Forays into the world of forex trading often lead traders to encounter a perplexing acronym: APR. Standing for Annual Percentage Rate, APR plays a pivotal role in comprehending the costs associated with forex trading. This comprehensive guide aims to unravel the complexities of APR in forex, shedding light on its significance and providing a clear understanding of its implications for traders.

Image: www.autobytel.com

APR represents the annual interest rate charged on borrowed funds used in forex trading. It encompasses both interest and other finance charges, expressed as a percentage of the loan amount. Understanding APR is crucial for traders to weigh the expenses associated with leveraging their trades and make informed decisions.

APR’s Influence on Forex Trading

When traders employ leverage, they essentially borrow funds to augment their capital and amplify potential profits. However, this convenience comes at a cost – the APR charged on the borrowed sum. The higher the APR, the greater the interest expense that will erode potential gains. Hence, traders must meticulously assess the APR offered by their broker to strike a balance between leveraging opportunities and minimizing incurred expenses.

Calculating APR in Forex

Foremost, it’s essential to note that calculating APR in forex is rather distinct from calculating interest rates for traditional loans. Brokers determine APR for forex trades based on several factors: the base interest rate set by central banks, spread charges, commissions, and swap rates. The formula for calculating forex APR is:

APR = (Interest Charged + Commissions + Swap Charges) / (Notional Value of the Trade) x 360 / Actual Number of Days in the Trade

For instance, consider a trader who opens a forex position worth $100,000 with an APR of 5%, a commission of $100, and a swap charge of $150 for a 30-day period.

APR = ($100 + $100 + $150) / $100,000 x 360 / 30 = 10.8%

Impact of APR on Forex Trading Strategies

The interplay between APR and forex trading strategies is intricate. Traders employing long positions, where they purchase an asset in anticipation of its appreciation, bear the brunt of APR as the borrowed funds are used to finance the trade over a prolonged period. Conversely, traders utilizing short positions, where they sell an asset expecting its depreciation, may benefit from APR if the asset’s value declines, allowing them to repay the loan with a lower amount of capital.

Furthermore, traders engaging in high-frequency trading strategies, characterized by numerous trades executed over a short period, are exposed to compounded APR charges that can significantly diminish returns. It is prudent for traders to consider APR implications when formulating their trading strategies to avoid unanticipated expenses.

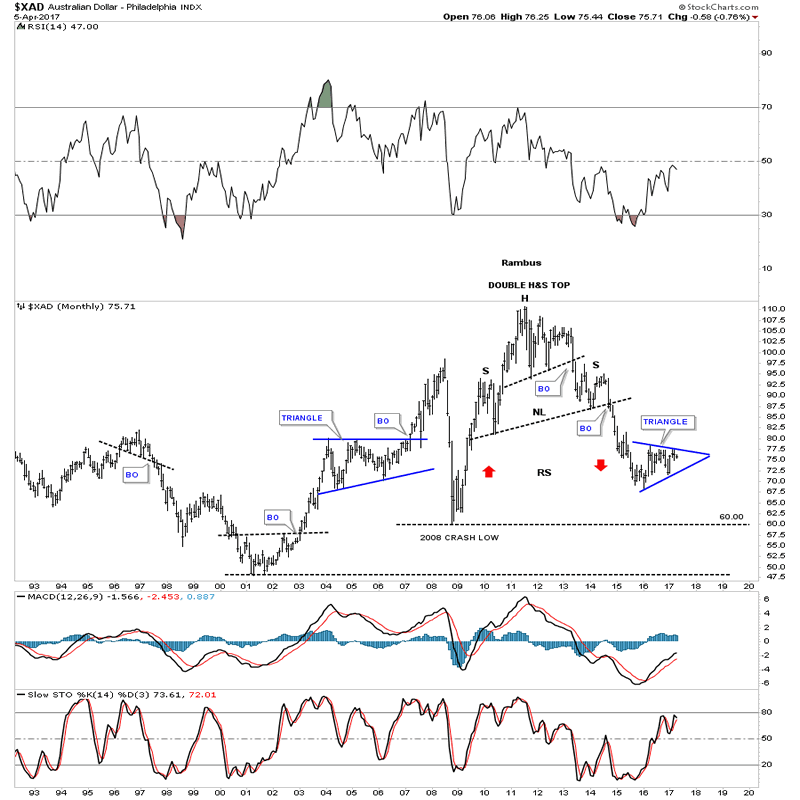

Image: www.marketoracle.co.uk

APR as a Reflection of Market Conditions

The APR offered by forex brokers is not static and often mirrors prevailing market conditions. During periods of economic stability, APRs tend to be lower, whereas in times of economic volatility, APRs surge. This dynamic underscores the importance of staying abreast of market trends to make informed decisions and navigate the complexities of forex trading effectively.

What Is Apr In Forex

Conclusion

APR in forex trading is an indispensable metric that wields a significant impact on profitability. By comprehending APR and its interplay with forex market dynamics, traders can optimize their strategies, minimize costs, and maximize returns. Whether you’re a novice or an experienced trader, understanding APR is pivotal to navigating the intricate world of forex trading.