The synchronous movements between the stock and forex markets have long intrigued investors and financial analysts. This interconnectedness, known as volatility spillover, plays a significant role in shaping global financial stability and influences investment decisions across asset classes. In this article, we delve into the fundamental concepts of volatility spillover, its implications, and provide valuable insights for investors navig ….

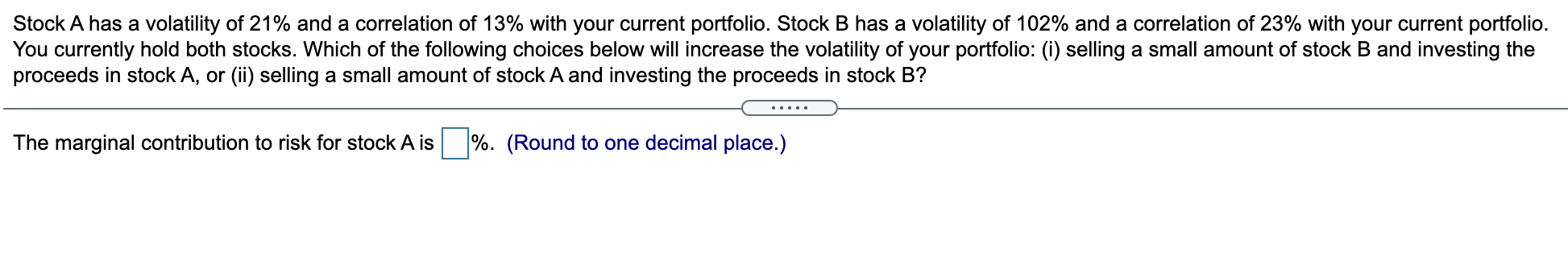

Image: www.chegg.com

Understanding Volatility Spillover

Volatility spillover refers to the phenomenon where heightened volatility in one market triggers a similar increase in volatility in another linked market. This phenomenon can be attributed to factors such as common macroeconomic forces, risk aversion among investors, and the interconnectedness of global financial systems. For instance, a sharp decline in the stock market can lead to increased volatility in currencies linked to that country’s economy.

Key Drivers of Volatility Spillover

- Economic Factors: Global economic events such as recessions, geopolitical uncertainties, and changes in interest rates can simultaneously impact both the stock and forex markets.

- Investor Sentiment: Market sentiment plays a crucial role in driving volatility spillover. Risk-averse investors tend to sell risky assets, such as stocks, and seek refuge in safe-haven currencies during periods of uncertainty.

- Financial Interconnections: Modern financial markets are highly interconnected, with investors and institutions actively trading across asset classes. This interconnectedness facilitates the transmission of volatility from one market to another.

Latest Trends and Developments

In recent years, the volatility spillover between the stock and forex markets has become increasingly pronounced due to the following factors:

- Globalization of Financial Markets: Technological advancements have made it easier for investors to access and trade in assets across different markets.

- Rise of High-Frequency Trading: Algorithms and advanced trading techniques can amplify volatility spillover by reacting quickly to market events.

- Emergence of Cryptocurrencies: The growth of cryptocurrencies has added a new layer of interconnectedness to financial markets, potentially influencing volatility spillover dynamics.

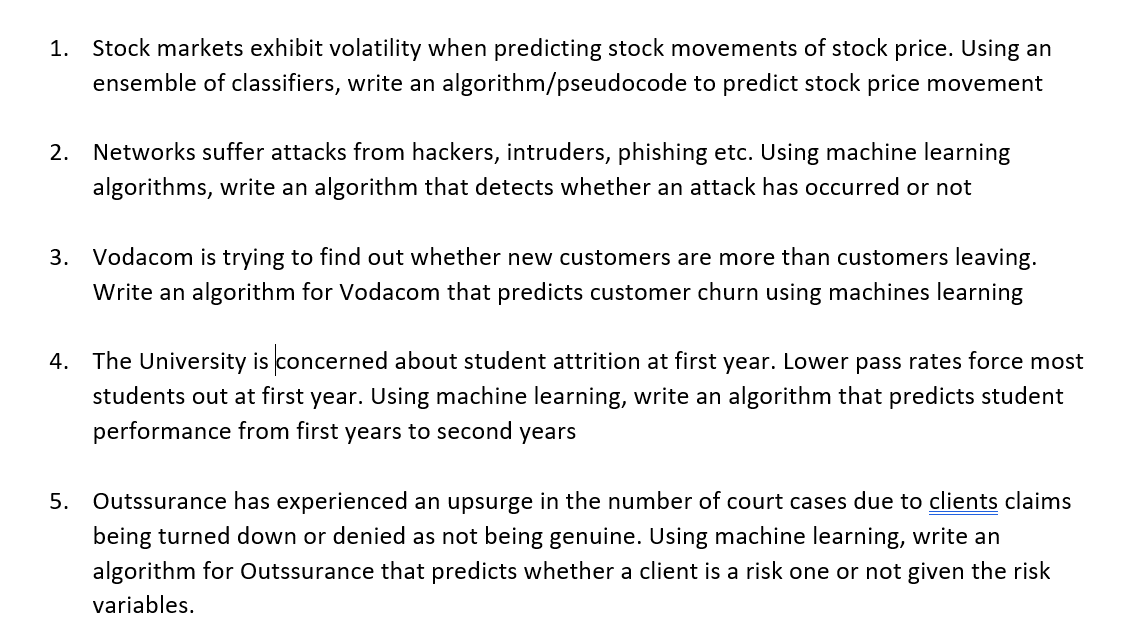

Image: www.chegg.com

Tips for Investors and Market Participants

Recognizing the implications of volatility spillover is essential for investors. The following tips can help navigate this interconnected market environment:

- Diversify Portfolio: Allocate investments across asset classes to reduce the overall portfolio risk during periods of volatility spillover.

- Hedge Against Volatility: Use financial instruments, such as options or futures, to hedge against potential volatility and protect portfolio performance.

- Monitor Market Trends: Stay informed about economic and market developments that may trigger volatility spillover and adjust investment strategies accordingly.

Expert Advice

Financial experts emphasize the importance of understanding volatility spillover and its implications for investment management. According to James Chen, a renowned market analyst, “Volatility spillover is a force that investors cannot ignore. By recognizing its mechanisms and incorporating strategies to mitigate its effects, investors can enhance their portfolio resilience and capitalize on market opportunities.”

Frequently Asked Questions (FAQ)

- Q: What causes volatility spillover?

A: Volatility spillover is driven by factors such as economic events, investor sentiment, and interconnectedness of financial markets. - Q: How does volatility spillover impact investments?

A: Volatility spillover can lead to increased market volatility and potential losses in one asset class following a shock in another. - Q: What can investors do to mitigate the effects of volatility spillover?

A: Investors can diversify portfolios, hedge against volatility, and monitor market trends to reduce risk and capture opportunities.

Volatility Spillover Between Stock And Forex Market Thesis Work

Conclusion

Volatility spillover between the stock and forex markets is a dynamic and ever-evolving phenomenon that warrants serious consideration by investors and market participants. By comprehending its drivers, latest trends, and practical implications, investors can make informed decisions, manage risk effectively, and navigate the challenges posed by this interconnected market environment.

Are you interested in learning more about volatility spillover and its implications for your investment strategies? Consult with a financial advisor to gain deeper insights and tailor a personalized investment plan. Remember, knowledge is the key to unlocking investment success in an increasingly interdependent financial landscape.