In the ever-evolving realm of currency trading, the US trading session holds immense significance, attracting traders worldwide with its unparalleled volume, liquidity, and volatility. This bustling period, stretching from 8 AM to 12 PM ET, presents a plethora of opportunities for discerning traders seeking to tap into the financial markets’ heart. Understanding the nuances, strategies, and pitfalls of this dynamic trading session can propel traders toward sustained returns and remarkable successes.

Image: tradeproacademy.com

The US trading session kickstarts as the financial epicenter of New York awakens from its slumber, igniting a surge of market activity. This wave of liquidity, driven by institutional trading desks, investment banks, and myriad market participants, creates an environment ripe for profit exploitation. Traders from across the globe converge in this vibrant arena, intent on capitalizing upon the myriad price movements that accompany such substantial order flow.

Harnessing the US Trading Session: A Strategic Edge

Navigating the US trading session effectively requires a multifaceted approach, encompassing in-depth market analysis, optimal trade execution, and sound risk management practices. By mastering these essential pillars, traders can elevate their performance and consistently outpace the market’s capricious nature.

1. Market Analysis: A Window into Price Movements

To navigate the ever-shifting tides of the US trading session, a profound understanding of market trends, patterns, and geopolitical events is imperative. Armed with this foresight, traders can anticipate potential shifts in currency values, enabling them to make informed trading decisions.

2. Execution Precision: Timing the Market to Perfection

In the high-octane environment of the US trading session, precise trade execution is paramount. Split-second decisions and lightning-fast order placement can mean the difference between profit and loss. Traders must possess exceptional market awareness and swift execution capabilities to seize transient opportunities.

3. Risk Management: Navigating Volatility with Confidence

Volatility, the lifeblood of trading, can also pose significant risks for the unwary. Traders must employ robust risk management strategies, including position sizing, stop-loss orders, and hedging techniques, to mitigate potential losses and preserve capital.

Trading Strategies for US Session Mastery

A vast array of trading strategies can be deployed during the US trading session, catering to diverse risk appetites and market conditions. Some of the most effective approaches include:

1. News Trading: Riding the Wave of Market Reactions

News trading leverages high-impact economic events and announcements to capture rapid price movements. Traders must meticulously monitor economic calendars, dissect market sentiment, and execute trades swiftly to harness market reactions effectively.

2. Scalping: Extracting Profits from Minor Price Fluctuations

Scalping, a fast-paced strategy, involves profiting from tiny price movements. Scalpers relentlessly enter and exit positions, accumulating fractional gains over time.

3. Swing Trading: Capturing Momentum for Moderate Returns

Swing trading involves holding positions for several days to weeks, capitalizing on longer-term price trends. Swing traders seek setups where there is confluence of technical indicators, fundamental factors, and market sentiment.

Image: forextraders.guide

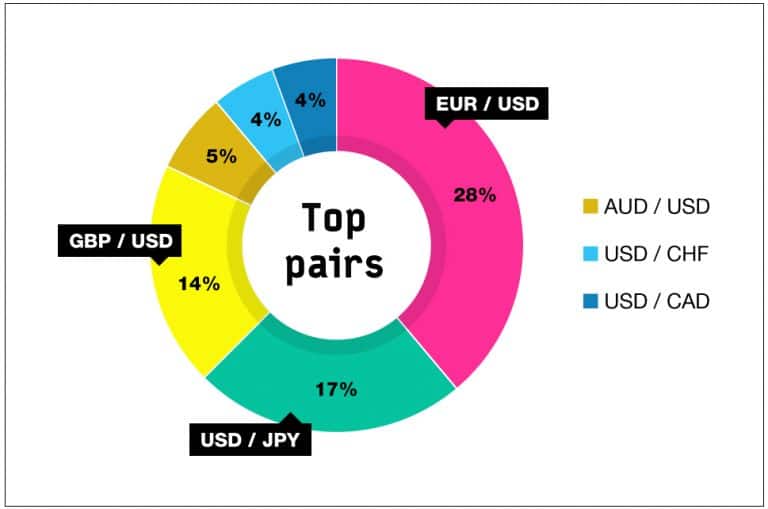

Us Trading Session Forex Pairs

Conclusion: Unlocking the Profit Potential of the US Trading Session

The US trading session stands as a formidable proving ground for forex traders, offering unparalleled opportunities alongside inherent risks. By embracing the principles of strategic market analysis, precise trade execution, and prudent risk management, traders can harness the power of this dynamic session and unlock the path to consistent profitability.

Remember, the key to forex trading success lies in continuous learning, adaptability, and emotional discipline. Whether you are a seasoned veteran or a novice trader, the US trading session presents an ever-evolving landscape that demands respect, vigilance, and an unwavering commitment to honing your skills. So, embrace the challenge, immerse yourself in market knowledge, and prepare to conquer the US trading session, one trade at a time.