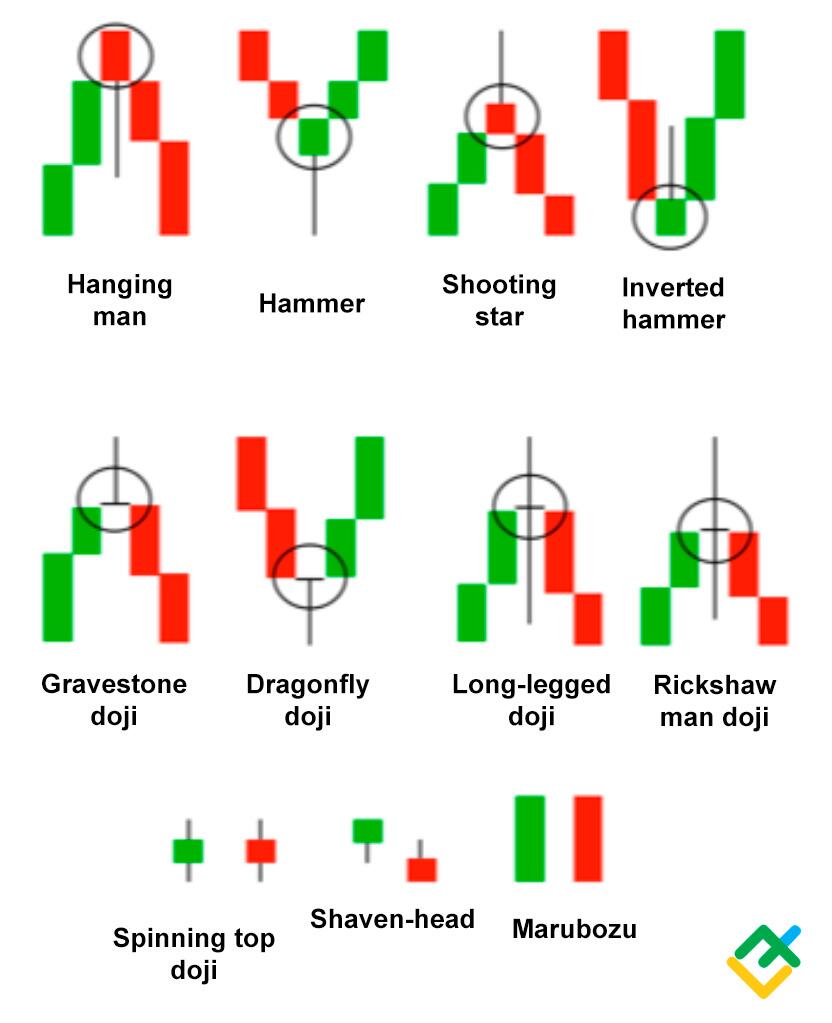

Candle stick charts are composed of individual “candlesticks” that encapsulate the essential elements of price movement within a specific time frame. Each candlestick comprises a body, which reflects the open and close prices, and wicks, extending above and below the body to indicate the highest and lowest prices reached during that period.

The ingenious design of candle stick charts allows traders to swiftly identify patterns that reveal the ebb and flow of market sentiment. By discerning these patterns, traders can gain valuable insights into the direction, momentum, and potential reversal points of impending price movements.

Common Candle Stick Patterns and Their Significance

The tapestry of candle stick patterns is vast and ever-evolving, with each formation holding its own unique significance in the language of market analysis. Some of the most widely recognized and influential patterns include:

-

Bullish Engulfing Candle: A bullish engulfing candle signals a reversal from a downtrend to an uptrend. It occurs when a red candle with a hollow body (lower close than open) is followed by a green candle whose body completely engulfs the previous candle’s body. This pattern suggests that bullish sentiment has regained control of the market.

-

Bearish Engulfing Candle: Conversely, a bearish engulfing candle heralds a trend reversal from an uptrend to a downtrend. It forms when a green candle with a hollow body is followed by a red candle that completely engulfs the prior candle’s body. This pattern portends a shift towards bearish market sentiment.

-

Hammer Candle: A hammer candle is characterized by a small body near the bottom of a long upper wick. It signals a potential reversal in a downtrend. The presence of a hammer candle suggests that buyers are attempting to regain control of the market after a period of selling pressure.

-

Inverted Hammer Candle: An inverted hammer candle bears a resemblance to a hammer candle, but with a short lower wick and a small body positioned near the top. It denotes a potential reversal in an uptrend, indicating that sellers are testing the resolve of the buyers.

-

Doji Candle: A doji candle is distinguishable by a small body with almost equal open and close prices. It signifies indecision in the market, suggesting that neither buyers nor sellers have gained the upper hand. Doji candles can appear in various forms, each conveying subtle nuances of market sentiment.

Expert Insights and Trading Strategies

Harnessing the power of candle stick chart patterns requires both an understanding of their language and the ability to apply it effectively. Seasoned traders emphasize several key strategies:

-

Trend Analysis: Candle stick patterns can provide valuable confirmation of ongoing market trends. By recognizing bullish and bearish patterns, traders can align their positions with the momentum of the market, amplifying their profit potential.

-

Support and Resistance Levels: Candle stick patterns often emerge at key support and resistance levels, providing clues about potential reversals or continuations of prevailing trends. These levels act as psychological barriers that can influence the behavior of market participants.

-

Risk Management: Identifying candle stick patterns can enhance risk management strategies. By identifying early signs of trend reversals or market indecision, traders can adjust their positions accordingly to mitigate potential losses.

Igniting Success with Candle Stick Charts

The mastery of candle stick chart patterns empowers traders with a potent tool for deciphering market sentiment, forecasting price movements, and optimizing trading strategies. By delving into the labyrinthine world of candlesticks, traders can unlock the secrets that guide successful navigation of the financial markets.

Remember, the pursuit of trading success is an ongoing journey. Continuous learning, diligent analysis, and adaptability are essential qualities for traders who seek to harness the full potential of candle stick chart patterns. Embrace the challenge, embrace the knowledge, and conquer the markets with the wisdom of candle stick charting.

Image: cleverlearn-hocthongminh.edu.vn

Candle Stick Chart Patterns