The financial markets are a realm of constant flux, where the ebb and flow of supply and demand dictate the prices of stocks, currencies, and other assets. Technical analysis, the art of deciphering patterns in market data, empowers traders and investors with valuable insights into these fluctuations. One such pattern, the long upper wick candlestick, holds immense significance in the world of candlestick charting. Its distinct visual representation offers clues about market sentiment, allowing traders to make informed decisions.

Image: phemex.com

Unveiling the Anatomy of a Long Upper Wick Candlestick

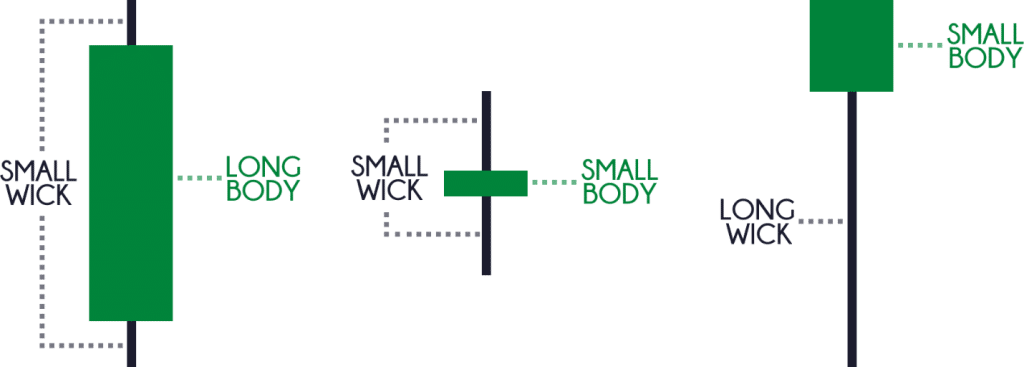

A long upper wick candlestick is characterized by a long, narrow projection extending from the top of the candlestick’s body. This wick represents the highest price reached during the trading period. The body of the candlestick, which indicates the difference between the opening and closing prices, can be either filled or unfilled, with filled bodies implying a bullish sentiment and unfilled bodies indicating bearishness.

The length of the upper wick, relative to the body, holds crucial information. A particularly long upper wick suggests that buyers actively pushed the price higher at the beginning of the trading period but faced resistance, resulting in a sharp reversal. Conversely, a short upper wick indicates that buyers were briefly in control but were quickly overwhelmed by sellers.

Harnessing Long Upper Wick Candlesticks for Market Analysis

Long upper wick candlesticks are versatile tools for gauging market sentiment and forecasting future price movements. Their appearance in different market conditions provides distinct insights:

1. Bullish Patterns

Long upper wick candlesticks appearing during downtrends often signal a bullish reversal. If the candlestick closes near its high, it suggests that buyers have gained control and are attempting to push prices higher. Traders may consider buying or entering long positions in anticipation of further upward momentum.

Image: www.tradingwithrayner.com

2. Bearish Patterns

In contrast, long upper wick candlesticks forming during uptrends can indicate a bearish reversal. A sharp rejection from the high, followed by a close near the low, signifies strong selling pressure and potential price declines. Traders may consider selling or entering short positions to capitalize on the downtrend.

3. Confirmation Patterns

Long upper wick candlesticks often serve as confirmation patterns, reinforcing bullish or bearish trends. For instance, a long upper wick candlestick following a bullish trendline breakout signals continued upward momentum, while a long upper wick candlestick following a bearish trendline breakdown confirms the downtrend.

Beyond Pattern Recognition: Unveiling the True Power of Wick Length

While long upper wicks provide valuable insights, it’s essential to consider the context of the broader price action and other technical indicators. The interpretation of the wick’s length can vary depending on the specific market conditions:

-

Long Upper Wicks in High Volatility Markets: In markets characterized by high volatility, long upper wicks may be less significant as they often reflect temporary price fluctuations. Traders should exercise caution before making trading decisions based solely on wick length.

-

Long Upper Wicks in Low Volatility Markets: In contrast, long upper wicks in low volatility markets tend to carry more weight. They indicate significant price rejections or reversals, prompting traders to reassess their market outlook.

-

Relationship to Average True Range: The average true range (ATR) measures market volatility. Longer upper wicks relative to the ATR suggest stronger price fluctuations, while shorter upper wicks relative to the ATR indicate less volatile price movements.

Long Upper Wick Candlestick

Unlocking the Potential of Long Upper Wick Candlesticks: A Practical Guide

Harnessing the power of long upper wick candlesticks requires a disciplined and methodical approach. Here’s a practical guide to help traders navigate the nuances of this candlestick pattern:

-

Confirm the Trend: Always consider the prevailing market trend before interpreting long upper wick candlesticks. A long upper wick during a downtrend has a bullish implication, while a long upper wick during an uptrend has a bearish implication.

-

Length of the Upper Wick: The length of the upper wick is crucial. A long upper wick, extending beyond the ATR or a significant portion of the candlestick’s body, holds greater significance than a shorter upper wick.

-

Body Position: Pay attention to the position of the candlestick’s body relative to the upper wick. A candlestick with a body near the low suggests a stronger bearish reversal, while a candlestick with a body near the high implies a stronger bullish reversal.

-

Volume: Volume provides additional context to long upper wick candlesticks. High volume accompanying a long upper wick reinforces the significance of the price action, while low volume may indicate a less significant price reversal.

5. Multiple Time Frames: Analyze long upper wick candlesticks across different time frames (e.g., daily, weekly) to gain a more comprehensive view of the market trend and potential price movements.