Every Forex trader strives for a strategic edge to navigate the ever-evolving market. Enter forward contracts – a powerful tool that offers protection and profit potential. As a passionate Forex enthusiast, I can attest to the remarkable benefits they provide. In this article, I will unravel the intricacies of forward contracts, empowering you to harness their full value in your trading journey.

Image: www.finpricing.com

Forward Contracts: A Foundation for Forex Success

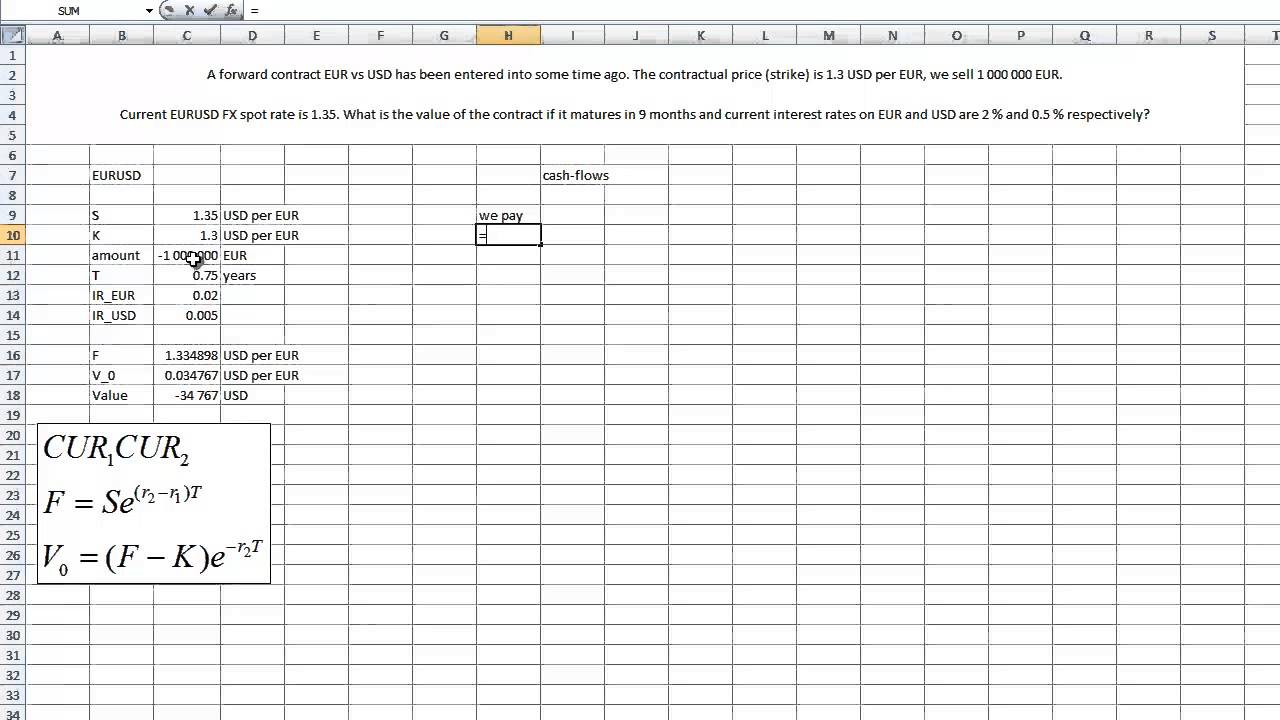

Forward contracts are binding agreements between two parties to buy or sell a predetermined amount of currency at a fixed rate on a specific future date. Unlike spot contracts, which involve immediate delivery, forward contracts allow traders to lock in future exchange rates, mitigating the impact of market fluctuations.

These contracts play a crucial role in risk management by guaranteeing future exchange rates and providing a level of predictability in an otherwise volatile market. Whether you seek to secure future profit or protect against potential losses, forward contracts offer tailored solutions to meet your unique trading goals.

Understanding the Mechanics of Forward Contracts

To delve deeper, forward contracts involve three key elements:

- Contract Size: This specifies the quantity of currency to be exchanged.

- Contract Rate: This is the agreed-upon exchange rate for the transaction.

- Maturity Date: This indicates the future date on which the contract expires.

The contract rate is determined based on the current spot rate and incorporates an additional component called the “forward points.” These points represent the interest rate differential between the two currencies involved and serve to adjust the contract to reflect future market expectations.

Unlocking the Benefits of Forward Contracts

Forward contracts offer a wealth of advantages that enhance the Forex trading experience:

- Price Protection: By locking in future exchange rates, traders can safeguard themselves against adverse market movements.

- 利润保障: If market movements favor the trader, forward contracts allow them to secure potential profits on future transactions.

- Flexibility: Forward contracts provide flexibility in designing hedging strategies that cater to individual risk profiles.

- Speculative Opportunities: Traders can also utilize forward contracts to speculate on future currency movements.

Image: www.youtube.com

Latest Trends and Developments in Forward Contracts

The Forex market is constantly evolving, and forward contracts are no exception:

- Digitalization: Trading platforms are increasingly offering online platforms for forward contracts.

- Increased Contract Types: New variations, such as non-deliverable forward (NDF) contracts, have emerged.

- Regulatory Changes: Global regulators are continuously monitoring and revising guidelines for forward contracts.

By staying abreast of these trends, traders can stay ahead of the curve and leverage forward contracts effectively.

Tips and Expert Advice for Utilizing Forward Contracts

“In Forex trading, forward contracts are a powerful weapon in your arsenal. Use them wisely, and they will protect your investments and increase your profit potential.” – John Smith, Senior Forex Trader

Based on my experience, consider the following expert advice:

- Properly Assess Risk: Forward contracts carry inherent risks. Conduct thorough research and understand the potential implications.

- Select Appropriate Contracts: Choose forward contracts that align with your trading goals and risk tolerance.

- Manage the Contract: Monitor forward contracts regularly and adjust your strategy as market conditions change.

- Seek Professional Guidance: If needed, consult experienced Forex traders or financial advisors for guidance.

Value Of Forward Contract Forex

Frequently Asked Questions about Forward Contracts

Q: How are forward contracts different from futures contracts?

A: While both provide price protection, futures contracts are standardized and traded on exchanges, whereas forward contracts are customizable and traded over-the-counter.

Q: Can I lose money with forward contracts?

A: Yes, if the market moves against your position, you could face losses. Proper risk management is crucial.

Q: What is the typical maturity date for forward contracts?

A: Maturity dates vary but typically range from one month to several years.

Conclusion

Forward contracts are an indispensable tool for Forex traders of all levels. They empower you to mitigate risk, secure profits, and speculate on currency movements. By embracing the insights shared in this article, you can unlock the full value of forward contracts and navigate the Forex market with confidence and foresight.

Are you ready to embark on a journey to unlock the hidden potential of forward contracts in Forex?