In the realm of foreign exchange (forex) trading, understanding volume is paramount to making informed decisions and maximizing profit potential. As a novice trader, it is essential to grasp the concept of a standard lot, its significance, and how volume plays a crucial role in shaping trading strategies. This comprehensive guide will delve into the intricacies of volume for standard lots in forex trading, equipping you with the knowledge you need to navigate this dynamic market successfully.

Image: forexbangladesh-fxbd.blogspot.com

What is a Standard Lot in Forex Trading?

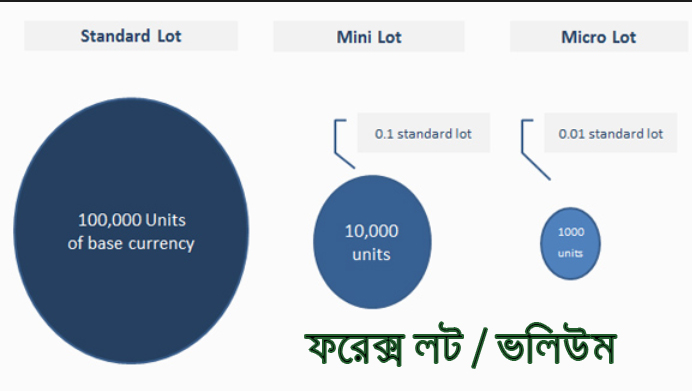

A standard lot in forex trading represents a predetermined unit of currency. It is the most commonly traded lot size and is standardized across different brokers. The standard lot size is 100,000 currency units. This means that each pip movement in the exchange rate of the currency pair you are trading equates to a profit or loss of $10 for every standard lot held.

Why is Volume Important in Forex Trading?

Volume is a measure of the number of currency units traded within a specific time frame. It provides invaluable insights into market sentiment and trading activity. Higher trading volume indicates that there is significant buying or selling interest in a particular currency pair. This information can be used to assess the strength of a trend, identify potential entry and exit points, and gauge market liquidity.

How to Use Volume to Enhance Trading Strategies

By incorporating volume analysis into your trading strategies, you can significantly improve your decision-making process. Here are key ways to utilize volume in forex trading:

-

Identify Market Trends: High volume trading days often indicate a strong trend in progress. By aligning your trades with the direction of volume, you increase your chances of capturing significant profits.

-

Confirm Breakouts: Volume spikes can signal potential breakouts from established support or resistance levels. If you observe a sharp increase in volume alongside a price breakout, it suggests that the breakout is genuine and has the potential to continue.

-

Time Market Entries: Heavy volume can assist in timing market entries. Entering a trade during periods of high volume indicates increased market participation, which can enhance trade execution and reduce slippage.

-

Assess Market Liquidity: Volume also provides insights into market liquidity. High volume trading indicates ample liquidity, facilitating seamless trade execution, while low volume can result in wider spreads and increased slippage.

-

Manage Risk: By monitoring volume, you can better manage risk. Trading against low-volume trends can increase the likelihood of false signals and unexpected price reversals.

Image: mollywilson.z13.web.core.windows.net

Volume For Standard Lot In Forex

Conclusion

Understanding and utilizing volume in standard lots for forex trading is essential for successful market navigation. By incorporating volume analysis into your trading strategies, you gain a deeper understanding of market sentiment, trading activity, and market liquidity. This knowledge empowers you to identify market trends, time market entries, assess risk, and maximize your profit potential. Remember to practice responsible trading by utilizing risk management strategies and continuously educating yourself to stay abreast of evolving market dynamics.