The tumultuous realm of the world forex market stands as a veritable force in the global financial landscape, a financial tsunami that unceasingly shapes the ebb and flow of economies around the planet. Forex, short for foreign exchange, encapsulates the buying, selling, and trading of currencies across international borders, constituting a decentralized global marketplace where trillions of dollars transact daily. This maelstrom of monetary exchange serves as the lifeblood of international trade and investment, determining exchange rates and impacting industries far beyond the realm of finance. Understanding the dynamics of the world forex market empowers investors, businesses, and individuals alike; it unlocks opportunities for growth, mitigates risk, and illuminates global economic trends.

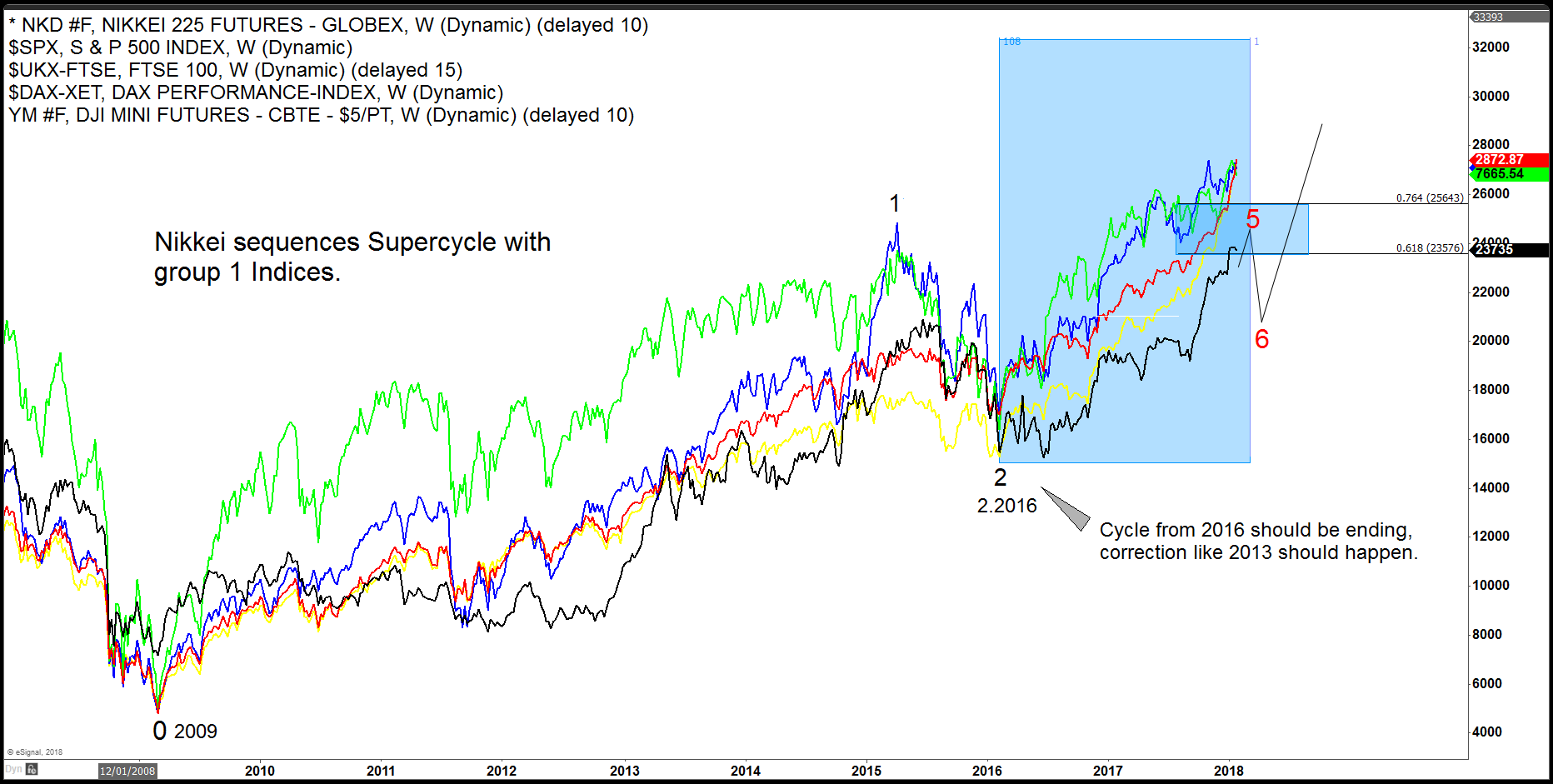

Image: www.forexcycle.com

Exploring the Heart of the Forex Market: Liquidity, Volatility, and Leverage

At the heart of the forex market’s immense allure lies its unparalleled liquidity. The sheer volume of currencies traded daily, exceeding $5 trillion, ensures that buyers and sellers can execute transactions near instantaneously, with minimal price slippage. This liquidity translates into reduced transaction costs and enhanced efficiency for market participants. The bustling forex market further tantalizes with its inherent volatility. Currency values fluctuate perpetually, driven by a plethora of economic, political, and global events. This volatility can provide ample opportunities for savvy traders to capitalize on price movements and generate substantial profits. However, it also underscores the inherent risk associated with forex trading, demanding meticulous risk management strategies.

The world forex market beckons with another alluring feature: leverage. Brokers offer varying degrees of leverage, enabling traders to control a larger trading position with a comparatively smaller investment. Leverage can magnify potential profits exponentially but conversely, can amplify potential losses to the same extent. This double-edged sword demands prudent risk management and a clear comprehension of one’s trading limitations.

Navigating the Currency Convergence: Base, Quote, and Exchange Rates

Delving into the world of forex trading entails familiarity with its fundamental terminologies and processes. Base currencies and quote currencies form the bedrock of forex transactions. The base currency represents the currency being purchased, while the quote currency denotes the currency being sold to facilitate the purchase. The exchange rate, the crux of forex trading, quantifies the value of one currency in terms of another. For instance, an exchange rate of 1.12 EUR/USD indicates that 1 Euro is worth 1.12 US Dollars.

Charting the Forex Market’s Depth: Market Maker, Retail Traders, and Central Banks

The forex market encompasses a diverse array of participants, each playing a pivotal role in its dynamic equilibrium. Market makers, the liquidity providers, continuously quote bid and ask prices, ensuring a seamless flow of transactions. Retail traders, ranging from experienced veterans to novice speculators, engage in forex trading to capitalize on price fluctuations. Central banks, guardians of monetary policy, exercise their influence through interventions, interest rate adjustments, and other measures aimed at stabilizing exchange rates and managing inflation.

Image: chnprotrading.com

Navigating the Forex Market’s Nuances: Trading Pairs, Currency Correlations, and Spreads

Forex traders strategically combine currencies into trading pairs, allowing for speculation on the relative strength or weakness of one currency against another. Currency correlations, the statistical relationships between currency pairs, provide valuable insights into market dynamics and potential trading opportunities. Spreads, the difference between the bid and ask prices quoted by market makers, represent the transaction cost associated with each trade.

Unveiling the Allure of Forex Trading: Opportunities, Risks, and Rewards

Forex trading offers a tantalizing blend of opportunities, risks, and rewards. The potential for substantial profits attracts traders from all walks of life, eager to tap into the market’s volatility. However, the inherent risk of losses demands responsible risk management and a grasp of one’s risk tolerance. Rewards in forex trading are commensurate with the risks assumed, underscoring the necessity of informed decision-making and a disciplined trading approach.

Www.Live World Market Indices Forex

Mastering the Forex Market: Strategies, Tools, and Education