Imagine yourself in the pulsating heart of a global financial hub, surrounded by towering skyscrapers that reflect the relentless ebb and flow of capital. As you witness the dizzying ascent and disquieting descent of stock prices, you may wonder, what unseen forces orchestrate this enigmatic dance? What drives the capricious movements of these financial instruments that shape the destinies of countless individuals and economies?

Image: awealthofcommonsense.com

Join us as we delve into the intricate world of stock market dynamics, revealing the myriad factors that influence the trajectory of stock prices. From macroeconomic trends to company performance, let’s unravel the secrets that govern the rise and fall of stocks, empowering you to navigate the tumultuous waters of the financial markets with greater confidence and insight.

Unveiling the Invisible Hand: Macroeconomic Forces

The performance of individual stocks is profoundly intertwined with the broader macroeconomic climate. Economic growth, inflation, interest rates, and fiscal policies cast an invisible hand over the stock market’s machinations.

- Economic growth: As economies expand, companies tend to generate higher profits, fostering optimism among investors and driving stock prices upward.

- Inflation: Inflation erodes the purchasing power of money, making it less valuable in the future. High inflation can be detrimental to stock prices, especially for companies with high costs of goods sold.

- Interest rates: Interest rates influence investment decisions. Higher interest rates make bonds more attractive relative to stocks, potentially leading to a decrease in stock prices.

- Fiscal policies: Government spending programs and tax policies can impact corporate earnings and economic growth, which in turn affect stock prices.

Decoding Corporate Performance: The Engine of Share Value

While macroeconomic forces set the stage, the intrinsic performance of companies plays a significant role in determining stock price fluctuations. Several key metrics provide insights into a company’s financial health and prospects.

- Earnings per share (EPS): EPS measures a company’s profitability on a per-share basis. Higher EPS often indicates strong financial performance and can boost stock prices.

