Are you an avid traveler or an international business enthusiast seeking the most cost-effective solution for your currency exchange needs? Look no further! USD least card rates for forex, a transformative tool in the world of currency conversions, offer an array of unbeatable advantages that will revolutionize your financial endeavors.

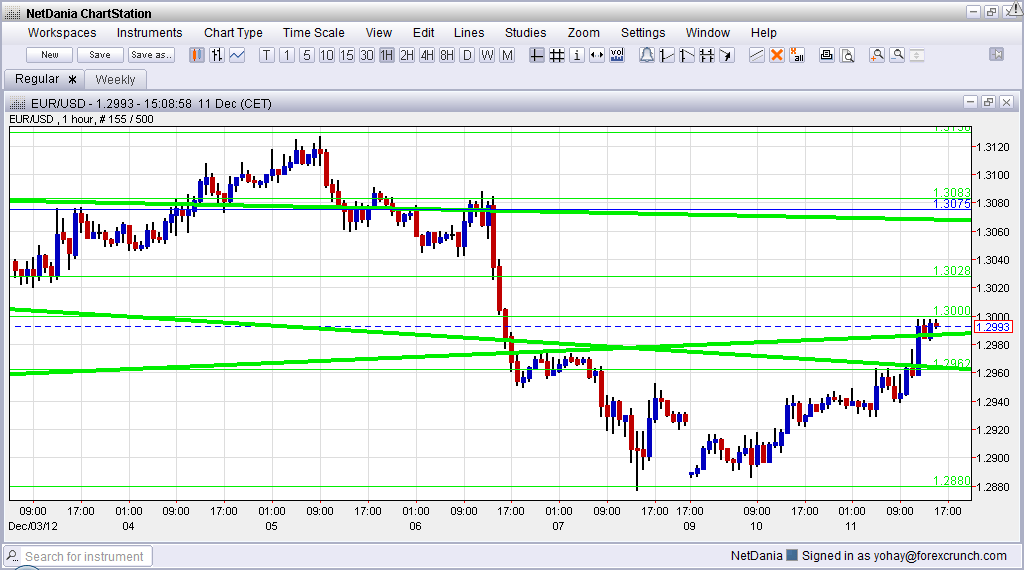

Image: xytiyyreli.web.fc2.com

In this comprehensive guide, we will delve into the intricacies of USD least card rates, exploring their historical significance, core principles, and real-world applications. Whether you’re a seasoned forex professional or just starting your global financial journey, this guide will empower you with invaluable knowledge and strategies to maximize your currency exchange outcomes.

Unveiling the Essence of USD Least Card Rates

USD least card rates represent the most favorable exchange rates available for converting US Dollars (USD) into foreign currencies using debit or credit cards. These rates are determined through a competitive marketplace, where financial institutions and currency exchange providers strive to offer the most competitive rates to attract customers. By leveraging these exceptional rates, individuals and businesses can minimize transaction fees and secure substantial savings on their international currency exchanges.

The significance of USD least card rates lies in their ability to reduce the hidden costs associated with currency conversions. When exchanging currency through traditional methods, such as bureaux de change or banks, hefty markups and commissions can significantly inflate the exchange rates. In contrast, USD least card rates eliminate these excessive charges, resulting in significant cost reductions for the user.

Navigating the Fundamentals of USD Least Card Rates

To fully harness the benefits of USD least card rates, it’s crucial to understand the fundamental mechanisms that govern their operation. Key factors influencing these rates include:

1. Market Forces: USD least card rates are influenced by the global foreign exchange market, where supply and demand dynamics determine the value of currencies. Fluctuations in market conditions can lead to variations in exchange rates, making it essential to stay informed about economic trends and geopolitical events that may impact currency values.

2. Interbank Rates: Interbank rates serve as the benchmark for USD least card rates. These rates are the exchange rates at which banks trade currencies among themselves, excluding any markups or commissions. By referencing interbank rates, USD least card providers can offer highly competitive rates to their customers.

3. Card Issuer’s Fees: While USD least card rates often provide significant cost savings compared to traditional exchange methods, it’s important to consider the fees charged by the card issuer. Some cards may impose small transaction fees or foreign currency exchange fees, which should be factored into the overall cost of the exchange.

Embracing the Power of USD Least Card Rates: Real-World Applications

Harnessing the advantages of USD least card rates opens up a world of possibilities for optimizing your international financial activities:

1. Travel Smarter, Spend Less: For frequent travelers, USD least card rates offer a way to save money on every currency exchange. Whether you’re exploring bustling markets, dining at local restaurants, or booking accommodations, using a card with competitive exchange rates will significantly reduce your travel expenses, allowing you to experience more while spending less.

2. Empower Your Business with Global Reach: Businesses operating on the global stage can unlock substantial savings by utilizing USD least card rates for their international transactions. From making payments to suppliers to managing cross-border investments, leveraging these competitive rates can enhance profitability and boost competitiveness in the global marketplace.

3. Enhance E-commerce Transactions: The rapid growth of e-commerce has made it imperative for businesses to accept payments in multiple currencies. By offering USD least card rates, e-commerce platforms can attract international customers, expand their market reach, and increase their sales volume.

Image: www.milemoa.com

Staying Informed: Strategies for Identifying the Best USD Least Card Rates

In the ever-evolving world of currency exchange, staying informed about the best USD least card rates is essential for maximizing your savings. Here are some tips to help you find the most favorable rates:

1. Compare Rates: Take the time to compare different USD least card providers, including banks, credit unions, and online currency exchange platforms. Use comparison websites or financial aggregators to view real-time rates from multiple providers, ensuring you secure the best deal.

2. Leverage Technology: Mobile apps and online platforms specializing in currency exchange offer convenient and often competitive rates. These platforms provide instant access to live exchange rates, allowing you to make informed decisions on the go.

3. Seek Expert Advice: If you’re unsure about which USD least card provider offers the most suitable rates for your specific needs, consider consulting with a financial advisor or currency exchange specialist. These professionals can provide personalized recommendations based on factors such as your transaction frequency and currency requirements.

Usd Least Card Rate Fo Forex

https://youtube.com/watch?v=YHwBGeIM7Fo

Conclusion: Embracing the Future of Currency Exchange

In the dynamic global economy, USD least card rates stand as a beacon of cost-effective currency conversion. By embracing their advantages, individuals and businesses alike can navigate the world of international finance with greater ease and financial prudence. From seamless travel experiences to enhanced business profitability, the power of USD least card rates is undeniable.

For those seeking to stay ahead in today’s interconnected world, we encourage you to delve deeper into this transformative tool. By staying informed and leveraging the strategies outlined in this guide, you can unlock the full potential of USD least card rates and reap the rewards of cost-efficient currency exchange.