Introduction: A Journey into the World of Currency Fluctuations and Tax Implications

In the dynamic realm of international business, foreign exchange transactions play a pivotal role. Amidst this financial landscape, valuing these transactions under the multifaceted framework of the Goods and Services Tax (GST) has emerged as a paramount concern. This article aims to illuminate the intricacies of valuation methods for forex transactions under GST, empowering businesses with the knowledge to navigate this complex terrain effectively.

Image: www.zeebiz.com

GST, a comprehensive indirect tax regime implemented in India, has far-reaching implications for businesses engaged in importing or exporting goods and services. Understanding the appropriate valuation method for forex transactions becomes essential to ensure compliance and avoid potential disputes with tax authorities. This comprehensive guide will delve into the various methods, their applicability, and provide practical insights for businesses seeking to optimize their GST obligations.

Method 1: Transaction Value Method

The transaction value method constitutes the primary approach for valuing forex transactions under GST. It entails utilizing the price agreed upon between the buyer and seller as the basis for valuation. This method is applicable when all the following conditions are met:

- The price is the sole consideration for the supply of goods or services.

- The price is not influenced by any condition or restriction imposed by the buyer or supplier.

- The price is not dependent on any subsequent event.

Method 2: Assessed Value Method

Should the transaction value method prove inapplicable, the assessed value method comes into play. This method involves determining the value of the imported goods based on their normal price at the time of importation. The normal price is defined as the price at which similar goods are sold in the ordinary course of trade under comparable circumstances. This method is typically employed when the transaction value is unavailable or unreliable.

Method 3: Cost Plus Method

The cost plus method serves as an alternative approach when neither the transaction value method nor the assessed value method can be applied. This method entails calculating the value of the imported goods by adding the cost of acquisition to a reasonable profit margin. The cost of acquisition includes the cost of goods, transportation, insurance, and other expenses incurred up to the point of importation.

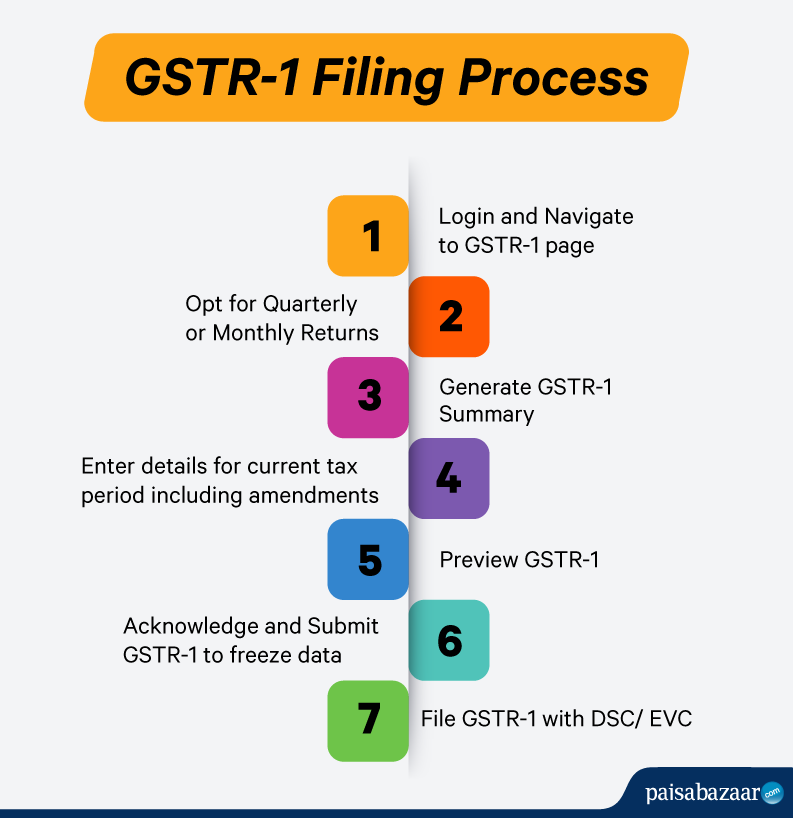

Image: www.paisabazaar.com

Method 4: Residual Method

The residual method, often used in conjunction with the cost plus method, allocates the value of imported goods among different components, such as raw materials, components, and finished products. This method is particularly relevant for complex manufacturing processes involving multiple inputs and outputs.

GST Implications and Practical Considerations

The choice of valuation method for forex transactions under GST hinges on the specific circumstances and nature of the transaction. Careful consideration should be given to the eligibility criteria and applicability of each method to ensure accurate valuation. Furthermore, businesses must maintain proper documentation to substantiate the valuation method employed, including invoices, contracts, and supporting documents.

Valuation Method For Forex Transaction Under Gst

Conclusion: Empowering Businesses in the GST Landscape

Navigating the complexities of GST valuation for forex transactions requires a comprehensive understanding of the available methods and their implications. By embracing the insights outlined in this guide, businesses can enhance their compliance posture, optimize their GST obligations, and effectively manage the financial implications of currency fluctuations. The ability to accurately value forex transactions is not merely a technical exercise but a strategic imperative in the modern business environment.