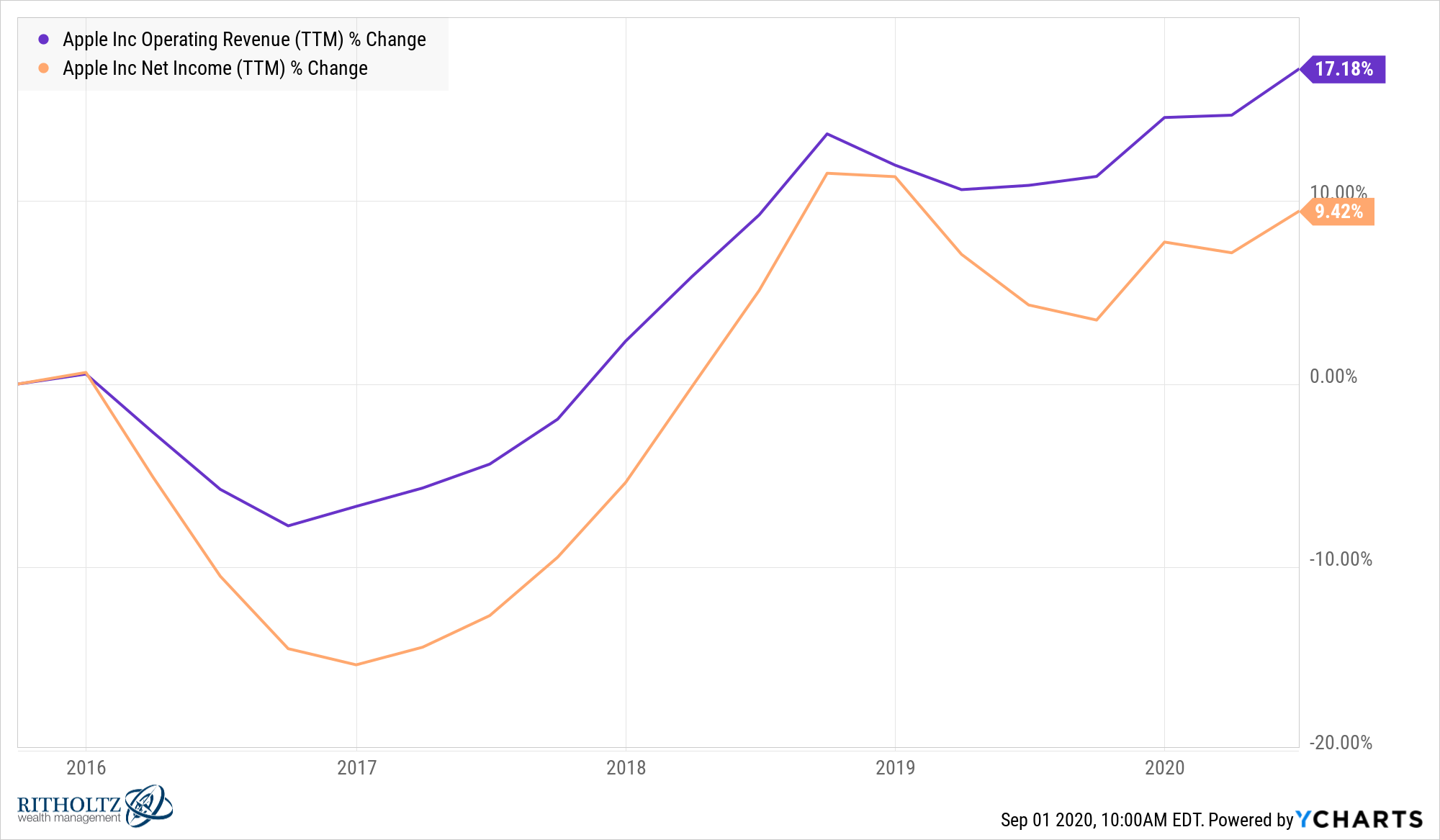

- Revenue growth: The rate at which a company is growing its top line is crucial. Consistent revenue growth suggests expanding operations and market share, potentially leading to higher future earnings.

- Profit margins: Profit margins reflect a company’s profitability after subtracting costs. Companies with high profit margins tend to be more resilient to economic downturns and can command higher valuations.

- Debt-to-equity ratio: This ratio indicates a company’s level of financial leverage. High debt-to-equity ratios can increase the risk of bankruptcy and negatively impact stock prices.

- Return on equity (ROE): ROE measures the return generated by a company’s shareholders’ equity investment. A high ROE indicates efficient use of capital and can enhance investor confidence.

The Psychology of Investing: Sentiment and Market Dynamics

While hard numbers form the backbone of stock valuation, the psychology of investors plays a subtle yet potent role in driving stock prices.

- Market sentiment: Optimism or pessimism among investors can create a feedback loop, driving stock prices higher or lower. Bull markets are characterized by widespread positive sentiment, while bear markets are marked by pervasive negativity.

- Fear and greed: Fear of missing out (FOMO) can lead to panic buying, while fear of losing money (FLOM) can trigger sell-offs. Greed and irrational exuberance can also contribute to price bubbles.

- Technical analysis: Some investors use technical analysis, which involves studying historical price patterns and indicators, to predict future stock movements. While not universally accepted, technical analysis can provide insights into potential trading opportunities.

Image: topgunoptions.com

Navigating the Stock Market’s Unpredictability

Given the myriad factors that influence stock prices, predicting their exact movements with certainty is akin to chasing a mirage. However, by comprehending the underlying dynamics and managing expectations, investors can mitigate risk and position themselves for long-term success.

Diversification, which involves spreading investments across different assets and sectors, can help reduce volatility and improve overall returns. Value investing, which focuses on identifying undervalued stocks with solid fundamentals, has outperformed the broader market over the long term. Dollar-cost averaging, which involves investing a fixed amount in a stock at regular intervals, can smooth out market fluctuations and reduce the impact of short-term price swings.

What Drives Stock Prices

Conclusion: Mastering the Market’s Elusive Dance

The stock market is a captivating theater where myriad forces intertwine, creating a mesmerizing yet unpredictable spectacle of price movements. Understanding the interplay of macroeconomic trends, corporate performance, investor sentiment, and market dynamics is paramount to navigating the market’s labyrinthine corridors. By embracing a comprehensive approach, investors can decipher the enigmas of the stock market and waltz gracefully through the challenges and opportunities it presents. Remember, the market may be capricious, but it rewards those who approach it with knowledge, patience, and a measured degree of audacity.