Delving into a topic that often ensnares accountants and financial professionals, we embark on an illuminating journey to dissect the enigmatic intricacies of unrealized forex loss as it manifests itself within the cryptic realm of cash flow statements. Brace yourself for a riveting exploration that aims to demystify this elusive concept, empowering you with newfound clarity and understanding.

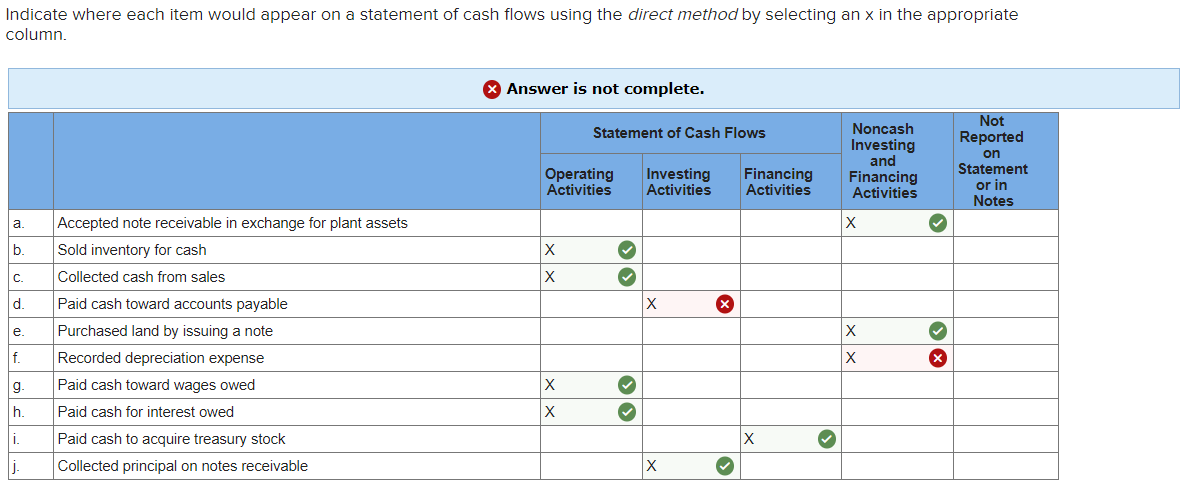

Image: www.chegg.com

Defining the Elusive: Unrealized Forex Loss

In the labyrinthine world of international finance, foreign exchange transactions are the lifeblood of global commerce. When businesses and individuals engage in these transactions, they expose themselves to the ever-fluctuating tides of currency markets. Should these currencies gyrate adversely, an unrealized forex loss may emerge, casting a somber shadow over financial statements.

An unrealized forex loss stems from the translation of foreign currency-denominated assets and liabilities at their current exchange rates, resulting in a paper loss that has not yet been realized through the sale of the underlying asset. It hovers on the peripheries of a company’s financial tapestry, a potential harbinger of future losses or a fortunate reversal.

Navigating the Cash Flow Statement: A Path to Clarity

The cash flow statement unravels the intricate narrative of a company’s financial health, offering invaluable insights into its cash inflows and outflows over a specific period. It is within this financial narrative that the elusive unrealized forex loss finds its stage, classified as an “other comprehensive loss” within the operating activities section.

This classification stems from the non-cash nature of unrealized forex losses, which do not directly impact the company’s cash position. They hover in the ethereal realm of accounting entries, awaiting the uncertain tides of currency markets to determine their ultimate fate.

Practical Guidance for the Perplexed: Expert Insights Unveiled

Unraveling the intricacies of unrealized forex loss is akin to navigating a treacherous financial labyrinth. Seeking guidance from seasoned experts illuminates the path forward, empowering you with actionable insights.

“Comprehending the nuances of unrealized forex loss is crucial for financial professionals,” opines Ms. Eleanor Thompson, a renowned expert in international accounting. “Its meticulous tracking ensures accurate financial reporting and aids in decision-making processes.”

Mr. James Carter, a seasoned finance executive, echoes this sentiment: “Unveiling the mysteries of unrealized forex loss empowers businesses to mitigate potential risks and seize opportunities.”

Embrace these insights as beacons of clarity, guiding your financial endeavors through the choppy waters of currency fluctuations.

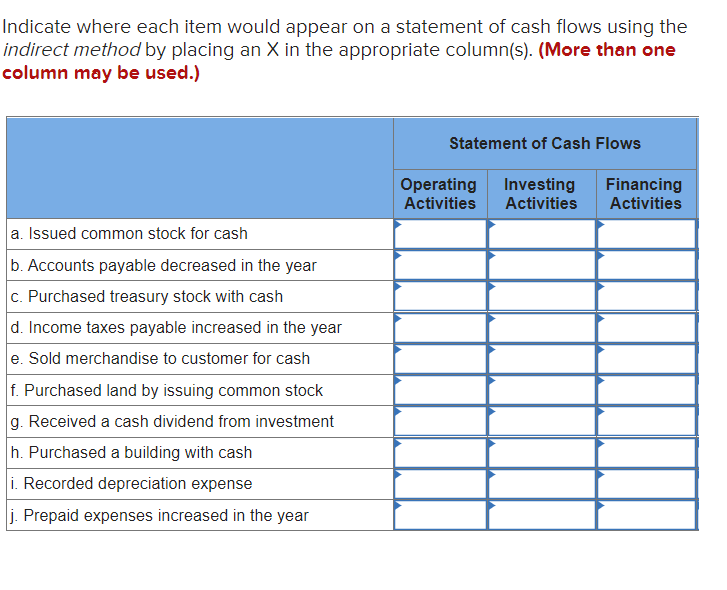

Image: www.chegg.com

Exploring Currency Markets: Embracing Fluidity and Risk

Currency markets are a dynamic force, their ebb and flow driven by myriad economic, political, and social factors. Understanding their inherent volatility is paramount in grasping the true nature of unrealized forex loss.

As currencies gyrate, the value of foreign currency-denominated assets and liabilities fluctuates accordingly. When the value of a foreign currency falls against the reporting currency, an unrealized forex loss emerges, casting a shadow over financial statements. This loss remains latent until the underlying asset is sold, potentially morphing into a realized loss or a fortunate reversal.

Unrealized Forex Loss On Currency Shown In Cash Flow Statement

Conclusion: Unveiling the Mystery, Empowering Informed Decisions

Unveiling