Imagine holding a magnifying glass to the chaotic movements of the foreign exchange market and seeing intricate patterns emerging from the seemingly random fluctuations. Fractals, those self-similar structures found in nature’s most mesmerizing creations, offer this extraordinary lens, empowering traders to make informed decisions amidst the turbulent forex landscape.

Image: theforexgeek.com

Fractals are geometric patterns that repeat themselves at different scales, creating a unique fingerprint for any given market. By applying fractal analysis to price charts, traders gain an unmatched ability to identify patterns, forecast trends, and optimize their trading strategies. Fractal analysis opens a window into the intricate dynamics driving market behavior, revealing valuable insights often missed by traditional methods.

Understanding Fractals in Forex Trading

Forex markets, known for their high volatility and transient nature, are a fertile ground for fractal patterns to manifest. These patterns arise due to the repetitive nature of human behavior in financial markets, where fear and greed drive market sentiments and influence price movements. By recognizing these repeating patterns, traders can anticipate market behavior and develop strategies to capitalize on them.

Fractal analysis involves identifying repeating patterns within forex price charts and quantifying these patterns using mathematical equations. Fractals are characterized by their self-similarity, meaning they appear similar at different scales. This property enables traders to spot patterns across multiple time frames, from the short-term intraday fluctuations to long-term market trends.

Practical Applications of Fractals in Forex

Fractal analysis empowers forex traders with an arsenal of practical applications that can radically transform their trading approaches. Some of the key applications include:

-

Pattern Recognition: Fractals help traders identify repeating patterns in price charts, allowing them to anticipate future market behavior. By spotting these patterns, traders can make informed decisions about potential trading opportunities.

-

Trend Forecasting: Fractals can reveal emerging trends and provide insight into their continuation or reversal. By analyzing fractal patterns, traders can make educated guesses about the future direction of the market and position themselves accordingly.

-

Market Timing: Fractals can assist in determining optimal entry and exit points for trades. By understanding the fractal patterns of a particular market, traders can identify support and resistance levels, allowing them to time their trades more effectively.

-

Risk Management: Fractals aid in risk management by identifying potential reversal points. By anticipating market turning points, traders can implement strategies to minimize their losses and preserve their capital.

-

Trading Strategy Optimization: Fractals help traders refine and improve their trading strategies. By analyzing fractal patterns, traders can assess the effectiveness of their strategies and make adjustments to optimize their performance.

Case Study: Fractal-Based Forex Strategy

Let’s consider a practical example of how fractals can be applied in forex trading. Imagine a trader observing a self-similar fractal pattern forming on a EUR/USD chart. This pattern suggests a potential short-term reversal in the currency pair. The trader can use this insight to place a sell order with a target price at the support level identified by the fractal pattern and a stop-loss order just above the fractal resistance level.

This trade is based on the assumption that the fractal pattern will continue to hold, influencing market behavior. If the trader’s prediction is correct, the fractal pattern will guide the trade towards a profitable outcome. However, it’s crucial to note that fractals, like any analytical tool, are not infallible, and their effectiveness can vary depending on market conditions and the trader’s interpretation.

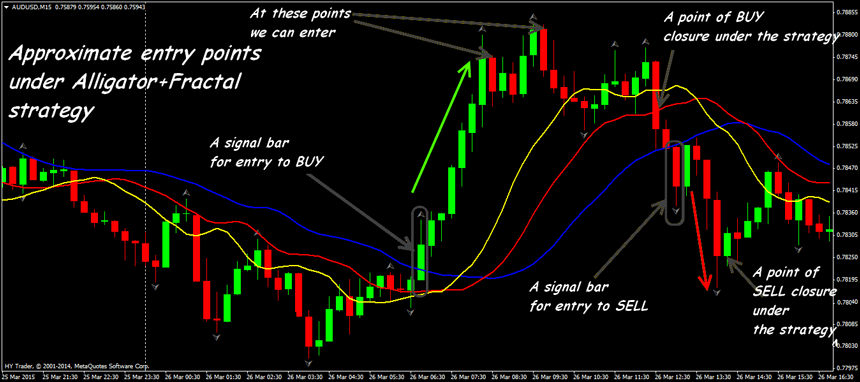

Image: www.fxchief-indonesia.com

Use Of Fractals In Forex Trading

Conclusion

Fractals are a transformative tool that empowers forex traders to unlock market insights and navigate the complexities of the financial markets. By understanding fractal patterns and applying them to trading strategies, traders gain a significant advantage. Fractal analysis provides a deeper understanding of market dynamics, empowers traders to make informed decisions, and enables them to maximize their trading potential. As fractal applications continue to evolve, they will undoubtedly remain a cornerstone of successful forex trading. Embrace the power of fractals and unlock the secrets to becoming a confident and successful forex trader.